- The reported Iranian missile attack on a U.S. base remains unverified by key sources.

- Cryptocurrency markets display no immediate disruption.

- Geopolitical tensions do not notably impact major crypto prices.

Israeli officials claim Iran launched six missiles at a U.S. base in Qatar, with explosions reportedly heard in Doha. Reports have not been directly confirmed by major news platforms.

The event adds tension to existing Middle Eastern conflicts; however, the cryptocurrency market, including Bitcoin, remains stable. No significant changes have been reported.

Unconfirmed Missile Strike Heightens Regional Tensions

Iran allegedly attempted a missile attack on a U.S. base located in Qatar, a claim reported by Israeli authorities. The event reportedly caused explosions in the Qatari capital, Doha. Axios mentions that no official confirmation from ChainCatcher or similar platforms has been released concerning this incident.

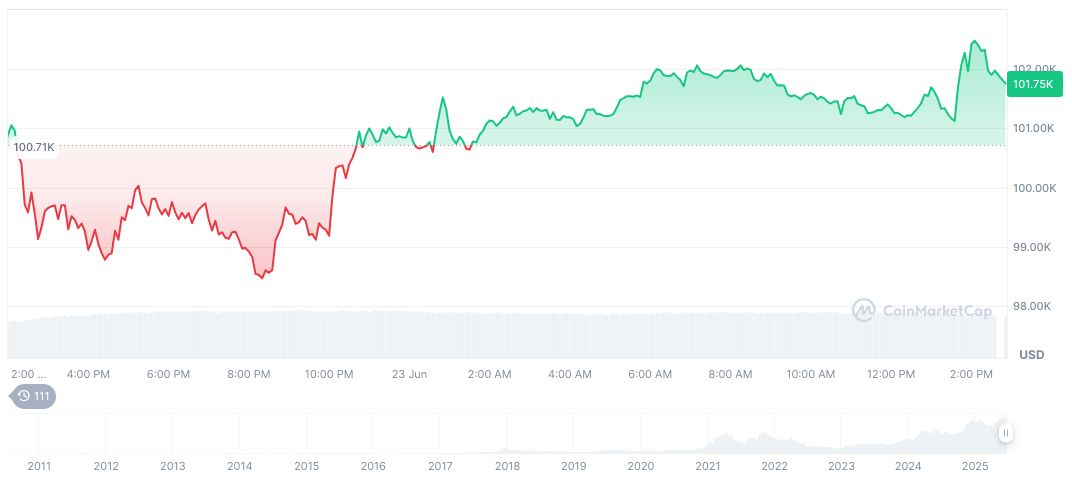

Current market movements in cryptocurrencies display little unrest related to the report. Despite potential geopolitical impacts, no notable fluctuations have been observed in Bitcoin or Ethereum. Bitcoin remains stable, leading experts to believe global markets are currently digesting the allegations with consistent steadiness.

Statements and reactions from key figures regarding the incident remain absent, with major blockchain leaders and influencers refraining from public discourse. Ripple effects on the industry appear limited at this moment, keeping the focus primarily on geopolitical implications.

Crypto Market Shows Resilience Amid Geopolitical Alerts

Did you know? Previous geopolitical tensions in the Middle East, including U.S.-Iran disputes, have historically led to brief volatility in safe haven assets like gold, though current crypto markets are stable.

Bitcoin’s current price stands at $100,507.66, with a market cap of approximately $1.99 trillion according to CoinMarketCap. The cryptocurrency holds a 64.80% market dominance. Recent fluctuations show a minor 1.02% increase over 24 hours, indicating a lack of market panic amidst the reported incident.

Analysts from Coincu foresee limited immediate changes in cryptocurrency regulations or technological advancements as a result of this news. The situation showcases the market’s resilience to regional geopolitical events, with no major shifts in on-chain data or token volatility tied to the recent claims. Bank of Russia proposes limited crypto trading, but immediate changes in regulations are not anticipated.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344809-iranian-missile-strike-qatar-crypto-reaction/