While the crypto market boomed in 2025 amid widespread adoption, Polygon recorded minimal to no gains on its price charts.

Even though POL underperformed, its network usage and adoption rate reached record-breaking levels.

As a result, Polygon’s CEO was left dreaming of a resurrective 2026, building on the gains realized so far.

Is 2026 really the year of Polygon’s resurrection?

According to Polygon’s CEO, Sandeep Nailwal, the network is currently on its S-curve, driven by fee generation.

Sandeep posited that the network has recorded a massive surge in fees, mostly spent on token burns. As such, 1 million POL tokens have been burned daily over the past 3-4 days through fees accrued on the network.

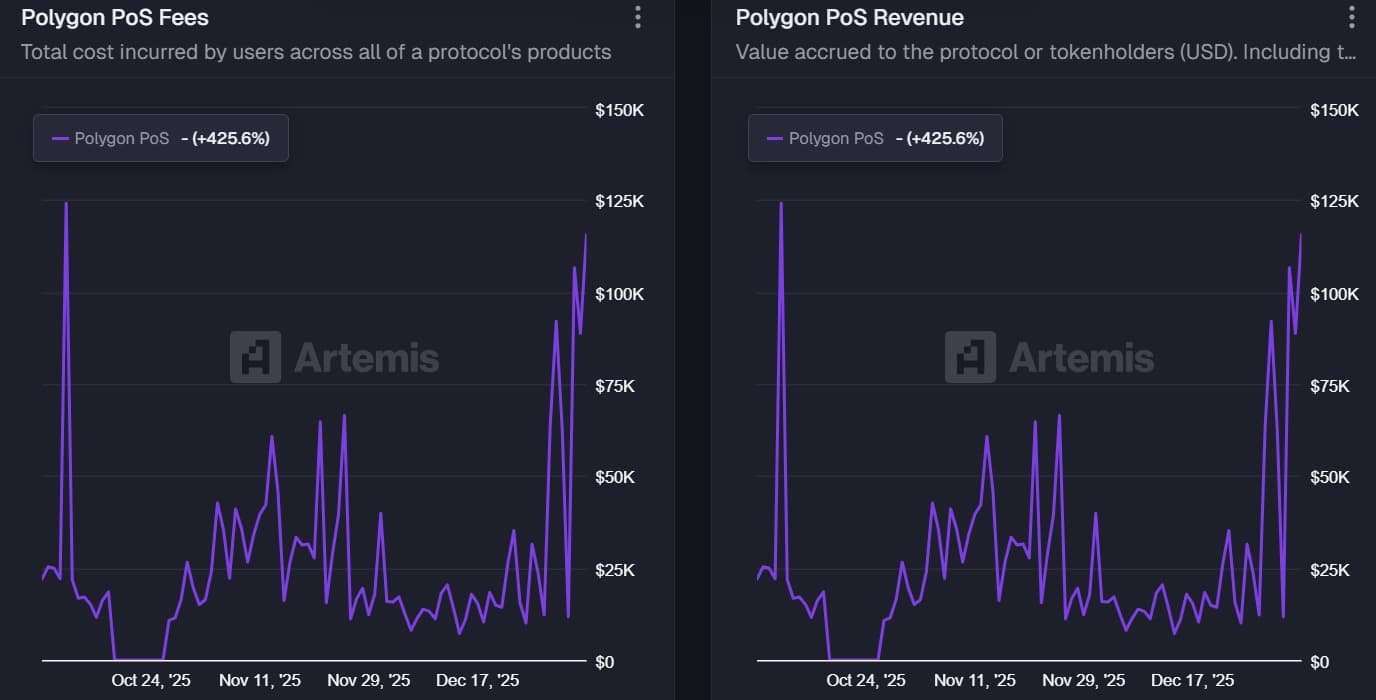

In fact, over the past three months, the network’s daily fees and revenue surged 425% to $115k, most of which was spent on burns.

Source: Artemis

As Sandeep observed, at this rate, if it continued for the whole year, 3.5% of POL’s total supply would be burned.

Such a burn rate introduces massive deflationary pressure on POL. Reduced inflation is key for POL’s future growth, as it accelerates upward movement.

Historically, there has been a direct correlation between higher scarcity and higher prices. For example, over the past six months, POL declined significantly when inflation rose, and has recovered in 2026 as inflation fell.

Source: Santiment

Additionally, 3.6 bln POL is staked, and stakers and validators earn a combined reward of 1.5% of POL. This also further elevates token scarcity.

Therefore, if the model holds for a sustained period, POL could benefit extensively in 2026.

Polygon hits a record 1.4 billion transactions in 2025

In addition to deflationary moves, Polygon usage and adoption have skyrocketed. According to official observation, Polygon reached a record 1.4 billion transactions in 2025, reflecting massive adoption.

Source: Polygon on X

In fact, daily transactions stabilized above 5 million, with occasional spikes to 7 million, while transaction volume stayed above 20 million.

Source: Santiment

Significantly, the growth in transactions was also backed by a growing user base.

Active addresses grew significantly, with weekly addresses stabilizing above 15 million while daily addresses hovered around 1 million and 700k.

Usually, when addresses and transactions rise in tandem, it signals increased network usage. Thus, more users are actively engaged with the network, pointing to actual demand for the asset.

Can POL claim a high 2026?

After trading in a descending channel through Q4 2024, POL kicked off 2026 on a positive note. In fact, the altcoin jumped 21% from $0.09 to $0.127 over the past week.

At press time, POL traded at $0.126, up 4.67% on the daily charts. This bullish outlook has carried over to the monthly charts after price cleared December losses.

As a result, the altcoin’s Stochastic Momentum Index moved from the negative zone to 84 at press time, indicating strong upward momentum.

Source: Trading View

With Polygon recording a significant adoption rate amid reduced scarcity, the sustainability of deflationary measures could set POL up for a positive run in 2026.

As of now, the altcoin faces significant long-term resistance at $0.17, according to the Future Trend Channel. To reach this level, POL must first target $0.15 in the short term.

However, a break in the current momentum will see the altcoin drop to $0.11, then attempt another leg up.

Final Thoughts

- Polygon is set for a significant deflationary boost in 2026, with 1 million POL burned daily via generated fees, which could amount to 3.5% of the supply.

- Polygon network usage recorded a significant milestone in 2025, hitting 1.4 billion transactions.

Source: https://ambcrypto.com/polygon-after-deflation-and-network-adoption-can-pols-price-reset-2026/