- Nouriel Roubini anticipates a tech-led U.S. economic resurgence.

- US recession expected late 2025, quick recovery follows.

- Technology advancements might neutralize rising real bond yields.

Economist Nouriel Roubini forecasts a strong U.S. economic rebound driven by technology, despite a brief downturn, at BlockBeats News on November 27th.

Roubini’s outlook defies fears of a stock bubble, emphasizing technology’s role in sustaining U.S. leadership and potential market effects.

Roubini Foresees Tech-led Growth Surpassing Economic Hurdles

Nouriel Roubini, a recognized economist, anticipates a temporary U.S. recession against the backdrop of tariff-induced inflation. He suggests a robust rebound fueled by innovations in AI and robotics. This prediction highlights the resilience of the US economy and the role of market discipline in stabilizing financial activities.

The forecast suggests growth may double the current rate by the decade’s end. Technological advancements are expected to drive a positive supply shock, potentially reducing inflation. Bond yield dynamics might stabilize as technological deflation counteracts tariff effects.

Market experts and analysts emphasize the importance of market discipline and Federal Reserve independence. Roubini’s view challenges concerns over medium-term economic risks, emphasizing the role of technology in shaping future economics. “Tech trumps tariffs. And what I mean is that the US is really No. 1 in many of the technologies of the future… So tech trumps tariffs. Tech trumps Trump, too” (source).

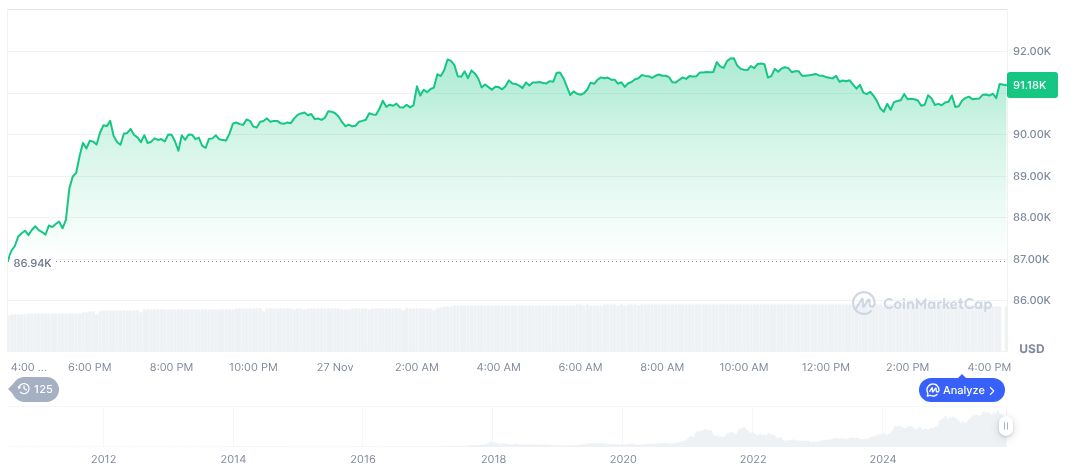

Bitcoin Price Trends Amid Economic Forecasts

Did you know? In past economic downturns, technology has often served as a catalyst for recovery, highlighting its critical role in overriding negative economic shifts.

Bitcoin, according to CoinMarketCap, is currently valued at $91,523.34, with a market cap of $1.83 trillion. Despite a 19.06% price decrease over the past 30 days, its dominance remains at 58.47%. Recent 24-hour trading volume stands at $59.14 billion, reflecting a 10.75% decline.

Insights from the Coincu research team indicate potential shifts in global economic dynamics. The anticipated technological growth could alter market behaviors, influencing both traditional and emerging markets. This offers valuable guidance for investors navigating future economic conditions. Concerns over AI and its impact on US tech stocks add another layer to the evolving economic landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/nouriel-roubini-tech-economic-rebound/