- New York Fed projects under 1% GDP growth with rising unemployment.

- Fed maintains monetary policy, slowing balance sheet reduction.

- Crypto markets remain unreactive to economic predictions so far.

John C. Williams, New York Fed President, expects the U.S. economy to slow significantly in 2025, with GDP growth under 1% and unemployment rising to 4.5%-5%.

This economic outlook, highlighted by ongoing uncertainty and increased tariffs, suggests potential caution in market sentiment and investment strategies.

Fed Foresees GDP Growth Below 1% and Higher Unemployment

John C. Williams, President and CEO of the Federal Reserve Bank of New York, outlined a minimal GDP growth forecast for 2025 below 1% with unemployment possibly increasing to 5%. His forecasts warrant considerable attention, reflecting on unpredictability linked to tariffs and diminished labor force growth due to reduced immigration. This perspective was conveyed in his Economic Outlook and Monetary Policy Speech on April 11, 2025.

He elaborated on the Federal Reserve’s decision to reduce the pace of its balance sheet runoff, seeking to achieve stability without altering the fundamental stance on monetary policy. This adjustment is anticipated to ease the shift from an abundance of reserves to a more balanced level. However, Williams emphasized that the core monetary policy stance remains unchanged.

“Given the combination of the slowdown in labor force growth due to reduced immigration and the combined effects of uncertainty and tariffs, I now expect real GDP growth will slow considerably from last year’s pace, likely to somewhat below 1 percent. With this downshift in the pace of growth, I expect the unemployment rate to rise from its current level of 4.2 percent to between 4-1/2 and 5 percent over the next year. I expect increased tariffs to boost inflation this year to somewhere between 3-1/2 and 4 percent…” — John C. Williams, President, Federal Reserve Bank of New York

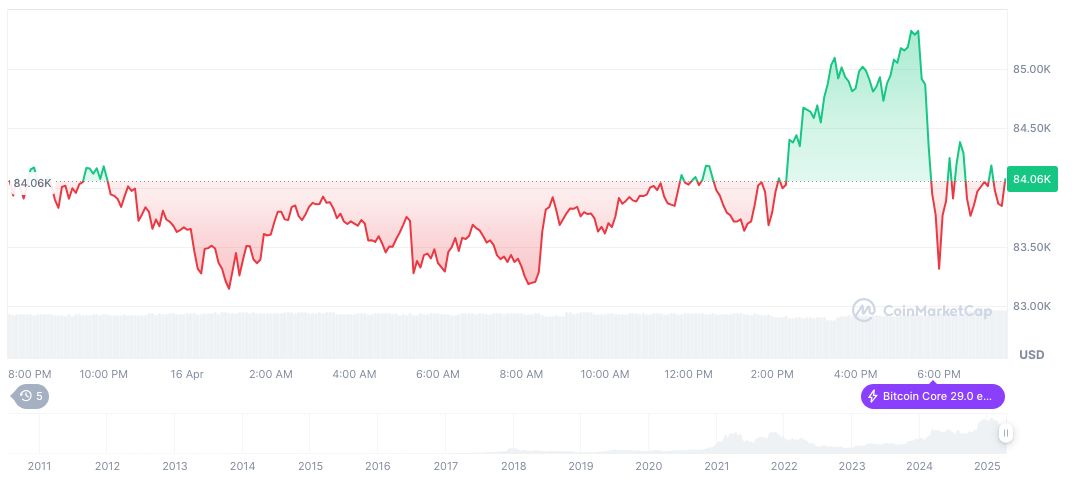

Crypto Markets Unmoved as Williams Outlines Fed Strategy

Did you know? Similar economic outlooks predicting GDP slowdown and rising unemployment amid tariff hikes occurred during the 2018-2019 U.S.-China trade tensions, leading to risk asset outflows.

Bitcoin (BTC) trades at $84,641.95, securing a market cap of $1.68 trillion and dominance of 62.96%. The currency’s 24-hour volume faces an 8.76% decline, indicating altered trading activity. Current stats from CoinMarketCap reflect a slight 1.11% price increase within the last 24 hours, while the asset experienced a 12.78% drop over two months.

Coincu’s analysis underscores the Fed’s commitment to neutral policy shifts, hinting at stable regulatory responses amidst macroeconomic adjustments. Historical trends suggest a possible cautious approach to investment, with an emphasis on asset stability.

Source: https://coincu.com/332730-us-economic-slowdown-prediction-2025/