- OKX to launch OKB/USDT perpetual contract on Sep 4, 2025.

- Reduction in OKB token supply by 52% to boost market activity.

- Increased trading volumes and stronger market sentiment for OKB.

OKX will launch its OKB/USDT perpetual contract at 10:00 am (UTC+8) on September 4, 2025, across its website, app, and API.

This launch follows a significant OKB token burn, impacting derivative volume and open interest, and indicates potential shifts in trading dynamics and liquidity preferences.

OKX’s Strategic Move to Expand Derivatives Market

OKX’s launch of the OKB/USDT perpetual contract is scheduled for September 4, 2025, intending to enhance its derivatives market. Leadership involvement includes OKX founder Star Xu and marketing chief Haider Rafique, although neither has publicly commented on the event.

The contractual launch follows OKX’s significant 52% reduction in OKB token supply. This move aligns with a broader strategy to boost trading volumes and derivatives open interest. Market dynamics have shifted, as reflected in increased trading activity and interest rates for OKB futures.

90%+ of $OKB has successfully transitioned to its new home on X Layer from the Ethereum L1. One token. One chain. 21M fixed supply. $OKB is the native gas token driving The New Money Chain.

While OKX’s executives haven’t publicly addressed the launch, X Layer tweets emphasize community support for token migration to its new blockchain infrastructure. Speculative sentiment is evident, as long positions increase, showcasing professional traders’ optimistic outlooks.

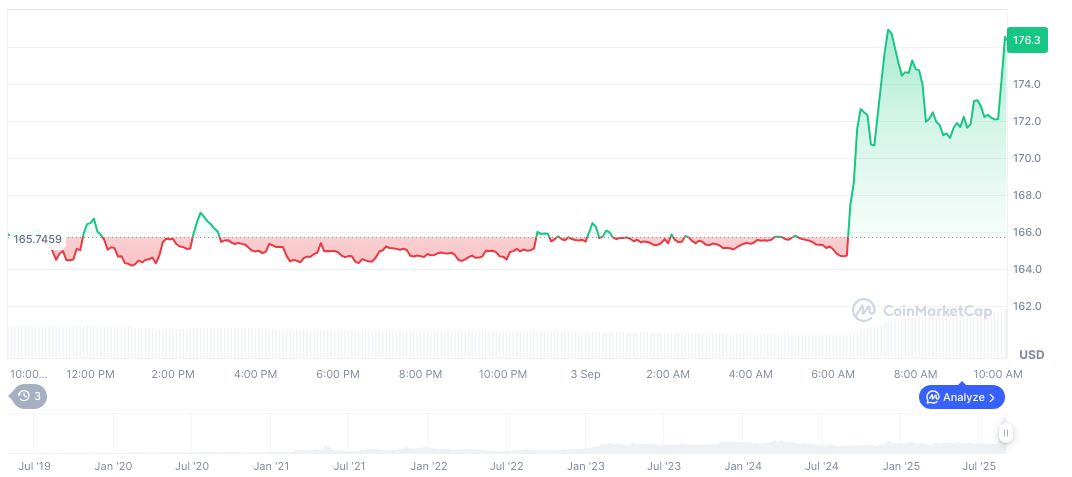

OKB Price Surge: 278% Monthly Gains Amid Strategic Supply Cuts

Did you know? OKX has a unique approach to enhancing its derivatives market by strategically reducing token supply.

Recent CoinMarketCap data show OKB trading at $174.97 with a market cap of $3.67 billion. 24-hour trading volume stands at $207.76 million, indicating robust investor participation. OKB has seen notable gains, with a 30-day increase of 278.35%, reflecting positive market reception to supply adjustments.

Coincu research suggests that OKB’s increased derivatives involvement and strategic liquidity shifts could spur further market participation. Insights from suggest that as institutional interest in compliant exchanges increases, OKX’s compliance with SEC and MiCAR standards adds to its global appeal.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/okx-launches-okb-usdt-contract/