- SAND surged 20.49%, retesting $0.36 resistance with bullish MACD and Fibonacci support.

- On-chain metrics showed rising activity, reduced reserves, and a 54.89% open interest spike.

The Sandbox [SAND] has made headlines with an extraordinary 20.49% surge in price, climbing to $0.3629 in a remarkable display of market strength.

Additionally, trading volume skyrocketed by a stunning 480.65%, reaching $666.26 million in just 24 hours.

At press time, SAND was retesting the critical $0.36 resistance, sparking speculation about whether the bullish momentum can continue or if a pullback might occur.

Can SAND sustain its bullish momentum?

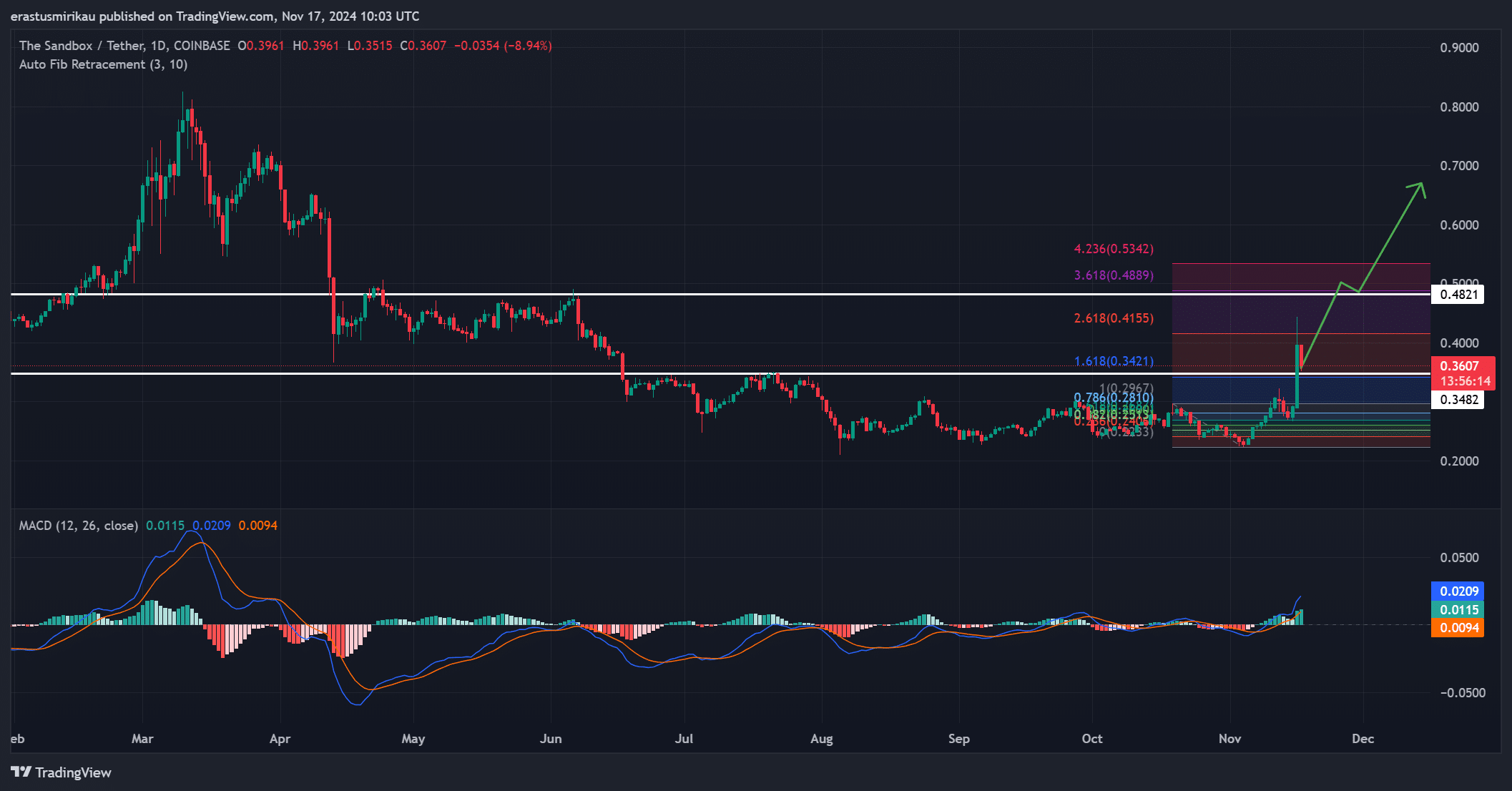

SAND’s price action demonstrated significant resilience as it tested $0.36, a key resistance level that has previously capped upward movements.

However, breaking above this threshold could unlock higher targets, particularly at $0.42 and $0.48, as indicated by Fibonacci retracement levels.

On the other hand, rejection at this level may lead to short-term price corrections before any further upward trajectory.

Momentum indicators like the MACD are signaling bullish strength, with a crossover supported by increasing histogram bars. This suggests that buying pressure remained robust.

Additionally, SAND’s position near the 1.618 Fibonacci level ($0.34) reinforced the importance of the $0.36 level as a make-or-break point for the token.

Source: TradingView

On-chain signals highlight rising activity

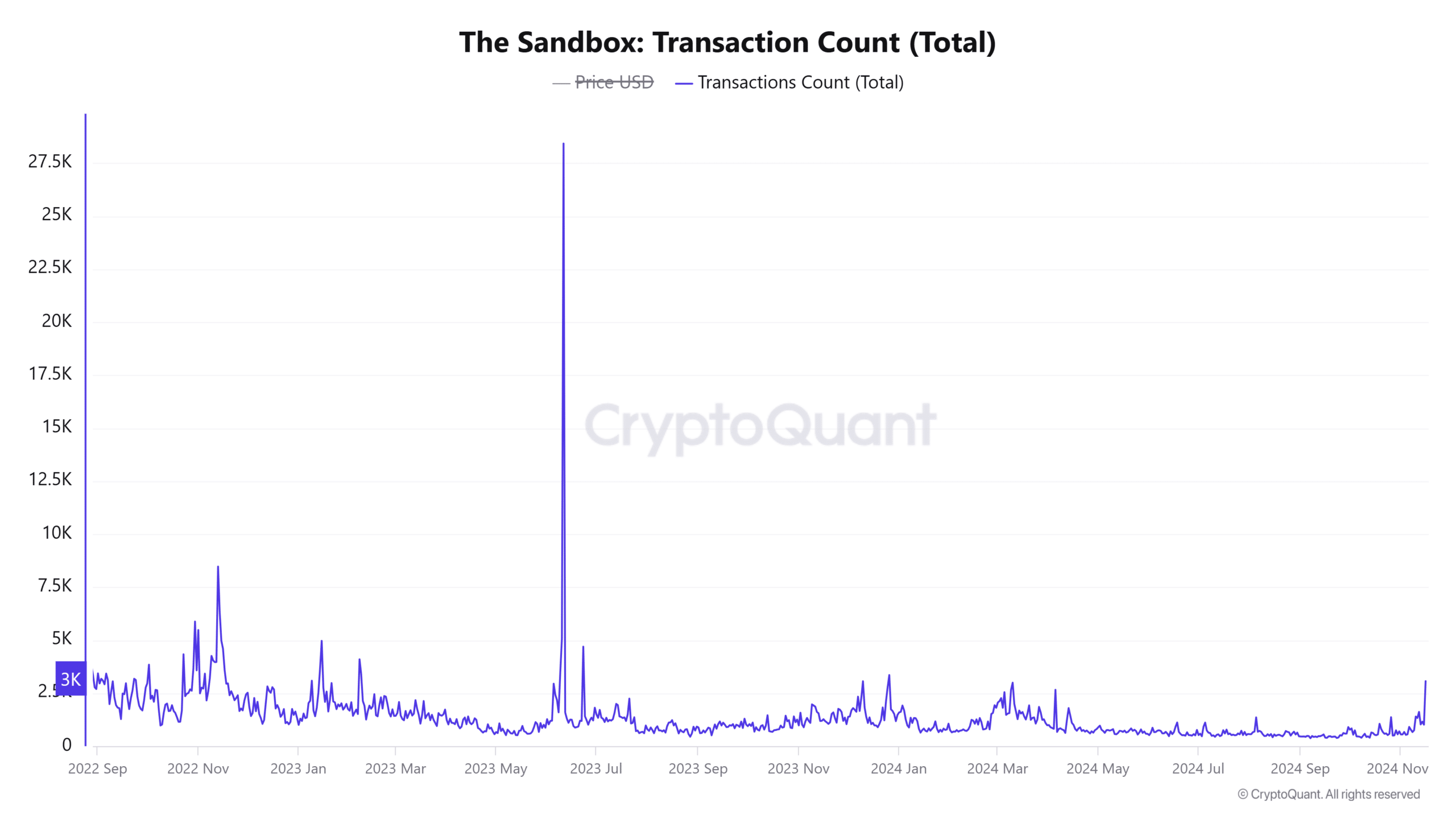

On-chain metrics for SAND continued to show promising developments. Active addresses rose 2.42%, reflecting growing interest among market participants.

Additionally, transaction counts climbed by 3.44%, reaching 3,720 over the same period. These data points highlighted increased activity within the ecosystem, which could further fuel SAND’s bullish momentum.

Therefore, rising network engagement aligned closely with the token’s recent price surge.

Source: CryptoQuant

THIS points to accumulation

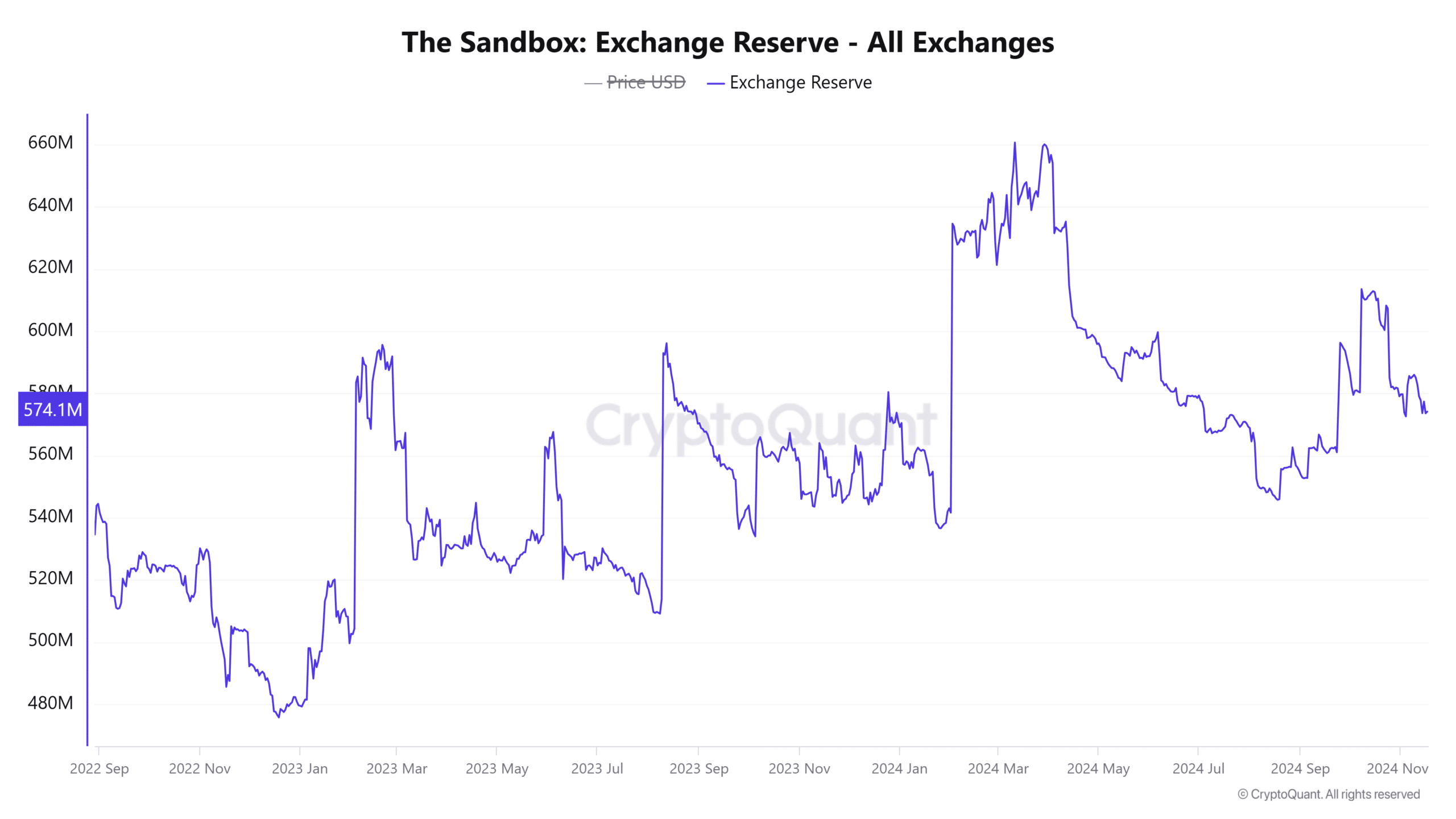

Exchange reserves for SAND dropped slightly by 0.17%, with 575.59 million tokens now held on exchanges. This indicated reduced selling pressure and hinted at accumulation by long-term holders.

If this trend continues, it could provide a stable foundation for sustained price growth as circulating supply tightens in the market.

Source: CryptoQuant

Open Interest signals speculative activity

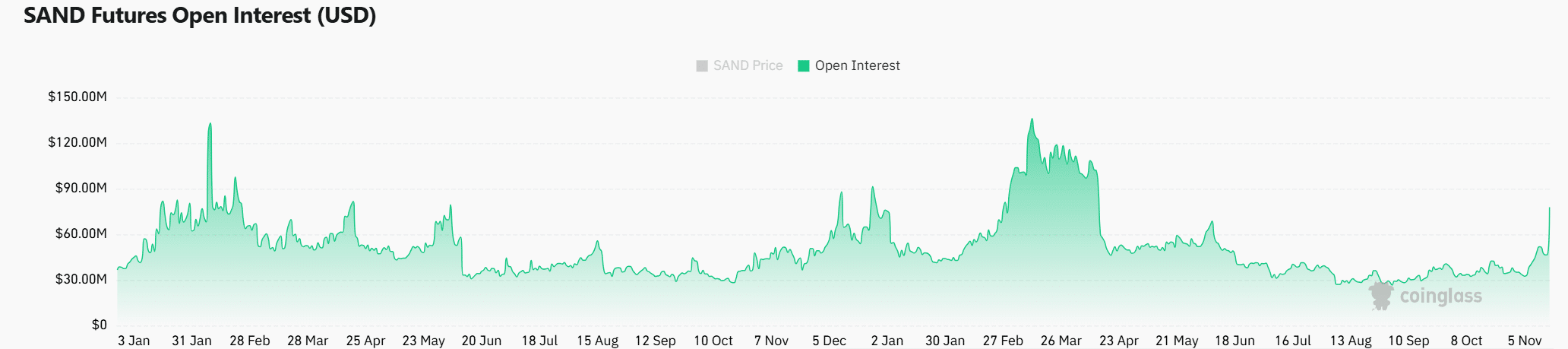

A remarkable 54.89% increase in Open Interest, bringing the total to $72.83 million, reflected heightened speculative activity.

This rise suggested that traders were positioning themselves for significant price movements.

However, while this could amplify upward momentum, it also increases the likelihood of heightened volatility, depending on market sentiment.

Source: Coinglass

Realistic or not, here’s SAND market cap in BTC’s terms

SAND’s 20.49% price surge, supported by strong technical indicators and positive on-chain metrics, positions it well for a potential breakout. However, the $0.36 resistance level remains a critical hurdle.

A successful breakout could see SAND targeting $0.42 and beyond, while a rejection may trigger a short-term correction. For now, the bullish momentum appears to dominate.

Source: https://ambcrypto.com/sand-surges-20-49-can-0-36-resistance-ignite-the-next-rally/