- Robert Kiyosaki advises against relying on ETFs.

- Advocates for tangible assets such as gold, silver, and Bitcoin.

- His views reflect long-standing beliefs on financial security.

Robert Kiyosaki, author of ‘Rich Dad Poor Dad,’ cautions against reliance on ‘paper assets’ like ETFs, emphasizing the importance of holding physical gold, silver, and Bitcoin.

Kiyosaki urges investors to recognize the security of tangible assets, highlighting potential vulnerabilities of ETFs. This advisory underscores continuing debate on asset allocation strategies.

Kiyosaki’s Guidance on Asset Allocation

Kiyosaki advised ordinary investors to understand when physical assets should be prioritized over ETFs. While emphasizing the reliability of tangible assets, he pointed out that “only physical gold, silver, and Bitcoin” offer security during critical moments. Despite the warning, there has been no unusual market-wide redemption or self-custody activity observed since the statement.

Kiyosaki’s guidance on asset allocation, shared via his X platform account, reiterates his advocacy for physical assets amid financial crises. With insight rooted in previous financial unrests, Kiyosaki’s views continue to shape investor sentiment, signaling potential shifts from ETFs towards material investments in challenging times.

Community and regulatory entities, including major cryptocurrency influencers and platforms, have not shown strong directional shifts following Kiyosaki’s remarks. The sentiment reflects an acknowledgment of ETFs’ limitations without immediate change in assets held or owned on-chain. ChainCatcher continues to monitor ETH and BTC wallet activities without attributing changes to the current ETF debate.

Historical Context, Price Data, and Expert Analysis

Did you know? Kiyosaki’s advisory against relying solely on ETFs echoes reactions seen during the 2023 US banking crises when tangible asset demand surged amid market instability.

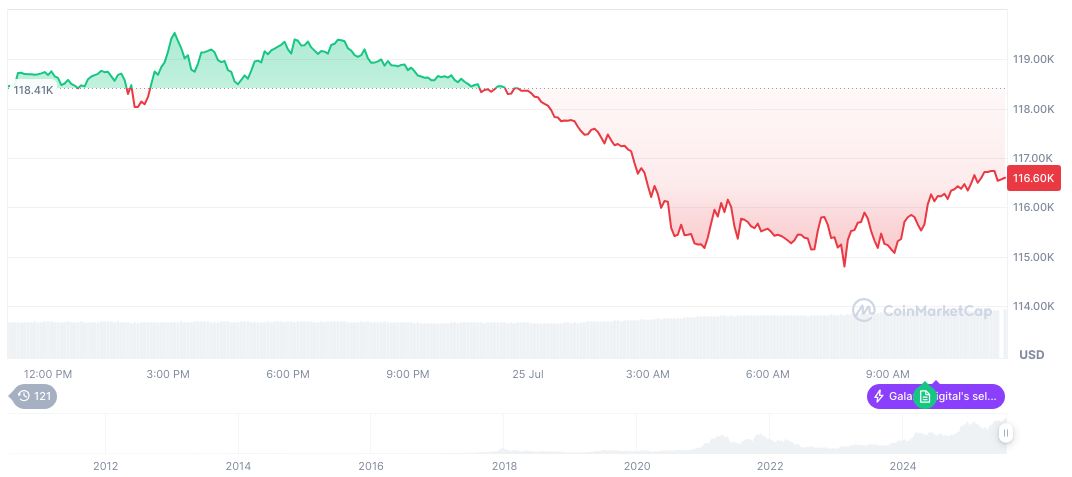

Based on the latest CoinMarketCap data, Bitcoin (BTC) holds robust market metrics with a price of $117,322.31 and a market cap of $2.33 trillion. Reflecting a 24-hour price increase of 1.24%, Bitcoin’s 90-day growth reached 24.25%. As of July 26, 2025, the stable supply boasts 19,897,493 BTC in circulation, illustrating a significant market presence with a $100.39 billion trading volume.

The Coincu research team observes the practicality of Kiyosaki’s views on asset security, especially during economic hardship. Analysts highlight the historical alignment of market behavior with Kiyosaki’s advocacy for tangible assets, especially following institution-driven disruptions. Robust data supports the viability of adopting these assets for sustained financial safety amidst evolving technological landscapes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/kiyosaki-cautions-etfs-security/