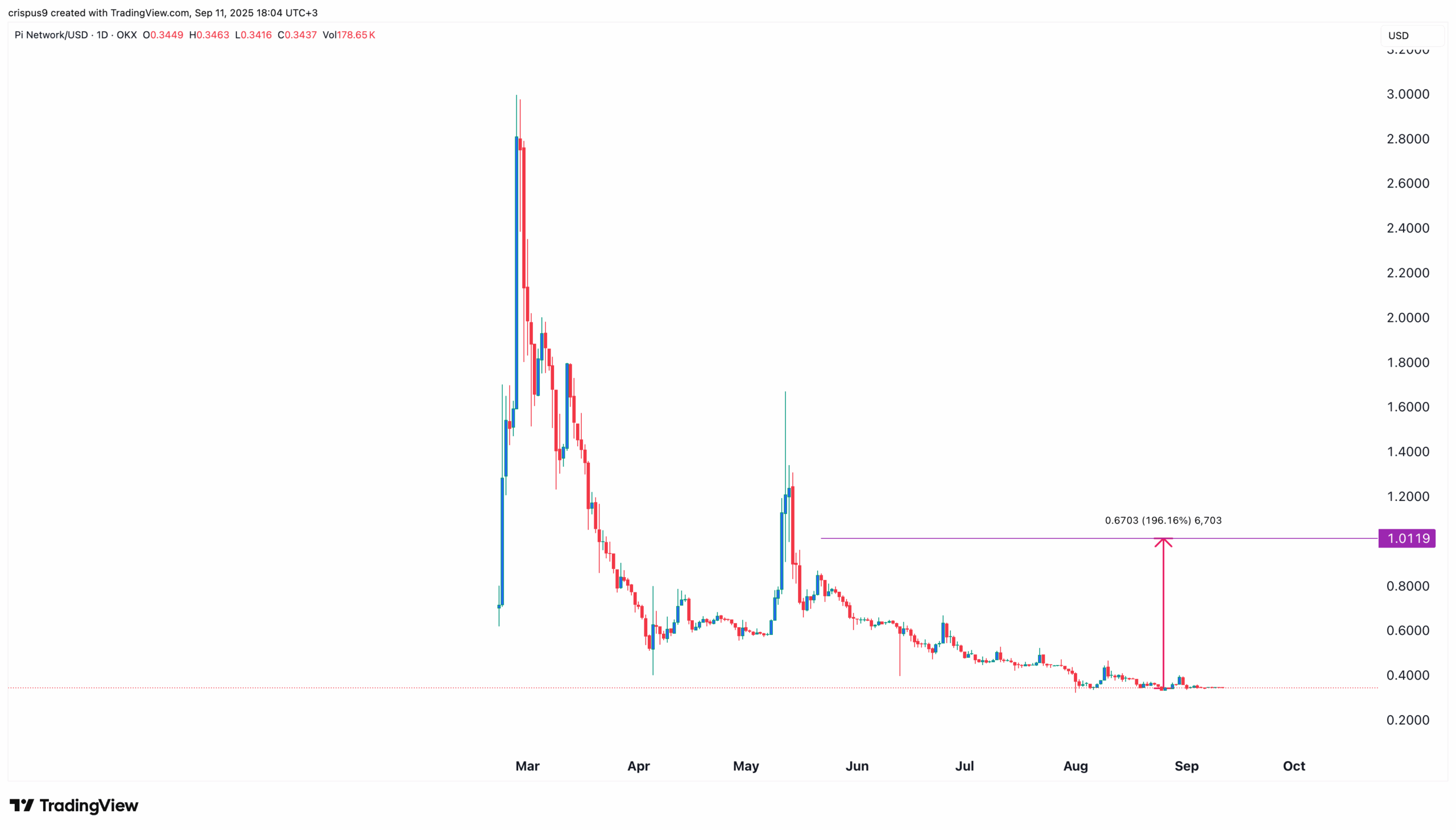

Pi Network price is flat today, continuing a performance that has been going on since August. This consolidation could be part of the Wyckoff Theory accumulation, pointing to an upside as one mysterious whale continues his buying spree.

Pi Network Price to Ultimately Rebound as One Whale Buys

Pi Network price has lost about 90% of its value from its all-time high as buyers have largely remained in the sidelines. However, one mysterious whale has taken the contrarian view and accelerated his purchases of the coin.

This whale believes that investors are overly negative about Pi and that it will rebound. Data shows that the whale bought 1.57 million tokens on Wednesday, continuing a trend that started last month. A look at its transactions shows that he has been buying these tokens almost on a daily basis.

The whale now holds over 373 million coins valued at over $128 million, making it the biggest holder. He will likely continue with his buying spree as the coin remains near its all-time low.

The identity of this whale is hard to guess. It could be an ordinary person who is a fan of the project or a well-connected individual who has some inside information about Pi Coin. For example, it may be a person connected to a crypto exchange that plans to list it, a move that would spark a short squeeze.

The investor likely belongs in the camp that believes in buying assets when others are fearful and when sentiment is weak. This is a long-held principle by Warren Buffett, who recommends buying when everyone is selling and staying away when others are greedy.

Sentiment surrounding Pi Network has been weak in the past few months as token unlocks continued and exchange listings remained elusive.

Wyckoff Theory Signals a Pi Coin Price Rebound

Technical analysis suggests that the Pi Network could be on the verge of a major breakout. The most bullish element is known as the Wyckoff Theory, which identifies the stages that assets go through

In this case, Pi is in the accumulation stage, as evidenced by the one whale that is accumulating it. In this stage, an asset tends to move sideways in a low-volume environment. After this, it enters the markup stage, where it usually goes parabolic.

A good example of this pattern at work is MYX Finance, a relatively unknown cryptocurrency that surged this week after weeks of consolidation. If this pattern happens, then the most likely Pi coin price target is the psychological point at $1, followed by $1.6675, the neckline of the double-bottom pattern. This final target is about 388% above the current level.

Frequently Asked Questions (FAQs)

The most likely Pi Network price forecast is bullish as one whale continues the buying spree this week.

The Pi token could surge, potentially to the important resistance level at $1, followed by $1.665.

The main catalyst for the coin is the ongoing buying by one whale, who could have some inside information.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.