- POL has surged by 51.88% over the past month.

- Recently, Alameda Research transferred 2 million Polygon tokens to Binance.

Since hitting a local low of $0.35, Polygon [POL] has experienced a sustained uptrend to hit a recent high.

In fact, as of this writing, Polygon was trading at $0.5406. This marked a 17.59% increase over the past day. Equally, the altcoin has surged on weekly and monthly charts, rising by 34.38% and 51.88% respectively.

This uptrend has created room for long-term holders to take profits. One of these long-term holders is Alameda Research.

Alameda Research transfers 2 million POL

According to data from Arkham intelligence, Alameda Research has transferred 2 million tokens, worth $915K, to the Binance exchange.

Also, Alameda has been on a selling spree over the past week, transferring a total of 4.5 million tokens worth $1.98 million. This transfer has raised questions about potential negative impact, leading to a pullback.

Usually, when large holders sell and the market fails to absorb the selling pressure, prices tend to decline.

Impact on price charts?

Despite these transfers by Alameda, POL was still experiencing strong positive sentiment, and remained in a bullish phase.

As such, while the market anticipated selling pressure to arise from these activities, it seemed that POL was handling things very well.

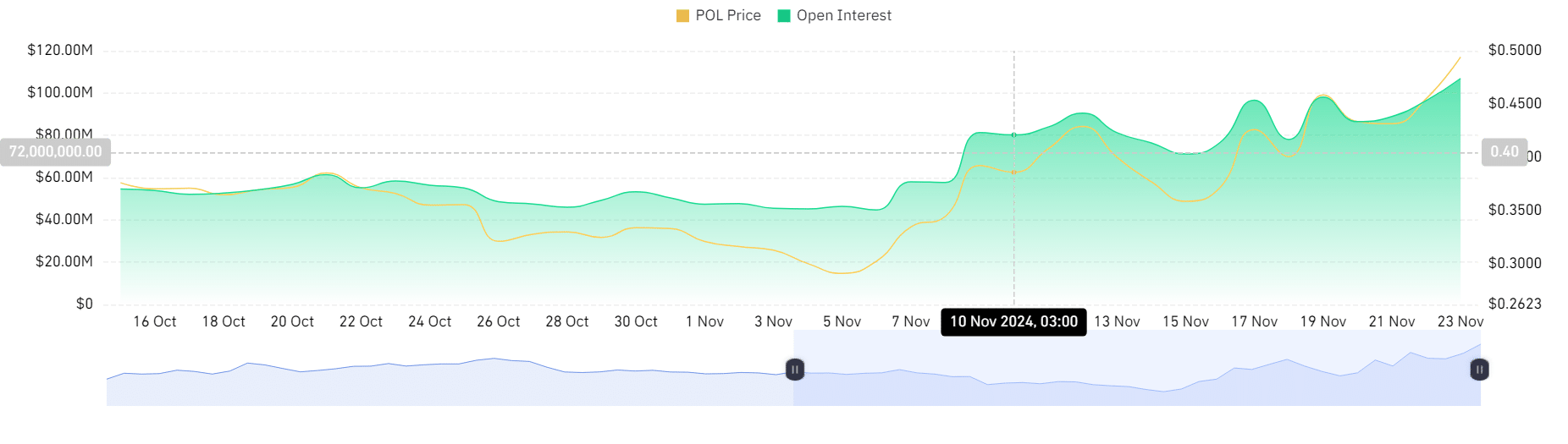

Source: Coinglass

We see this through a rise in Polygon’s Futures Open Interest, which surged to hit a new ATH of $106.9 million over the past 24 hours.

This rise in Open Interest reflected rising demand for the altcoin, as investors continued to open new positions.

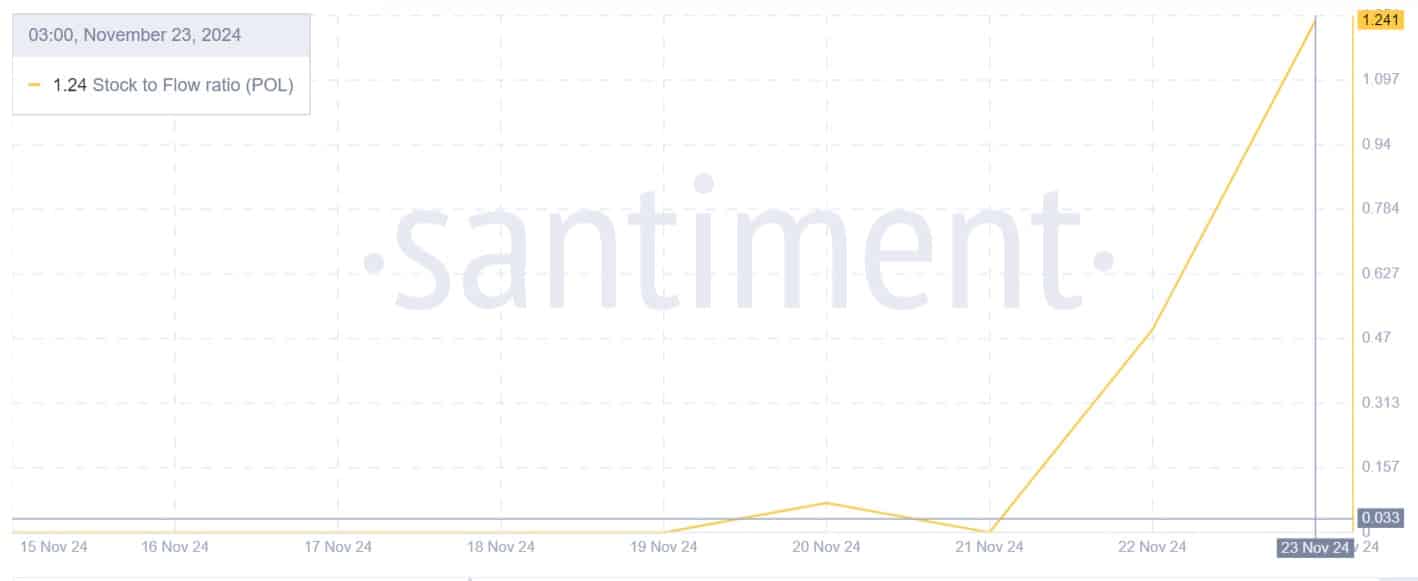

Source: Santiment

Additionally, Polygon’s Stock to Flow ratio has surged from oversupply levels to 1.24.

When SFR rises, it implies that the altcoin has become more scarce and scarcity leads to higher value. When supply declines while demand is rising, prices tend to appreciate.

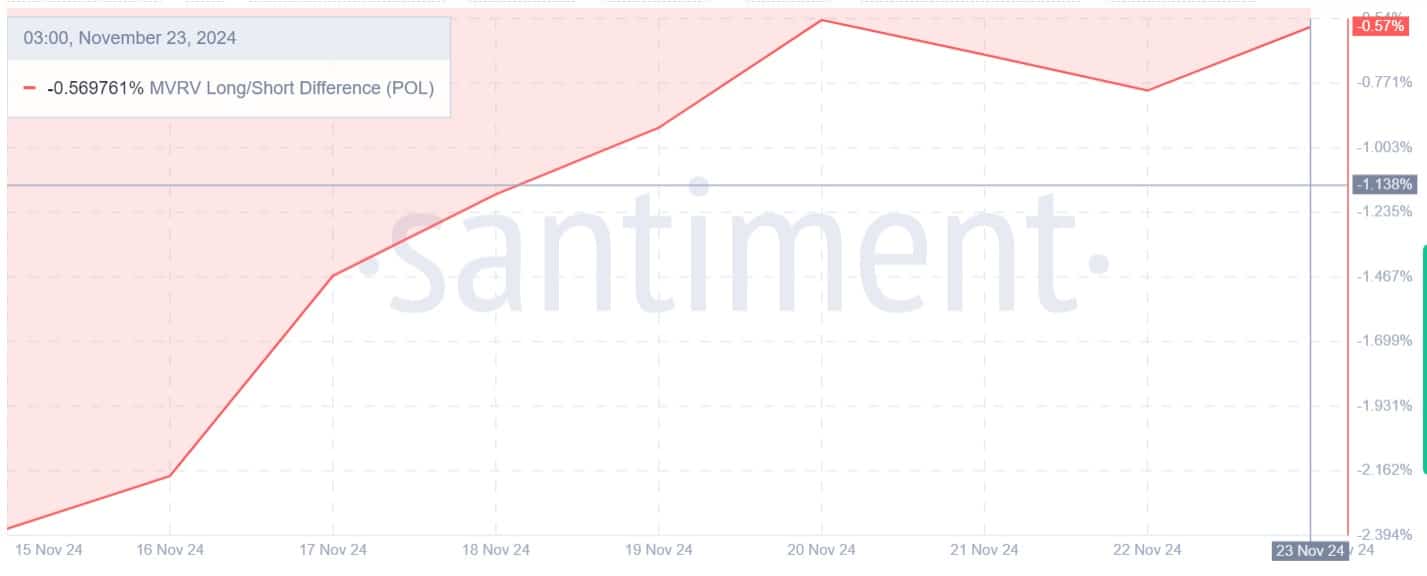

Source: Santiment

Finally, Polygon’s MVRV Long/Short Difference has surged over the past week from -2.37 to -0.56. This showed that long holders were in profit and highly bullish, anticipating further gains in price.

Read Polygon’s [POL] Price Prediction 2024–2025

In conclusion, despite Alameda Research’s massive transfers, POL was still experiencing bullish sentiment. However, these transfers are yet to negatively reflect on price charts.

With a strong upward momentum, POL could rise to $0.57 in the short term. Consequently, if these transfers end up affecting the market, POL will find support at around $0.47.

Source: https://ambcrypto.com/polygon-alameda-research-moves-2-mln-pol-impact-on-price/