- Powell clarifies dual mandate, focusing on inflation and employment.

- Fed actions impact USD-denominated assets indirectly affecting crypto.

- Monetary policy clarity signals cautious market movements.

Federal Reserve Chairman Jerome Powell addressed statutory mandates, emphasizing “moderate long-term interest rates” as derivatives of inflation stability and employment maximization at a September 18th press conference.

The clarification impacts U.S. economic expectations, possibly influencing USD-denominated and crypto markets, notably BTC and ETH, as long-term rate stability shapes investment strategies.

Dual Mandate Focus: Inflation and Employment Stability

Federal Reserve Chairman Jerome Powell stressed maintaining low and stable inflation and maximizing employment as the Fed’s key focuses. By clarifying that long-term interest rates derive naturally from these goals, the Fed signaled continued attention to its established dual mandate. This communication aligns with historical Fed policy.

Markets may interpret this clear stance from the Fed as maintaining a data-driven approach. USD-denominated assets, often influential on crypto, particularly Bitcoin and Ethereum, are likely to remain stable if inflation and employment targets are effectively managed. The Fed did not propose any immediate policy changes or institutional shifts directly impacting the crypto market, yet historical precedence suggests market reactions could occur indirectly.

Jerome Powell, Chairman, Federal Reserve, emphasized the Fed’s approach by stating, “We see that moderate long-term interest rates are the outcome of achieving low and stable inflation and maximizing employment.”

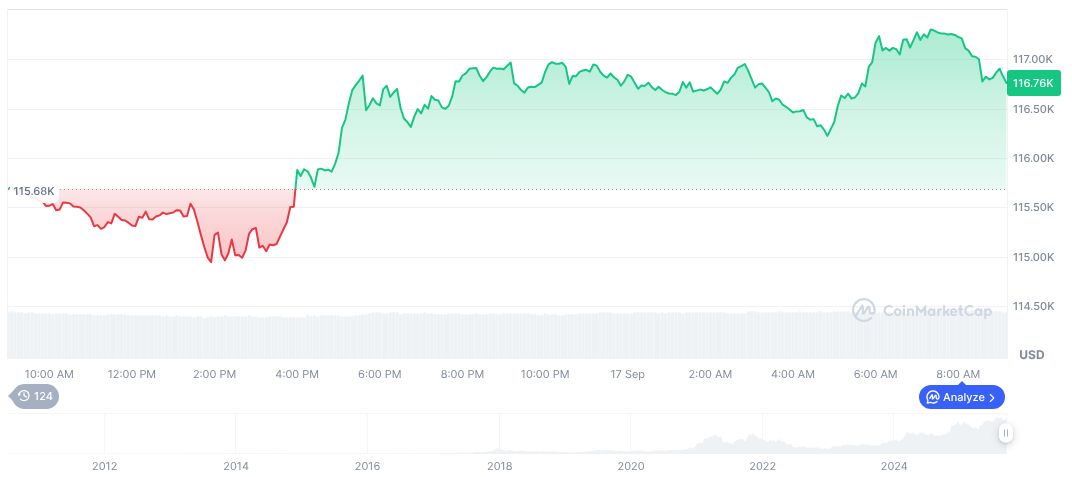

Crypto Markets Remain Steady Amidst Fed Announcements

Did you know? The Federal Reserve has emphasized its dual mandate since the late 1970s, influencing asset repricings during clarified policy updates.

Bitcoin (BTC) holds a price of $116,566.10, per CoinMarketCap. The cryptocurrency’s market capitalization is $2.32 trillion, while the fully diluted market cap reaches $2.45 trillion. With a 24-hour trading volume of $63.91 billion, Bitcoin saw a minor 0.12% price decline over the past day but increased by 2.17% over the last week. The cryptocurrency maintains a market dominance of 56.85%, driven by its circulating supply of 19,922,396 out of a maximum 21 million.

According to Coincu researchers, macroeconomic policy signals are expected to guide asset flows in interest-rate–sensitive tokens and protocols. Analysts predict that crypto projects will remain attentive to global financial developments that impact yield and borrowing costs, reflecting adjusted strategic developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/powell-clarifies-fed-dual-mandate/