Key Takeaways

- Popcat surged 16%, boosted by whale accumulation and rising derivatives interest. Despite bullish momentum, profit-taking and volatility may challenge its path to $0.40.

Popcat [POPCAT] rallied 16.14% after successfully defending $0.28, reaching a 3-week high of $0.3403 before slightly retracing to $0.336 at press time.

At the same time, the memecoin’s trading volume spiked by 113% reaching $84.7 million, reflecting vigorous on-chain activity. But what’s fueling the surge – investor conviction or a mere technical bounce?

Popcat whales are accumulating

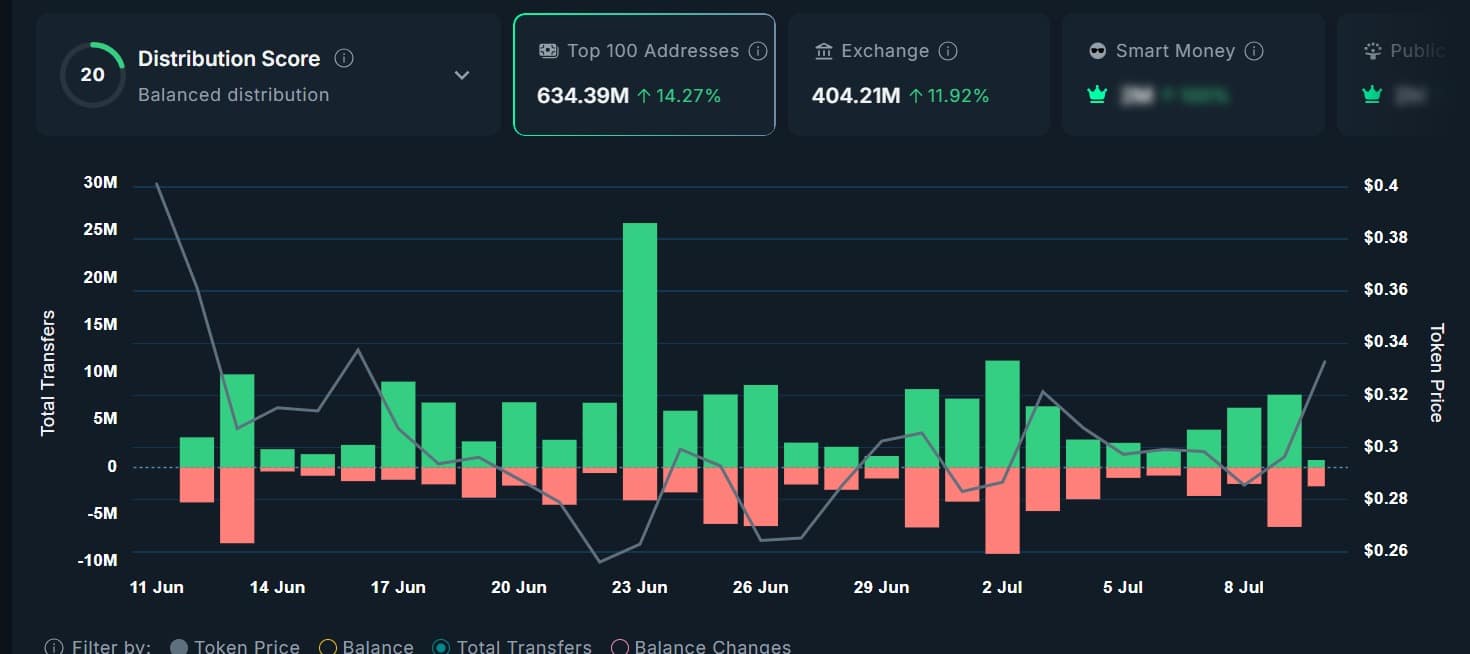

As the cryptocurrency market recovered over the past 24 hours, Popcat whales entered the market to increase their holdings.

According to Nansen, the memecoin’s top holders increased their holdings by 14.28% to $634.39 million, as of reporting.

Source: Nansen

On the 10th July 10th, these holders acquired 8.5 million tokens, increasing their total supply held to 64.74%. With large holders turning to aggressive accumulation, it reflects a firm conviction in the memecoin’s prospects.

As such, they anticipate that the Popcat value will continue to rise and see it as a good opportunity to buy now at lower rates.

Derivatives are eyeing more gains

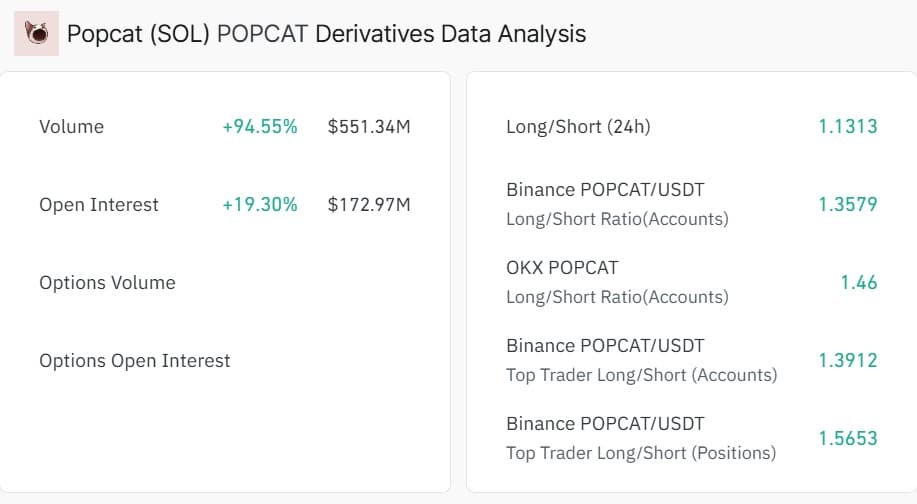

Notably, while whales have entered the rally, it appears they have done so to establish strategic positions.

According to CoinGlass, Popcat’s Open Interest (OI) soared 19.3% to reach $172.9 million, while the Derivatives Volume spiked 94.55% to $551.34.

Source: CoinGlass

Notably, a surge in OI alongside volume confirms increased activity in the futures volume. At the same time, Popcat’s Long Short Ratio surged to surpass 1 across all major exchanges.

The overall Ratio spiked to 1.1313, signaling strong demand for long positions. Typically, a higher demand for longs implies that investors are actively betting on prices to rise.

Holders get greedy

As the Popcat price surged, so did the urge to realize profit among all market participants.

According to CoinGlass data, Spot Netflow surged to $485.9K then slightly dropped to $278K, at the time of writing.

Source: CoinGlass

Such a spike implies that investors who have been underwater were cashing out despite the price surge.

In fact, Supply on Exchanges increased by 11.92% to $404.2 million, reflecting massive selling activity.

Can Popcat sustain recent gains?

According to AMBCrypto’s analysis, Popcat experienced a strong upswing as buyers, particularly whales, returned with increased strength.

As a result, the memecoin’s Stochastic RSI surged to 86.73, at press time, signaling strong upward momentum.

However, with this metric reaching these levels, it also warns of potential brewing volatility, as buyers could become exhausted.

Source: TradingView

In the same light, the Relative Strength Index (RSI) surged to 54, touching bullish territory, further confirming the presence of buyer momentum.

Therefore, under these circumstances, where buyers are strongly holding and momentum is strengthening, Popcat is poised for more gains.

Thus, if sentiments hold, the memecoin could reclaim $0.36 and target $0.40.

However, the continuation of the uptrend depends on the actions taken by holders on exchanges. If profit taking experienced over the past day persists, the memecoin will face downward pressure and drop to $0.28 again.

Source: https://ambcrypto.com/popcat-soars-16-hits-3-week-high-is-0-40-within-reach/