- Powell addresses tariff impacts; policy remains moderately restrictive.

- Future Fed actions driven by forthcoming data.

- Crypto market stabilizes with no major shifts.

Federal Reserve Chairman Jerome Powell stated on July 31 that tariffs’ impact on inflation is temporary, with upcoming data crucial for future policy direction amidst current moderately restrictive stance.

Cryptocurrency markets, exhibiting modest volatility, reflect attentiveness to Powell’s comments as investors await forthcoming data to navigate potential shifts in monetary policy impacting BTC and ETH.

Powell Highlights Temporary Nature of Tariff Impacts

Federal Reserve Chairman Jerome Powell addressed inflation concerns, highlighting that tariff impacts are seen as temporary. Upcoming data will strongly influence the Federal Reserve’s future policy decisions. The current policy stance is moderately restrictive, reflecting ongoing inflation risks. Powell reiterated, “The impact of tariffs on inflation is expected to be temporary. Upcoming data releases will help the Federal Reserve determine future policy. The current stance is aligned with inflation risks and is moderately restrictive.” Source.

Market parties are reacting cautiously, keeping a close eye on economic indicators. Federal Reserve’s economic data context in policy uncertainty. These data will be pivotal in defining how the Fed proceeds. Following Powell’s comments, there was slight fluctuation in cryptocurrency markets, primarily in Bitcoin and Ethereum. Nonetheless, there was no significant shift in asset value or trading strategies.

Industry figures have yet to make official responses regarding these comments.

Within cryptocurrency markets, the prevailing focus remains on the stability of fundamental assets. Jerome Powell’s remarks drew attention, yet no immediate policy changes were announced by regulatory figures or major institutional entities.

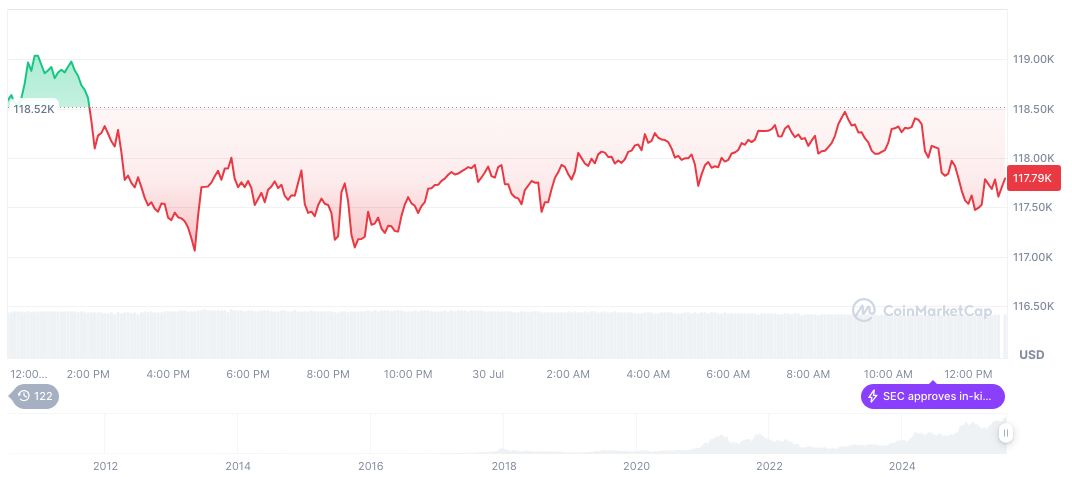

Bitcoin Trades at $116,811 Amidst Stable Market Conditions

Did you know? Previous tariff-related statements by Powell witness temporary volatility in crypto markets, stabilizing once long-term Fed guidance is clarified.

According to CoinMarketCap, Bitcoin (BTC) currently trades at $116,811.62, with a market cap of $2.32 trillion and a dominance of 60.68%. The trading volume over 24 hours amounts to $64.21 billion, marking a 7.38% decrease. Recent price shifts include a monthly rise of 8.89% and a quarterly increase of 20.58%, reflecting its sustained market position and investor confidence.

Expert insights from Coincu highlight potential outcomes, noting stable yet attentive market conditions as key. The team anticipates close monitoring of inflation data as critical in determining policy adjustments. Binance square post on market trends. Historical patterns suggest markets will remain on alert for further announcements, maintaining a cautious but steady outlook.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/powell-inflation-tariffs-fed-policy/