- Hope for PEPE bulls as ranking on Binance indicates healthy visibility to potential investors.

- PEPE addresses and profitability reveal growth in the right direction.

Can Pepe [PEPE] still pull off a robust performance even as the memecoin segment becomes saturated? Most memecoin traders have shifted their attention to upcoming memecoins in the pursuit of maximum potential gains.

Mainstream memecoins like PEPE have been relegated to the back seat. Nevertheless, recent data shows that the frog-themed memecoin is still relevant. For example, it recently ranked seventh in the list of top 15 most searched coins on Binance.

The ranking confirms that the memecoin still commands a noteworthy degree of attention on one of the major crypto exchanges. The potential implication of this observation could be the ability to attract robust inflows if the bulls make a strong comeback.

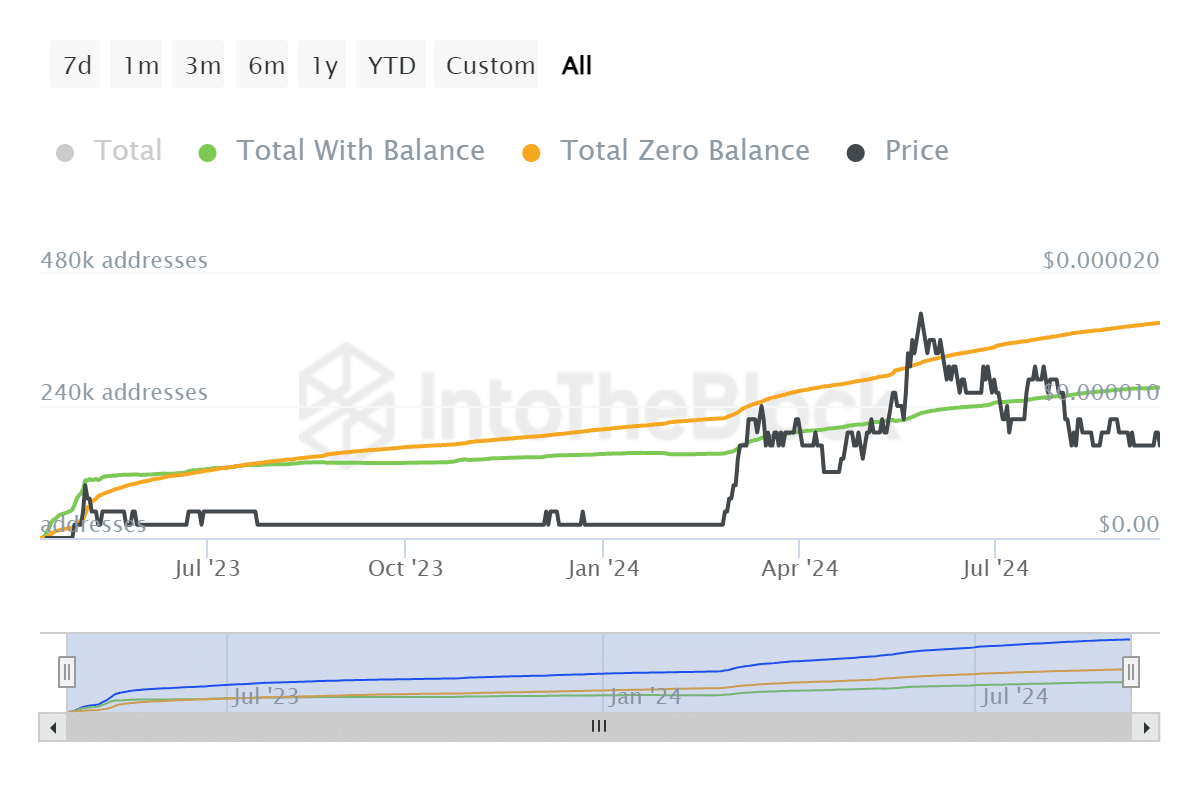

On top of the ranking, the attention on the memecoin continues to manifest in its address growth. For example, the total number of addresses with PEPE (non-zero balance) maintained a positive trajectory ever since the memecoin was launched.

The rate of growth notably ticked higher in March 2024. PEPE currently has over 273.400 addresses that have a non-zero balance. The total number of addresses with zero balance currently sits at 391,220 addresses. The total number of addresses was 664,000.

Source: IntoTheBlock

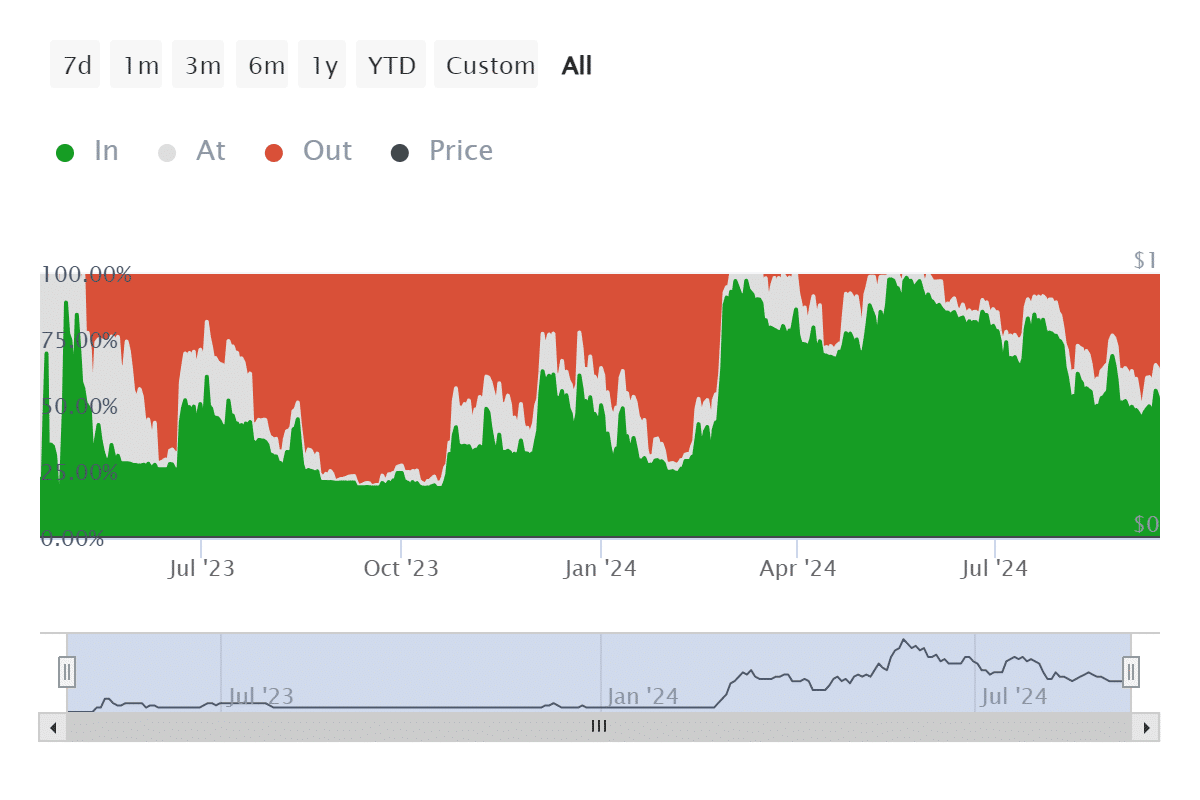

As for profitability, the numbers reveal that PEPE currently has more profitable holders than it did 12 months ago. Roughly 156,200 addresses (about 66.24% of total addresses with balance) were in profit at its press time level.

About 21,360 addresses (9.30%) with PEPE balance were at breakeven. The rest 53,550 addresses or 24.45% of addresses were in the red, meaning they bought above the press time price level.

Can PEPE keep up with the newer memecoins?

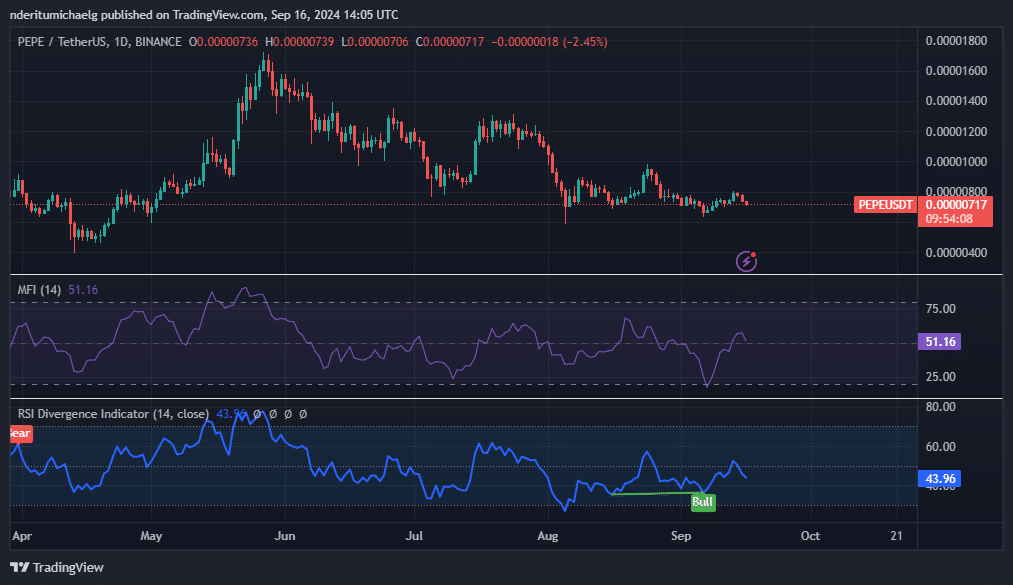

PEPE exchanged hands at $0.00000717 at press time. Its second week of September was characterized by some accumulation and an attempt at recovering from recent lows.

However, those attempts were not very successful, signaling low demand. This was also a reflection of the overall state of the altcoin segment.

Source: TradingView

Pepe still traded close to a key support level near the $0.0000065 price zone. Accumulation took over the last time it retested the same level, suggesting there is a strong liquidity zone near that level. It also underscores strong possibility that price may pivot on the same level.

Is your portfolio green? Check the Pepe Profit Calculator

On the other hand, it may also provide a healthy exit liquidity zone in case of a selloff. A rally may push the memecoin to a 31% gain at the next resistance level near the $0.000095 price level.

The next resistance zone will be at the $0.000012 level which is close to an 80% gain from current levels.

Source: https://ambcrypto.com/pepe-climbs-to-top-10-in-this-ranking-heres-what-it-means-for-prices/