Bitnomial Exchange is now officially the first exchange to support stablecoins as margin collateral. The new version brought RLUSD to the market and improved support for XRP.

Bitnomial Expands Margin Program with RLUSD and XRP

In a statement, Bitnomial confirmed that it is now the sole CFTC-regulated derivatives clearing organization (DCO) in the United States to support digital assets and stablecoins as native margin collateral.

The presence of these tokens provides traders with alternative methods to efficiently manage their funds with adherence to regulative standards.

Institutional clients can leverage RLUSD and XRP to trade margin perpetuals, futures, and options on the platform. Consumer support is imminent with Botanical, the proprietary trading interface.

The exchange could facilitate on-chain settlements related to the stability of the U.S. dollar by allowing traders to post margin with the stablecoin.

At the Ripple Swell conference in New York, CEO of Bitnomial Luke Hoersten commented: “It is a huge evolution in terms of how traders can utilize digital assets.” Hoersten went on to say that RLUSD brings “stablecoin efficiency to the margin market” and that support for XRP is simply adding to the flexibility of capital management.

Ripple’s SVP of Stablecoins, Jack McDonald, praised the strategy employed by Bitnomial.

“With native support for RLUSD and XRP as margin collateral, Bitnomial cements itself as one of the most innovative derivatives exchanges in the U.S. Stablecoins like RLUSD are moving from speculation to real-world financial use cases, this is the next phase of adoption,” he shared.

The exchange had earlier launched the first XRP futures market in March 2025. This is in line with improved regulations offered by the U.S. SEC.

Stablecoins Gain Global Traction in 2025

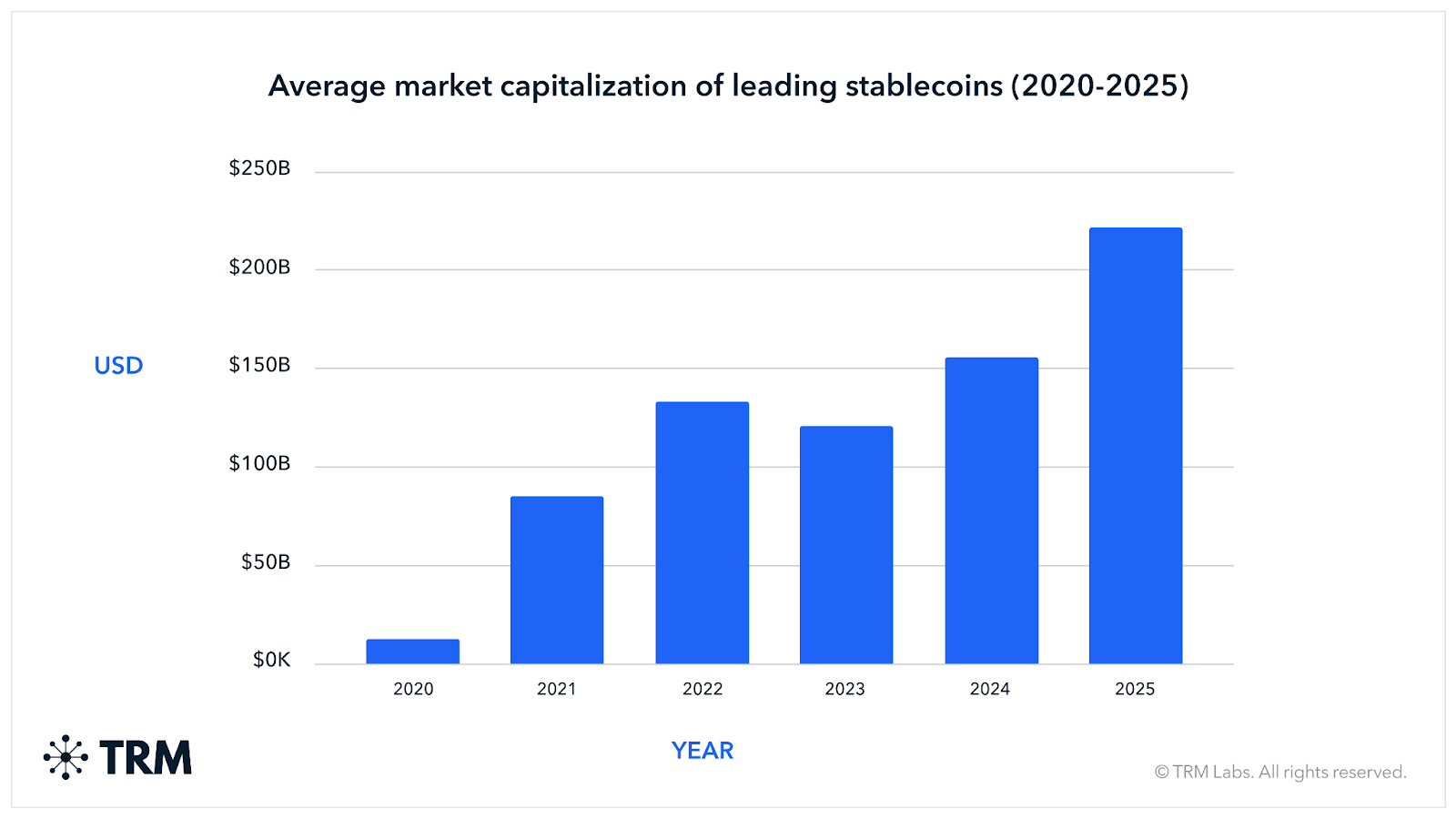

The integration of the Ripple coin among those offered by Bitnomial comes at a time when adoption of stablecoins is increasing. According to a report from TRM Labs, stablecoins constitute approximately 30% of total crypto transactions between the periods of January and July 2025.

More than 90% of stablecoins that have fiat support rely on the United States dollar. These also include Tether (USDT) and Circle’s USDC.

Each of the United States of America, the European Union, and Hong Kong has adopted regulations this year. This includes the GENIUS Act and MiCA.

Interestingly enough, there have been indications that Bank of America is looking at the possibility of utilizing stablecoin settlements. One of the top tipped stablecoins is RLUSD.