Key Takeaways

How does Ripple’s acquisition of Hidden Road impact RLUSD?

Ripple Prime is expected to significantly boost RLUSD’s usage, especially as collateral in prime brokerage services.

What’s driving XRP’s recent price surge?

Aggressive accumulation by retail traders and whales, along with reduced whale selling, is fueling bullish momentum.

Throughout the year, Ripple [XRP] has benefited from a favorable environment to advance its global ambitions.

With legal challenges easing and a pro-crypto administration in office, the company has embarked on an aggressive acquisition strategy.

So far, Ripple has completed three major acquisitions aimed at expanding its presence in traditional finance (TradFi).

Its latest move: the acquisition of non-bank prime broker Hidden Road, marking another step in Ripple’s growing dominance.

Ripple completes $1.25B acquisition of Hidden Road

Ripple has completed its $1.25 billion acquisition of Hidden Road, a non-bank prime broker, marking a major milestone for the company.

Following the deal, Hidden Road was rebranded as Ripple Prime, making Ripple the first crypto firm to own a global, multi-asset prime brokerage.

Ripple Prime now offers institutional investors a full-service platform for digital asset trading, including financing, clearing, and access to markets such as foreign exchange, fixed income, and derivatives.

Crucially, clients of Ripple Prime also gain direct access to Ripple’s digital asset ecosystem — including XRP and its stablecoin RLUSD.

What this acquisition means for RLUSD

Ripple President Monica Long stated that Ripple Prime offers extensive opportunities for institutional clients, especially when paired with Ripple’s stablecoin, RLUSD.

RLUSD is already being used as collateral across various prime brokerage products, and Ripple expects its adoption to grow significantly through Ripple Prime.

In fact, many clients have begun shifting their derivative holdings into RLUSD balances, signaling deeper integration of the stablecoin into institutional workflows.

Source: Artemis

Currently, RLUSD dominates Ripple’s stablecoin transfer volume, surpassing 25 million, followed by USDC at 2.5 million.

With the Ripple Prime, this volume is likely to surge and surpass 30 million in the near term.

Any impact on XRP?

As expected, the recent news had a positive impact on XRP price action. In fact, XRP surged 4.2%, reaching a local high of $2.56, then retraced to $2.54 at press time.

Over the same window, the altcoin’s volume jumped 35.82% to $4.62 billion, reflecting steady capital inflows.

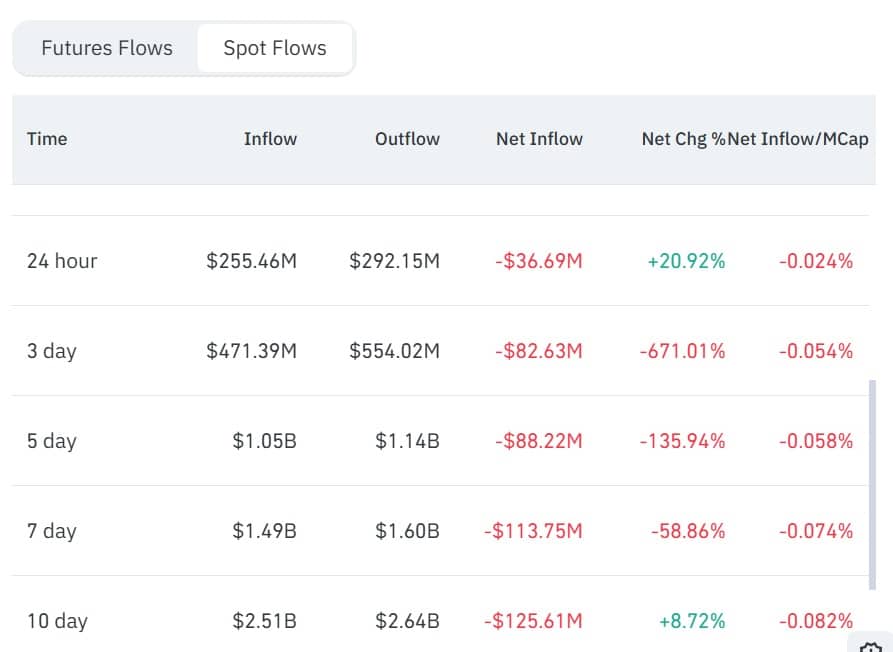

According to CoinGlass, the altcoin registered $292.15 million in spot outflows versus $255.46 million in inflows, a sign of strong buying interest.

Source: CoinGlass

As a result, the Spot Netflow declined to $36.69 million, a clear sign of aggressive spot accumulation. On top of that, Whale-to-Exchange Transactions plummeted, dropping from 2.2k to zero, at the time of writing.

Such a drop suggests that whales reduced spending, but instead turned to accumulating the altcoin, a clear bullish sign.

Source: CryptoQuant

When whale selling declines and Exchange Netflow remains negative, it usually signals strong bullish sentiment across the market.

Given these conditions, XRP appears well-positioned for further gains. If the current momentum continues, the token could aim for the $2.8 resistance level.

However, if the trend stabilizes without a breakout, XRP will likely trade within the $2.3 to $2.5 range.

Source: https://ambcrypto.com/ripple-expands-tradfi-reach-with-1-25b-hidden-road-deal/