- POL whales accumulated a substantial number of tokens in the recent past.

- It will be crucial for Polygon to go above the $0.6 resistance to start a fresh bull run.

Polygon [POL] has been underperforming in terms of its price action for multiple months. This was happening despite its major MATIC to POL upgrade, which had the potential to kickstart a revival.

Though the past wasn’t in investors’ favor, latest data revealed that the future might be different.

Polygon’s possible revival

Ali Martinez, a popular crypto analyst, recently posted a thread on X, pointing quite a few crucial updates on Polygon. POL price did increase by more than 26% in the past week, which can be attributed to the bullish market condition.

Despite the price hike, only 15% of POL investors were in profit. This was actually a positive development, as the lesser percentage indicated that the chances of profit taking are low.

When investors don’t cash out to take profit, the chances of a price hike increases.

In the meantime, the blockchain’s on-chain activity rose, indicating that new investors were positioning themselves. This was evident from POL’s rising active addresses and transaction volume.

Martinez also talked abut how whale activity was surging. The big pocketed players were on a buying spree as they accumulated 140 million POL tokens in the recent past. This massive hike reflected whales’ confidence in the token, which could be because they expect POL’s price to rise in the coming days or weeks.

Apart from this, POL’s price was moving inside a multi-year bullish pattern. Martinez mentioned that a weekly close above $0.7973 could trigger a rally to $15.27 or $36.17!.

Source: X

What on-chain data suggests

Since these aforementioned datasets indicated a revival, AMBCrypto then checked POL’s other metrics to see whether they also backed this possibility.

As per our analysis, POL’s long/short ratio registered a slight uptick in the 24-hour timeframe. This meant that there were more long positions in the market than short positions, reflecting investors’ confidence in the token.

Source: Coinglass

Polygon’s open interest also remained high last week when its price increased. Whenever the metric rises, it suggests that the chances of the ongoing price trend continuing are high, further back the possibility of a revival of POL.

Is your portfolio green? Check out the POL Profit Calculator

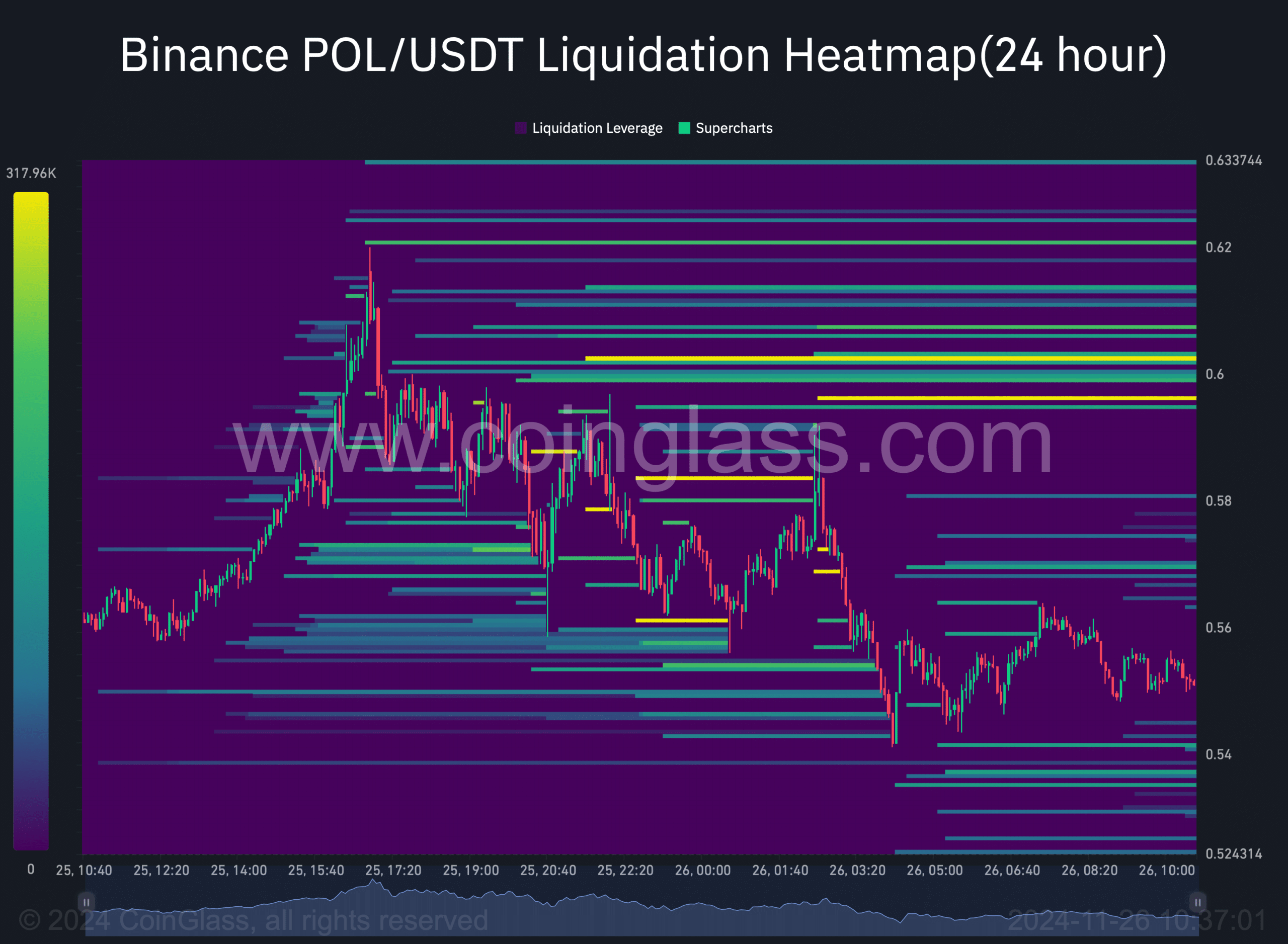

However, the token has a few obstacles ahead. In order for POL to close above $0.7 on the weekly chart, it must first cross its resistance at $0.6. This seemed to be the case, as liquidation will rise sharply at that mark.

Generally, a hike in liquidation results in price correction, which can restrict Polygon to spark a fresh bull rally.

Source: Coinglass

Source: https://ambcrypto.com/polygons-path-to-revival-how-crossing-0-6-could-spark-a-massive-rally/