In the latest development in the U.S. Securities and Exchange Commission (SEC) lawsuit against Ripple Labs, defendant Ripple opposed the SEC seeking audited financial statements, post-complaint contracts for the sale or transfer of XRP to

“non-employee counterparties”, and details on the amount of “XRP Institutional Sales proceeds” received after the lawsuit filing.

Ripple Opposes SEC’s Requests

According to a court filing late January 19, Ripple opposed the U.S. SEC’s motion to compel certain post-complaint discovery. Ripple lawyers have been tackling the SEC’s move in the XRP lawsuit, urging Judge Analisa Torres to rule in their favor due to irrational arguments by the SEC.

The SEC requested the court to compel Ripple to submit audited financial statements for 2022-2023, contracts for the sale or transfer of XRP to “non-employee counterparties”, and amount of “XRP Institutional Sales proceeds” received after the filing.

However, Ripple gave two reasons to deny the request. Firstly, the SEC has failed to request discovery while fact discovery was open and now lacks good cause for further discovery concerning post-complaint sales.

“The SEC never argued that post-complaint discovery was relevant to remedies but instead took the position that post-complaint conduct was entirely irrelevant to the case. That motion was resolved after Ripple agreed,” argues Ripple.

Secondly, the SEC requests are irrelevant and has no bearing on the court’s remedies determination. The SEC’s considering whether Ripple’s post-complaint conduct violated the law will need a lengthy fact discovery period or a new litigation.

The SEC’s interrogatory in particular, the SEC has used all of its interrogatories in the case and cannot unilaterally grant itself more.” Ripple urges the court to deny irrelevant post-complaint discovery.

CoinGape earlier reported that the SEC’s motion to compel is grounded in a July 2023 ruling, where it was determined that XRP tokens qualify as a security when sold to institutional investors.

Also Read: Bitcoin Price Sees Mild Bounce back, Whale Activity at 15-Month High

Lawyers Claim the Discovery As Irrelevant In XRP Lawsuit

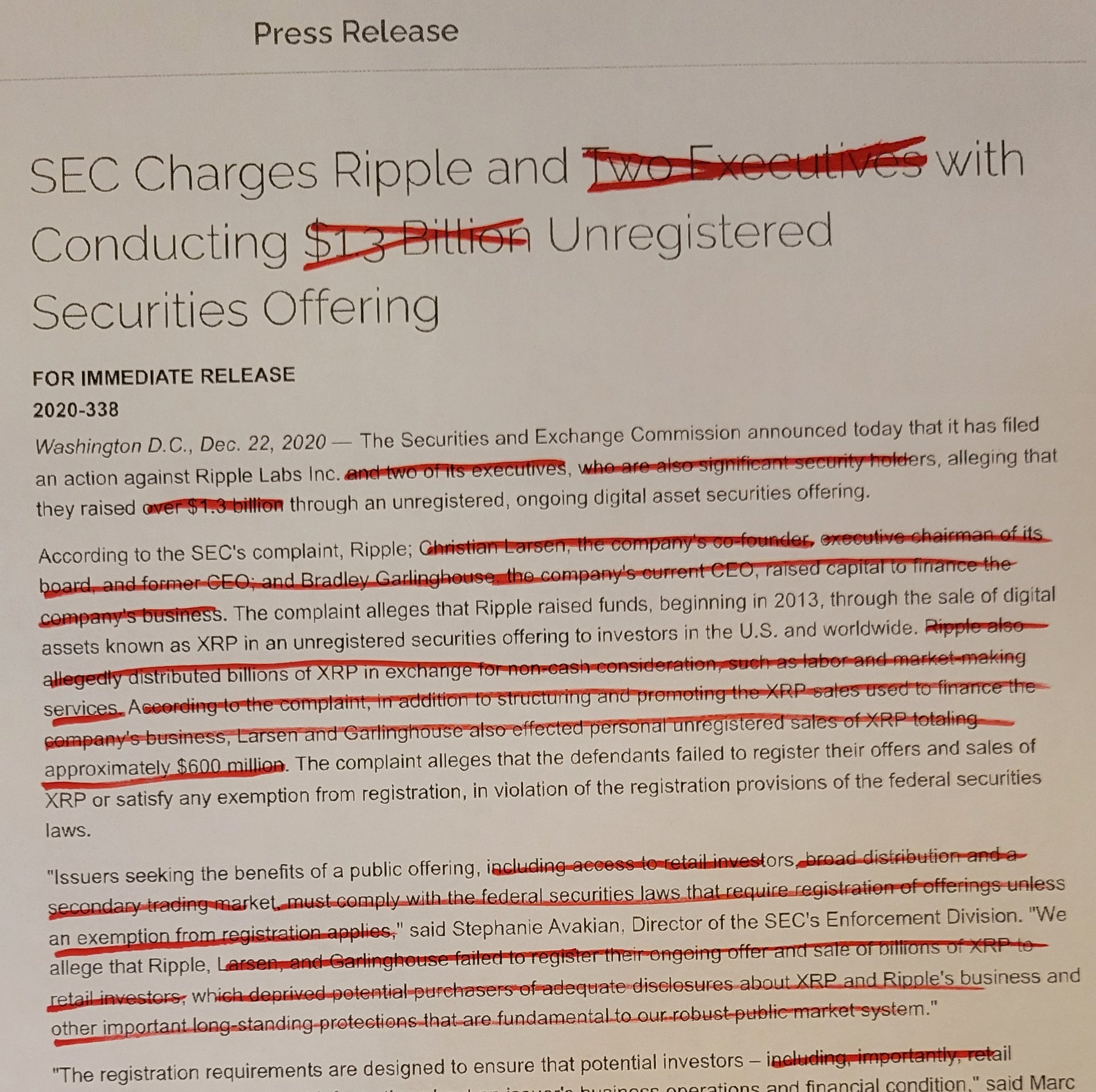

Attorney Jeremy Hogan said the SEC now seeking relatively minor discovery dispute is not all that legally interesting. He also looks at the SEC‘s grand press release from 2020 when it filed the lawsuit and it shows the SEC is losing its grip on the lawsuit.

Attorney Bill Morgan pointed out that the SEC would require litigating whether post-complaint sales meet the Howey test. He claims ODL customers will raise an issue as he referred to in his several earlier posts. “How does an ODL customers expect profits from using XRP.”

Also Read: US SEC Acknowledged Options for Spot Bitcoin ETFs, Approval By Feb End?

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/xrp-lawsuit-ripple-sec-financial-statements-discovery-news/

✓ Share: