- OKX will delist BADGER and X trading pairs.

- Action will happen on June 5 between 2PM-6PM (UTC+8).

- Leverage and spot lending services for these pairs will cease.

OKX, a major cryptocurrency exchange, announced it will delist BADGER and X trading pairs on June 5 between 2:00 PM and 6:00 PM (UTC+8), affecting leveraged and spot lending operations. Official site of OKX cryptocurrency exchange

The delisting follows OKX’s periodic review to manage market risk and maintain listing standards, resulting in suspension of relevant services and a necessary review of user positions.

OKX to Delist BADGER and X: Timeline & User Actions

OKX will initiate a two-hour process to remove the BADGER and X trading pairs on June 5, effectively influencing users involved in leverage trading and spot lending. OKX to delist several margin trading pairs and futures. The exchange’s decision aligns with its ongoing strategy to manage market risks by periodically reviewing and updating available trading pairs. “In order to prevent market risks and provide users with a good trading experience, OKX will periodically delist certain perpetual contracts and leveraged trading pairs.” — OKX Official Announcement. Once the delisting takes effect, all active orders related to these pairs will be automatically canceled, requiring users to manage their positions before the deadline.

The immediate implications include a halt on leverage and spot lending services. Users must settle any borrowing or risk being subject to enforced repayment mechanisms by the system. Historically, OKX typically delists pairs with low trading volume or that fail to meet exchange requirements. Crypto activities are now open to US banks

Market reactions to the OKX decision are limited, with no public statements from high-profile crypto figures. The action has not prompted significant community discourse, and project teams behind BADGER and X have yet to comment. As OKX did not cite regulatory changes for this action, it remains focused on internal risk assessments. President Donald Trump pledges crypto revival

Market Reactions and Regulatory Considerations

Did you know? In previous delistings, OKX often highlighted market dynamics as a key factor. The regular removal of trading pairs underscores a proactive approach to handling low-liquidity assets and maintaining market stability.

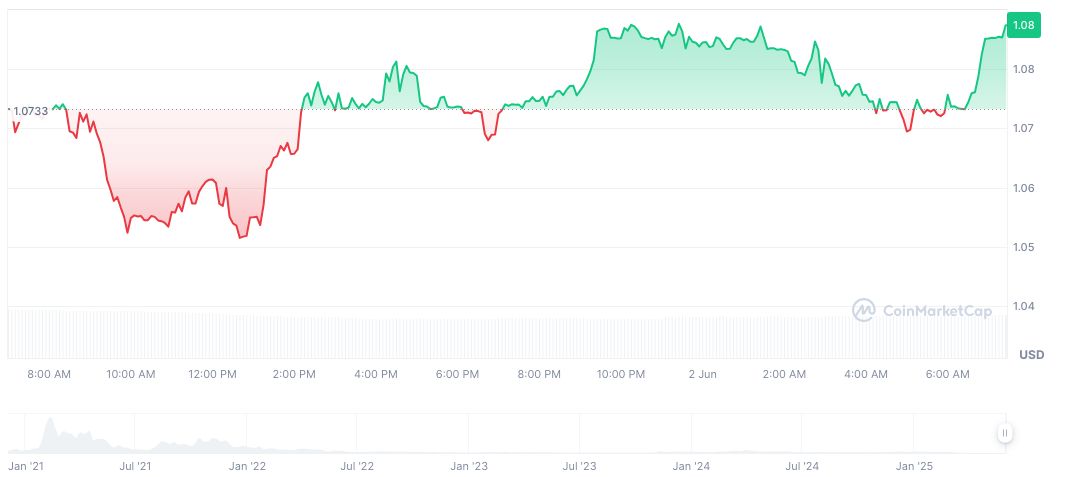

As of June 2, 2025, Badger DAO (BADGER) is priced at $1.09, with a market cap of $22.16 million, reflecting a 1.47% 24-hour price change. According to CoinMarketCap, this crypto experienced a 64.06% decline over 90 days amidst volatile trading volumes, indicative of broader trends in the DeFi sector.

Insights from Coincu suggest regulatory environments remain pivotal in the financial landscape for digital assets. Predicted technological advancements may further influence how exchanges manage liquidity, potentially leading to faster-paced policy adjustments. Industry experts emphasize the importance of aligning with evolving market trends to mitigate financial risks.

Source: https://coincu.com/341137-okx-delists-badger-x-pairs/