- Moody’s downgrades U.S. debt rating, sparking recession concerns.

- Interest rates may rise, increasing unemployment risks.

- Robert Kiyosaki suggests investing in Bitcoin, real estate.

Robert Kiyosaki posted on the X platform, citing Moody’s downgrade of the U.S. debt rating as a potential trigger for a recession akin to the 1929 economic depression. He advises securing assets like gold and Bitcoin.

Kiyosaki’s statement suggests potential financial instability, prompting investors to consider protective measures. He promotes entrepreneurship and strategic asset acquisition at lower price points, highlighting opportunity in crisis.

Moody’s Downgrade Sparks Recession Concerns and Market Shifts

Moody’s has downgraded U.S. debt, a move that Robert Kiyosaki believes may herald a recession akin to the 1929 depression. “The downgrade could be the warning signal that makes everyone realize the iceberg ahead,” he declared on his X feed, driving public discourse on its potential implications.

Kiyosaki emphasizes the likelihood of rising interest rates which could increase unemployment. He suggests investment in gold, silver, and Bitcoin as protective measures against this forecasted economic downturn. His message aligns with the sentiments of some market observers who caution of looming financial instability.

The market reacted swiftly to Kiyosaki’s predictions. Investors are reportedly adjusting portfolios, with some shifting to hard assets like real estate and commodities. These actions reflect broader concerns about future interest hikes and potential economic challenges.

Bitcoin Surges Amid Economic Instability With Regulatory Fears

Did you know? In 1929, the Great Depression was marked by a 25% unemployment rate, significantly affecting global economies. Kiyosaki’s current comparisons highlight investor wariness of repeating historical economic downturns.

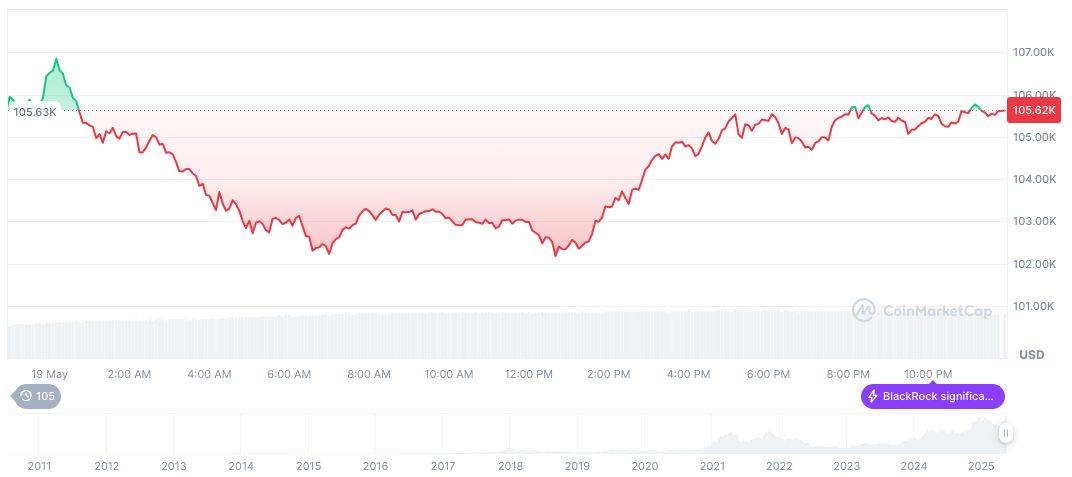

Bitcoin (BTC) currently trades at $105,278.73, with a market cap of $2.09 trillion, and a dominance of 62.94%. Over 7 days, BTC’s price increased by 1.54%, with a notable 25.29% rise over 30 days. Data from CoinMarketCap underscores its ongoing market significance.

The Coincu research team suggests that further monetary and regulatory shifts may arise due to Moody’s actions. Historical financial downturns often result in increased regulatory scrutiny and technological adaptation within the financial sector. Analysts project increased volatility in the cryptocurrency market as investors navigate potential regulatory changes.

Source: https://coincu.com/338668-kiyisaki-us-recession-warning-bitcoin/