- Qian Fenglei and Hengfeng International involved in unapproved investment scheme.

- Thousands reported losses following the incident.

- Regulatory action and market effects under scrutiny.

Qian Fenglei, a prominent businessman and ally of Jack Ma, faces allegations of selling unapproved investment schemes in Hong Kong via companies like Hengfeng International. Tens of thousands of investors have reportedly incurred losses, prompting calls for regulatory intervention.

The involvement of a high-profile figure like Qian Fenglei underscores serious implications for investors, as regulatory scrutiny is heightened to prevent similar occurrences.

Qian Fenglei’s Alleged Scheme Affects 120,000 Investors

Qian Fenglei and Hengfeng International are subjects of a regulatory investigation for allegedly marketing unauthorized investment schemes in Hong Kong. Such schemes have reportedly affected over 120,000 individuals, drawing the attention of Chinese mainland authorities and the Hong Kong Securities and Futures Commission.

Impacting many investors, this investigation emphasizes oversight issues involving unauthorized investment actions. Losses among investors accentuate the need for increased regulatory measures to protect consumers and assure investment transparency.

“No official statements addressing the crisis found on the LinkedIn, Twitter, or Medium accounts of Qian Fenglei or the implicated investors in primary sources as of July 20, 2025.” source

Market reactions have been significant, with affected investors urging intervention. There is a notable absence of major industry statements, with uncertainty regarding immediate regulatory responses from key stakeholders and institutions highlighting concerns surrounding investment scheme governance.

Stablecoin Trading Remains Resilient Amid Fraud Allegations

Did you know? Previous large-scale collective investment frauds often triggered heightened regulations, but they did not instantly affect crypto prices unless they entailed systemic platforms.

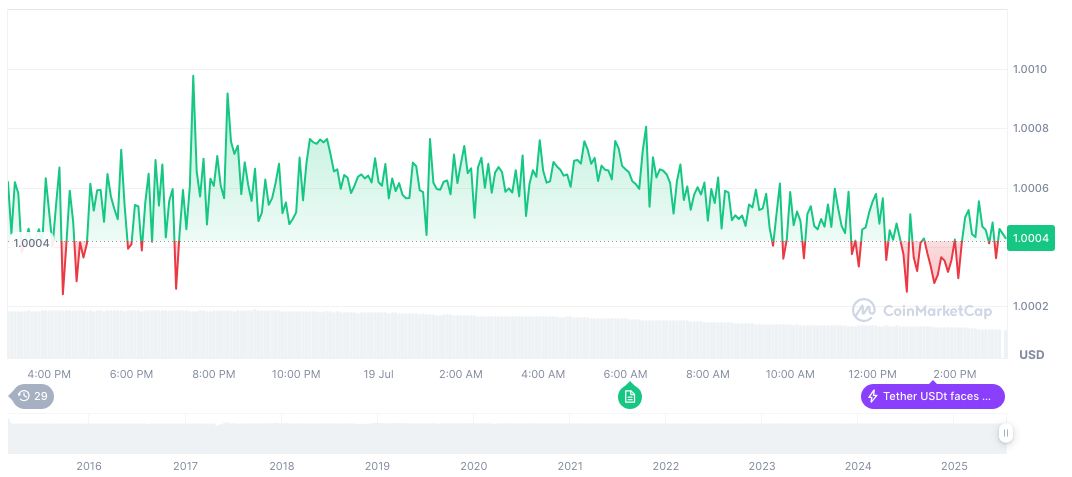

Tether USDt (USDT) maintains a stable price at $1.00 with a market capitalization of 161,650,199,722.00. U.S. dollars dominate cryptocurrency trading despite the recent scandal, with a 24-hour trading volume of 83,763,706,922.00, marking a 39.88% decrease. Data sourced from CoinMarketCap.

Insights from Coincu highlight increased regulatory focus on crypto-related activities following recent events. Historical trends suggest stringent regulations could follow, with ongoing scrutiny possibly impacting global stablecoin utilization. Broader implications rest on regulatory clarity and enforcement, as market and investor confidence are influenced.

Recent developments also point to a possible shift in regulatory approach towards cryptocurrencies. For example, the Bank of Russia proposes limited crypto trading and the SEC delays spot crypto ETF decisions, both indicating a cautious yet evolving regulatory landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349686-qian-fenglei-investment-scheme/