- Nomura expects Fed to cut rates by 25bp in October and December 2025, affecting crypto assets.

- Revised forecast signals increased liquidity with potential benefits for Bitcoin and Ethereum.

- Institutional repositioning and market anticipation precede the forecast changes.

Nomura Securities has revised its forecast, predicting the Federal Reserve will cut interest rates by 25 basis points in October and December 2025.

This anticipated rate change signals shifting market dynamics, impacting risk assets like Bitcoin and Ethereum, which are sensitive to global liquidity.

Nomura’s Forecast Shift and Market Liquidity Benefits

Nomura Securities revised its interest rate forecast, now anticipating the Federal Reserve will cut rates by 25 basis points in October and December 2025. These changes present a shift from Nomura’s earlier projection, which expected rate cuts only in December 2025. Such adjustments reflect evolving macroeconomic perspectives among major financial institutions.

The revised forecast highlights potential impacts on global financial markets, with expectations of increased liquidity potentially influencing asset allocations. Historically, similar conditions have resulted in greater inflows into risk assets, including cryptocurrencies.

According to Arthur Hayes, former CEO, BitMEX, “Rate cuts ignite renewed liquidity flows into crypto, which we might witness in the upcoming adjustments by the Fed.”

Market reactions suggest cautious optimism. Institutions and investors are closely monitoring the anticipated liquidity changes. While no direct statements have been made by key Federal Reserve officials, the financial community awaits confirmation from the Fed’s anticipated decisions.

Historical Rate Cuts and Cryptocurrency Market Dynamics

Did you know? In 1995, a similar “preventive” rate cut led the Nasdaq to increase fivefold during a subsequent bull run.

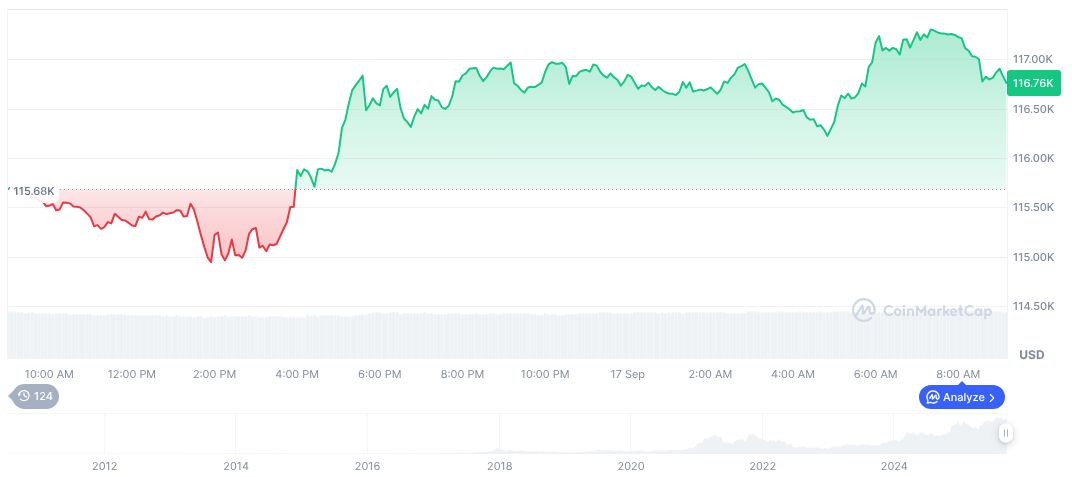

Bitcoin (BTC) is currently trading at $117,461.44, with a market cap of $2.34 trillion and a 24-hour trading volume of $67.78 billion, representing a 47.32% change. Over the past 90 days, BTC has appreciated by 12.41%, as reported by Coincu research.

The Coincu research team notes that rate cuts historically correlate with increased market liquidity, fostering environments conducive to higher investment inflows in crypto markets. This environment could see renewed interest in major cryptocurrencies, underscoring the importance of adapting investment strategies in response to potential Federal Reserve actions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/nomura-fed-rate-cut-forecast-2025/