- Bitcoin price today trades near $109,000, defending channel support with $106,100 as the deeper risk zone.

- Ohio becomes the first U.S. state to accept Bitcoin for taxes, strengthening long-term adoption narratives.

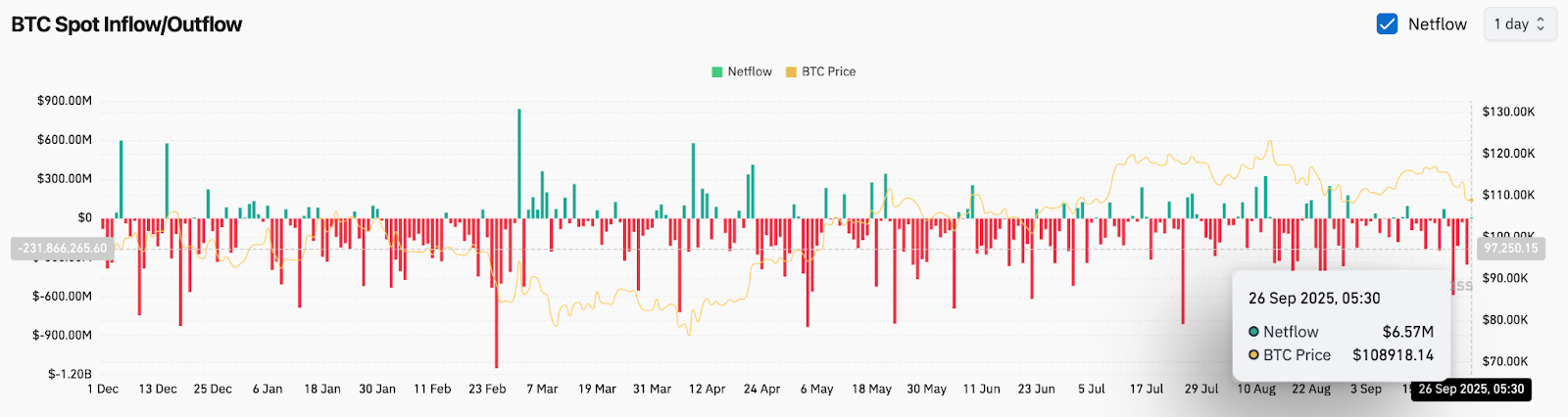

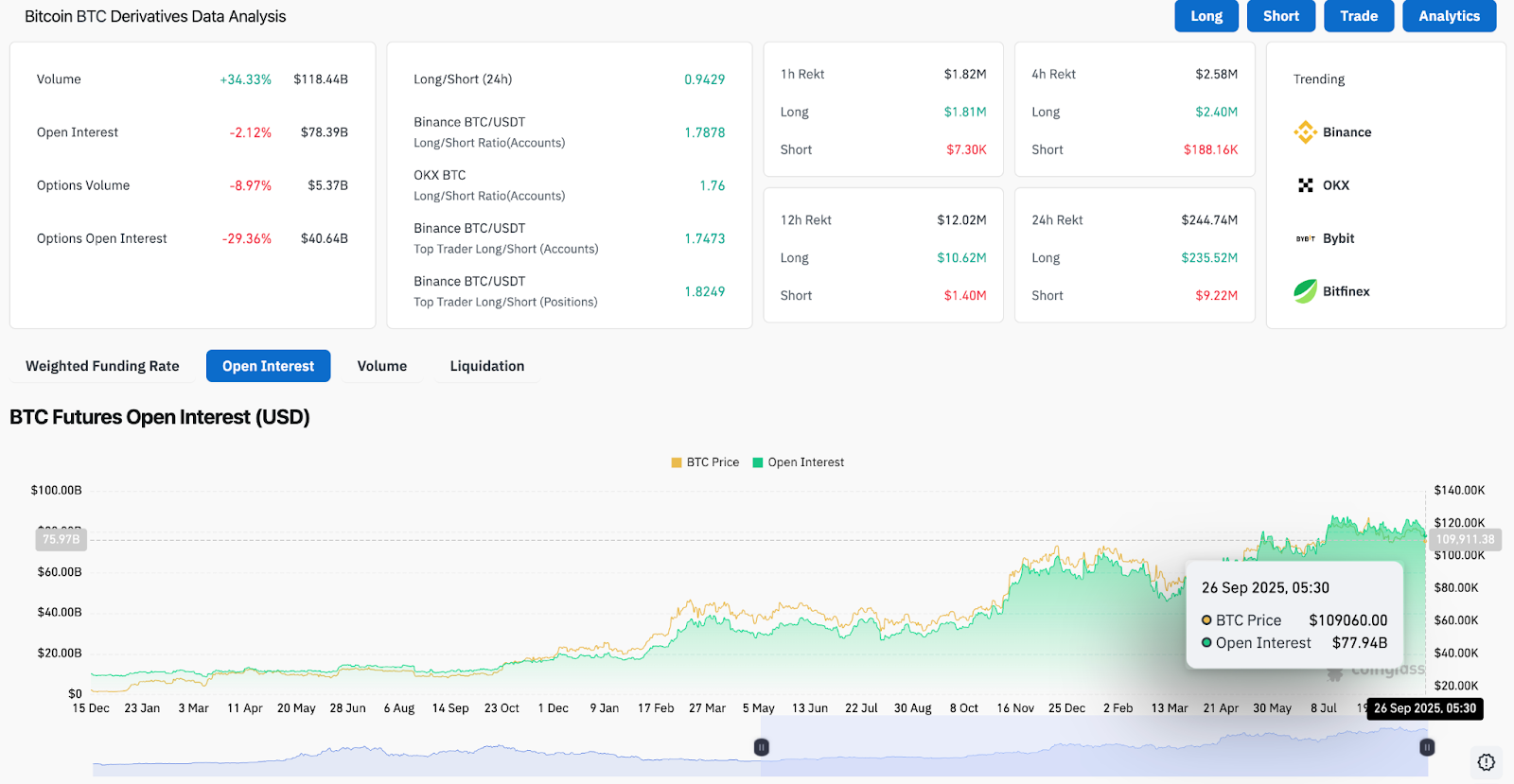

- On-chain flows show $6.5M net inflow, while futures and options activity signal cautious positioning.

Bitcoin price today is trading near $109,000, defending a key rising channel support while struggling below the $111,000–$113,000 resistance cluster. The market is torn between weakening momentum signals and a new adoption boost after Ohio confirmed it will accept Bitcoin for tax and government payments.

Bitcoin Price Tests Channel Support

The daily chart shows Bitcoin consolidating near the lower boundary of its rising channel, with immediate support at $108,000–$109,000. A breakdown from this area would expose the $106,100 level, marked by the 200-day EMA.

Related: Cardano Price Prediction: ADA at $0.77 Support as Analysts Debate $10 Cycle Target

On the upside, the 20-day and 50-day EMAs near $111,700–$113,400 remain heavy barriers. A sustained close above this zone would allow bulls to retest the 0.618 Fibonacci retracement at $117,300 and the 0.786 retracement near $120,000.

The Relative Strength Index (RSI) is at 36, highlighting oversold conditions that could fuel a relief bounce. However, repeated failures to reclaim the EMA cluster show that bullish conviction remains fragile.

Ohio Adoption Adds Fresh Catalyst

Market sentiment was lifted by news that the U.S. state of Ohio will begin accepting Bitcoin payments for taxes and government services. The decision marks the first U.S. state to integrate Bitcoin in this way and strengthens the digital asset’s use case as a settlement currency.

While the development boosts long-term adoption narratives, traders note that fundamental tailwinds have yet to override technical pressures in the short term. Analysts suggest that institutional players may wait for a clean breakout above $113,500 before repositioning aggressively.

Related: Ethereum Price Prediction: Analysts Warn of Whale Selling as ETH Tests $4K

On-Chain Flows Show Modest Accumulation

Exchange data from September 26 recorded a $6.5 million net inflow, a relatively small figure compared with recent outflow-heavy sessions. The broader pattern over the last month shows a market leaning toward distribution rather than aggressive accumulation, underscoring hesitancy among larger players.

Futures market activity is equally cautious. Open interest has slipped 2.1% to $78 billion, reflecting trimmed exposure. Options volume dropped sharply, with open interest sliding nearly 30% this week. Despite the pullback, long-to-short ratios on Binance and OKX remain tilted toward longs, suggesting that traders are attempting to defend the $108,000–$109,000 region.

Technical Outlook For Bitcoin Price

Bitcoin price prediction for the short term hinges on whether bulls can defend the channel floor and reclaim the EMA cluster.

- Upside levels: $111,700, $113,400, and $117,300 as near-term resistance. A breakout above $120,000 would reassert the bullish cycle, with scope toward $123,600.

- Downside levels: $109,000 and $108,000 remain first defenses, followed by $106,100. A deeper failure risks a slide toward $103,000–$101,000.

Outlook: Will Bitcoin Go Up?

The path forward for Bitcoin balances between immediate technical weakness and strengthening adoption headlines. The Ohio news reinforces Bitcoin’s long-term case, but on-chain and derivatives data show a market still unwinding excess leverage.

Related: XRP Price Prediction: Futures Data Highlights Cautious Positioning

As long as Bitcoin price today holds above $108,000, buyers retain a chance to stage a rebound toward $113,000 and $117,000. A decisive breakdown below $106,000 would shift focus to lower support and delay the bullish cycle outlook.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/bitcoin-price-prediction-ohio-news-offsets-fragile-technicals/