- RBI emphasizes CBDC over crypto, led by Governor Shaktikanta Das.

- CBDC development continues with pilot programs and retail sandbox.

- Cryptocurrency market faces regulatory pressures amid CBDC focus.

The Reserve Bank of India Governor emphasized on October 15 the preference for promoting a central bank digital currency over cryptocurrencies or stablecoins in India.

This priority underscores India’s cautious regulatory stance on private cryptocurrencies, impacting their local market landscape. The focus remains on developing a secure CBDC ecosystem.

India Focuses on e-Rupee Amidst Crypto Concerns

The Reserve Bank of India has reiterated its commitment to the development of the e-rupee as its central bank digital currency, taking precedence over cryptocurrencies and stablecoins. Governor Shaktikanta Das emphasized a cautious and safety-first approach to its adoption.

Immediate implications include delayed nationwide rollout of the CBDC as the project remains in its pilot phase. Fintech firms are invited to participate in a retail sandbox to innovate around the CBDC, highlighting a collaborative governmental approach.

Industries and the crypto community exhibit mixed reactions. While some developers welcome the regulatory clarity, others express concern over the competitive threat to private crypto innovation. Governor Das’s statements underscore the central bank’s cautious approach to CBDCs.

Expert Views on India’s Monetary Policy Shift

Did you know? India’s CBDC pilot, the e-rupee, reflects a global trend where initial enthusiasm for government-backed digital currencies often diminishes post-incentive periods, as seen in Nigeria’s eNaira adoption.

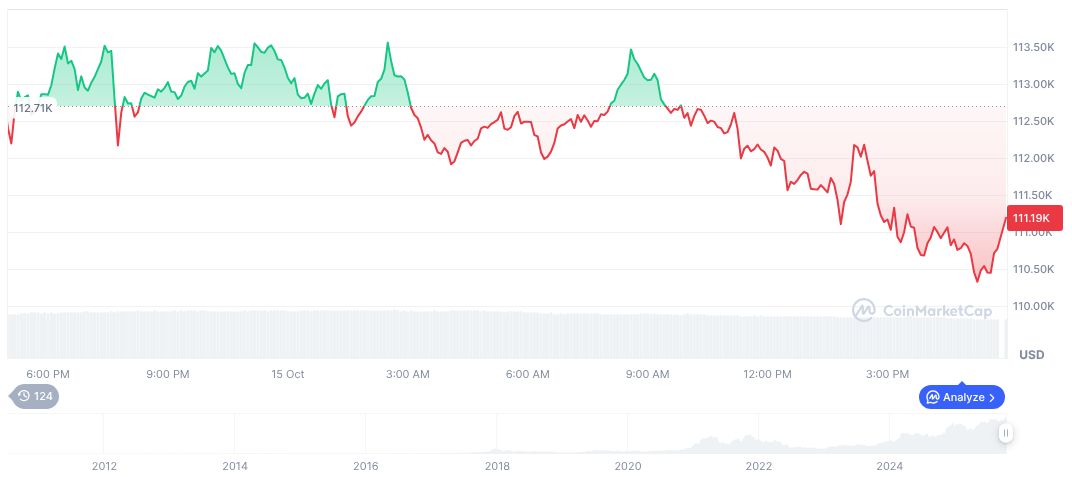

Bitcoin, symbol BTC, recorded a price of $111,547.25, with a market cap of formatNumber(2223628175675.58, 2), as per CoinMarketCap. The fully diluted market cap stands at formatNumber(2342492256312.39, 2), while trading volume decreased by 18.42%. Circulating supply is at 19,934,406, nearing its max supply.

Experts from Coincu Research anticipate that India’s focus on CBDCs could lead to enhanced regulatory frameworks affecting private cryptocurrencies. Historical trends showcase potential shifts in market dynamics as regulatory clarity strengthens state-backed solutions over private counterparts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/india-prioritizes-cbdc-over-cryptocurrencies/