- Polkadot raised $500M but failed to retain users or developers long-term.

- DOT’s price has fallen 96% since its November 2021 peak, as on-chain demand dried up.

While the cryptocurrency market has experienced significant growth amid increasing adoption and acceptability, Polkadot [DOT] has followed a distinct path.

Consequently, the chain’s network usage and price performance have all collapsed in unison.

The most glaring indicator has been its price. DOT has plunged 93.9% from its all-time high of $55, set nearly four years ago. That deep drawdown has revived debates about the chain’s long-term viability.

And some aren’t pulling punches. According to analyst Nonzee, Polkadot is “dead”—citing its failing usage metrics and ecosystem decay.

Raised $500M and lost the plot: The rise and stall

With $500 million in funding, its core team pitched a bold vision to outpace Ethereum as the go-to chain for developers.

Source: Token Terminal

But momentum faded after the launch of Parachains. Real usage stalled. Daily Active Users across major chains fell to 5,000 in 2025.

Developer interest, once strong, declined from 2,400 to 1,000.

Capital fled as activity vanished

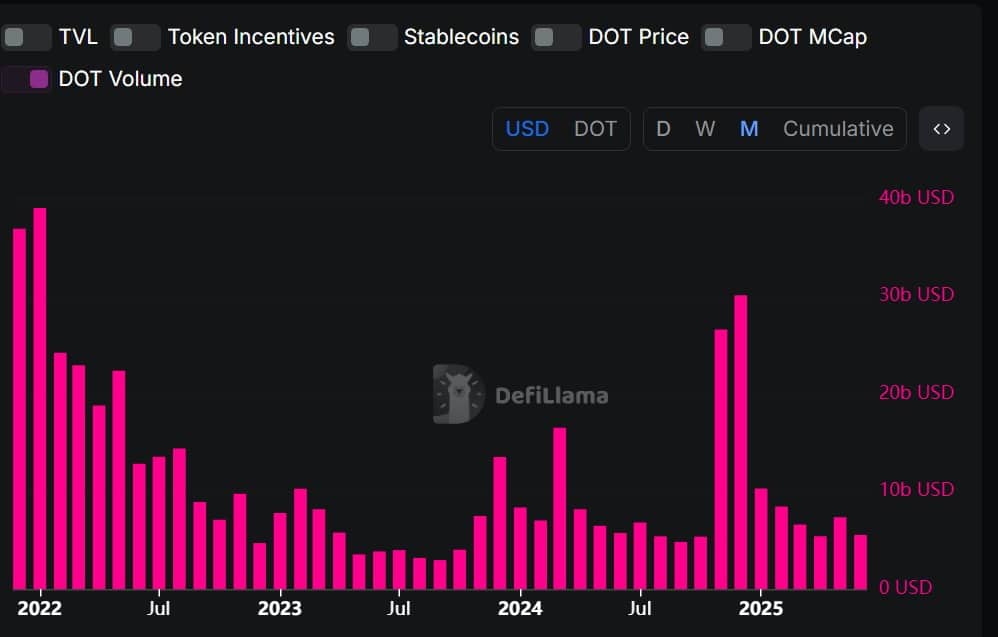

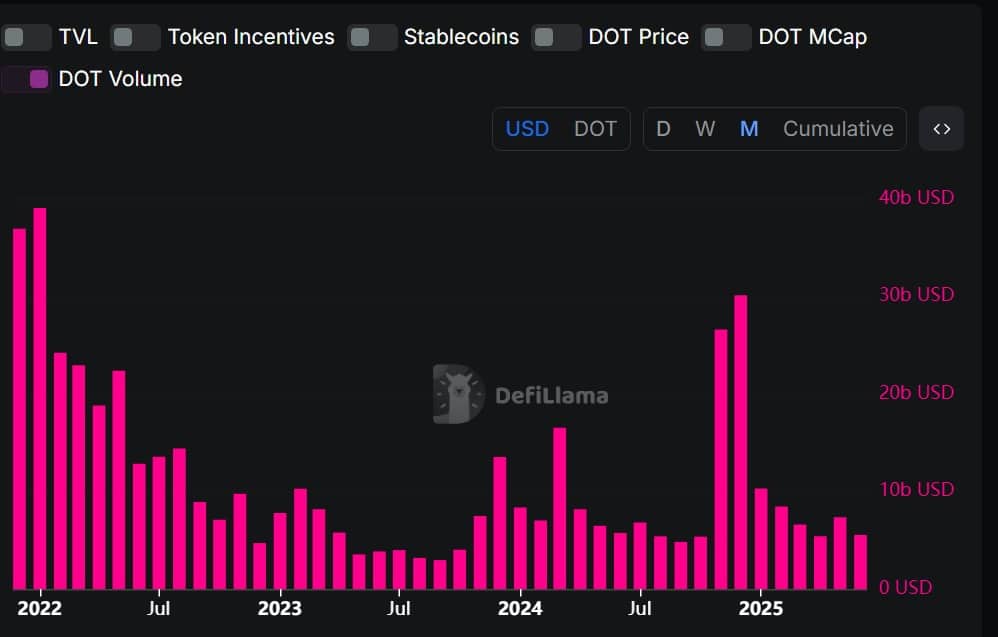

Source: DefiLlama

Amidst this decline in network usage, fresh capital stopped flowing, while existing investors exited the market.

As such, DOT’s Trading Volume has plummeted from 39 billion to 5 billion, indicating reduced on-chain activity.

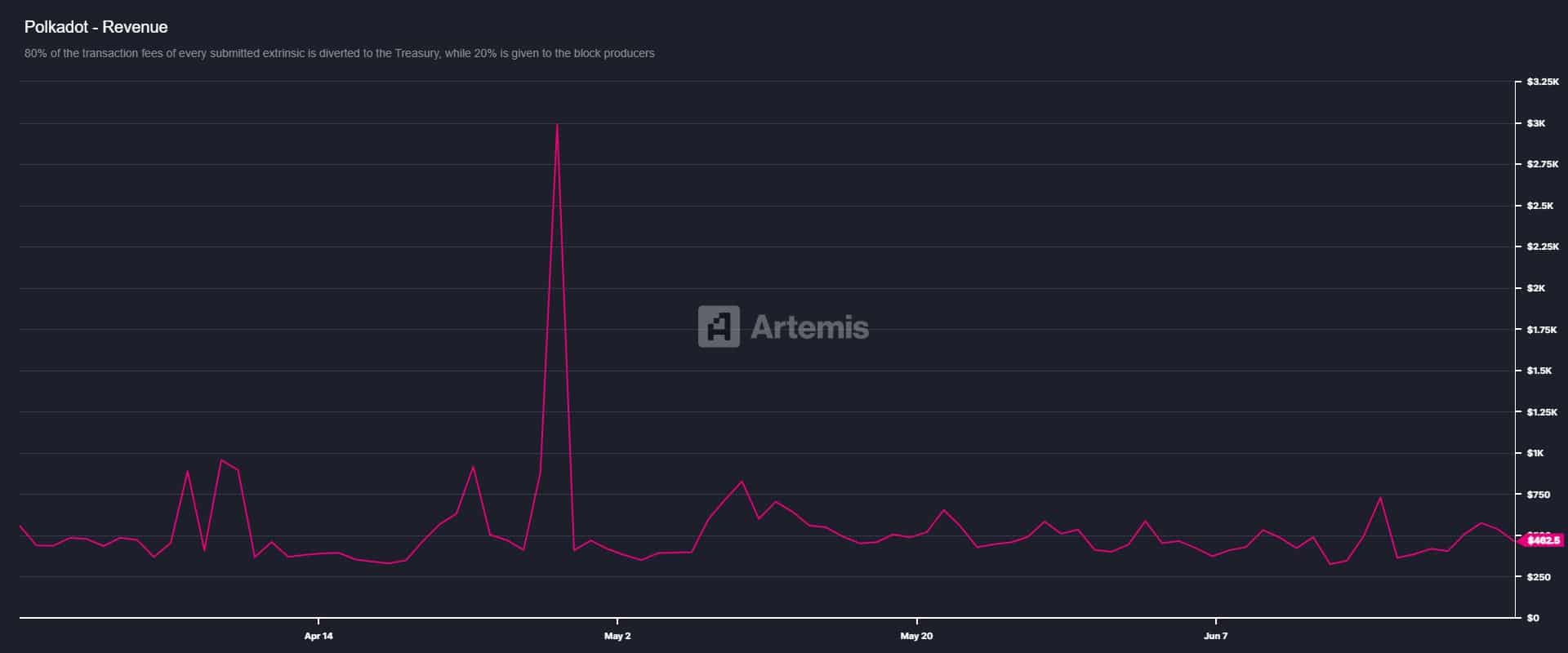

Revenue, too, evaporated. Polkadot generated just $462 and stayed below $1,000 for two consecutive months. That’s a red flag for a network once hyped as an infrastructure cornerstone.

Source: Artemis

Polkadot’s Circulating Market Cap Dominance sat at a meager 0.15%, cementing its slip into irrelevance amid competing chains. Investors responded by reallocating funds elsewhere.

No users, no devs, no future?

While DOT has continued to decline, other crypto assets are growing. In light of this, it’s a cause for concern as investors take a step back from the market.

Source: Messari

Can DOT recover, or is worse to come?

According to AMBCrypto’s analysis, Polkadot is experiencing unfavorable market conditions. These circumstances position DOT for potentially more losses on its price charts.

As of this writing, it traded at $3.3, down 26.8% in a month and 47.1% over the year.

Its RSI drifted toward oversold territory, signaling prolonged sell-side aggression. If sellers persist, DOT risks a fall to $3.0 support, then potentially $2.8.

Source: TradingView

Buyers would need to step in soon to prevent deeper damage.

A bounce isn’t impossible. If sellers ease, DOT may attempt a push toward $3.6 resistance. But if it breaks below $2.6, the case for DOT being a “dead chain” might be more than just harsh commentary.

Source: https://ambcrypto.com/polkadots-ecosystem-decay-and-dots-collapse-is-this-the-end-of-the-road/