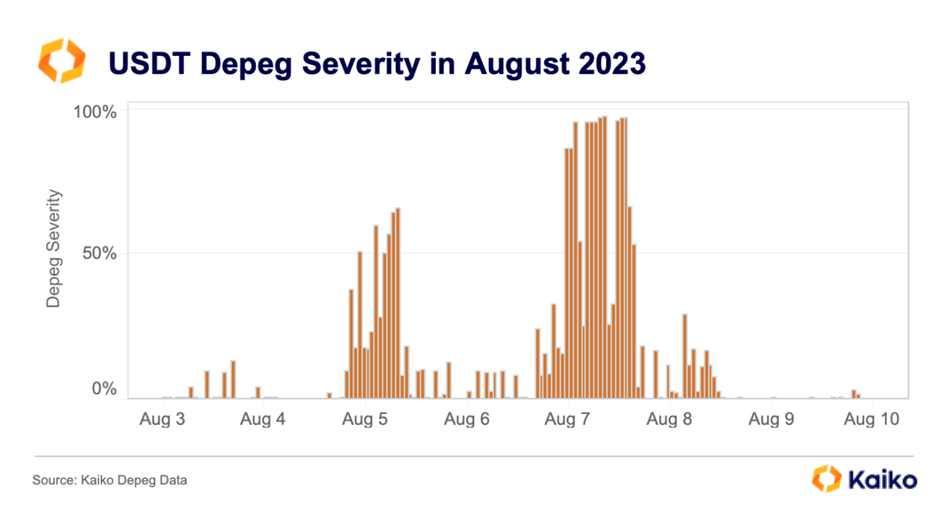

- Kaiko researcher Riyad Carey revealed an intricate USDT depegging pattern in August.

- USDT experienced a severe 98% depeg on August 7, when the stablecoin traded at a 2% discount.

- Low liquidity and high redemption fees are the major factors that led to the USDT depegging.

A recent analysis presented by a Kaiko researcher Riyad Carey, revealed an intriguing development in the world of stablecoins, providing insights into the intricate depegging pattern that the largest stablecoin USDT witnessed the last month. According to the research, Tether’s USDT experienced a severe 98% depeg, on August 7, when the stablecoin traded at around a 2% discount on almost every exchange.

Earlier today, the analyst took to Twitter to invite the readers’ attention to the unnoticed USDT depegging that took place in the month of August. Clarifying the readers’ ambiguities, the researcher elucidated that the platform introduced a new metric that assesses “the severity of stablecoin depegs”.

As per Kaiko’s report, on August 7, at around 8 a.m. (UTC), USDT traded at a lower price, compared to its $1 peg. The platform explained that the month’s USDT depegging followed the net selling of the token worth $500 million across the leading crypto trading platforms including Binance, Uniswap, and Huobi.

While Kaiko’s new metric creates a unique depeg threshold for each stablecoin, the analysis identified that the USDT has the smallest depegging threshold, whereas DAI has the largest. Notably, the metric works on the principle that stablecoins with higher trading volumes would be less open to depegging while highly traded stablecoins are more vulnerable to getting depegged.

While analyzing historical trends, it is notable that the USDT depegging is much influenced by several factors including lower liquidity, redemption fee, and Tether’s minimum requirements for USDT supply. Justifying history, the USDT depegging in August is also a result of lower liquidity and redemption fees. The prolonged crypto winter is also one of the major reasons for the stablecoin’s instability and the resultant depegging.

The analyst suggested that a reduction in the redemption fees could possibly tackle the prevailing dilemma in the USDT ecosystem. He added that the $850 million profit reported in the second quarter of 2023 would not be affected by the redemption fee removal.

Source: https://coinedition.com/recent-research-portrays-tether-usdts-intriguing-depeg-in-august/