Dogecoin price today is trading around $0.2312, consolidating near the upper boundary of a multi-month symmetrical triangle. The structure places DOGE at a decisive point, with rising support from $0.21 meeting overhead resistance between $0.24 and $0.25.

Dogecoin Price Builds Pressure Inside Triangle

The daily chart highlights a tightening range, with DOGE repeatedly testing resistance along the $0.24 zone. Fibonacci levels add further weight, as the 0.5 retracement sits at $0.2382, overlapping with the triangle ceiling. Support remains firm at $0.2180 and $0.2115, where the 50-day and 100-day EMAs converge.

Related: XRP (XRP) Price Prediction for September 9

Momentum indicators lean constructive. RSI stands at 55, trending higher from neutral territory, suggesting improving demand. If DOGE breaks $0.24 with volume, upside targets open toward $0.25 and $0.27, while a rejection could see a pullback to $0.21.

ETF Approval Odds Strengthen Market Sentiment

A major narrative shift comes from rising ETF speculation. According to Polymarket data shared on social platforms, the probability of a Dogecoin ETF approval by the end of 2025 surged to 94%, up sharply over the past three days. Traders view this as a pivotal development that could bring new institutional flows into DOGE.

The optimism has spilled into derivatives markets, with traders increasing exposure in anticipation of regulatory clarity. This speculation provides a strong narrative tailwind as DOGE approaches technical breakout levels.

Derivatives Data Signals Rising Participation

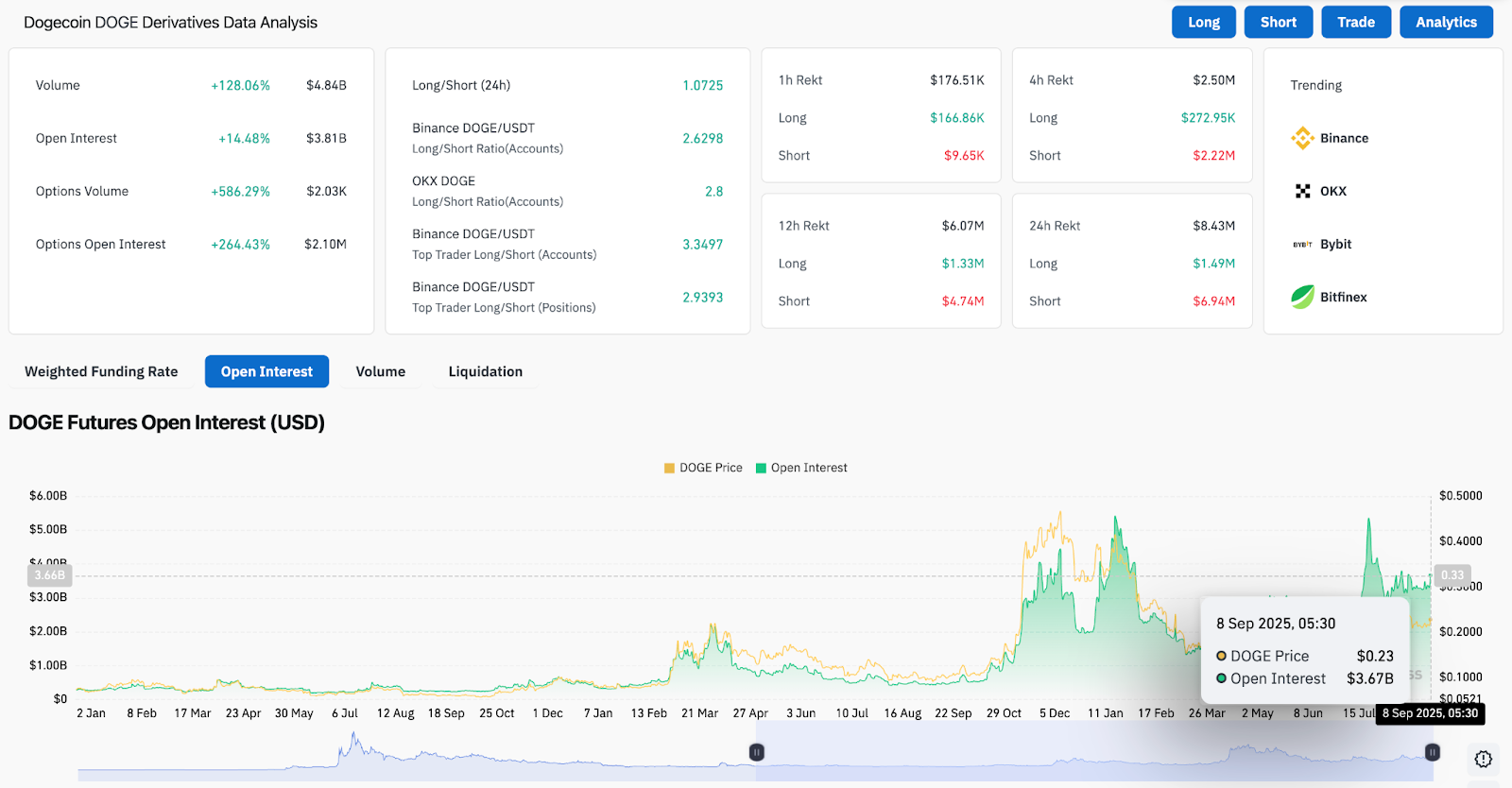

Open interest in DOGE futures has climbed 14.5% to $3.81 billion, while trading volume has doubled to $4.84 billion in the past 24 hours. Options activity has exploded, with open interest up over 260%, indicating traders are positioning for heightened volatility.

Long/short ratios across Binance and OKX lean heavily toward the bullish side, with accounts skewed more than 2.5:1 in favor of longs. This positioning reflects growing confidence but also raises the risk of sharp liquidations if price fails to sustain momentum above resistance.

Broader Cycle Views Highlight Upside Potential

Analysts tracking DOGE’s long-term structure continue to highlight its logarithmic uptrend channel. Bitcoinsensus noted that Dogecoin’s past rallies have each outperformed the previous wave, projecting a potential move toward $1.40 if the pattern repeats.

While this cycle-based forecast is longer term, it adds weight to bullish sentiment at current levels. If DOGE sustains above its consolidation, it could reignite a broader wave of speculative momentum similar to prior cycle peaks.

Technical Outlook For Dogecoin Price

Immediate resistance sits at $0.2380–$0.2490, with a breakout above this zone likely inviting buyers toward $0.2660 and the $0.2870 Fibonacci extension. On the downside, the $0.2180–$0.2115 band serves as critical support, with $0.1880 as the deeper cushion if the triangle fails.

DOGE’s next move hinges on whether technical compression gives way to bullish ETF-driven enthusiasm or if overextended longs lead to a washout.

Outlook: Will Dogecoin Go Up?

Dogecoin price action is at a crucial inflection point. ETF speculation has injected strong sentiment, while derivatives flows confirm heightened participation. As long as DOGE holds above $0.21, the bias favors an upside breakout, with $0.25–$0.27 as immediate targets.

Failure to clear resistance, however, risks triggering a flush back toward $0.21, where bulls will need to defend structure. As traders await confirmation of a decisive move, momentum and narratives currently align to keep DOGE at the forefront.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/dogecoin-doge-price-prediction-rising-etf-odds-spark-bullish-momentum/