- HBAR faces strong bearish sentiments, dipping by 9.18% in 24 hours.

- Nasdaq files 19b-4 form with SEC to list Grayscale’s Hedera ETFs.

Amidst increased institutional demand for crypto assets, exchange-traded funds have become highly popular. Since the launch of Bitcoin [BTC] ETFs earlier last year, most altcoins have entered the charts.

In recent developments, Hedera [HBAR] has seen major support for the next ETF.

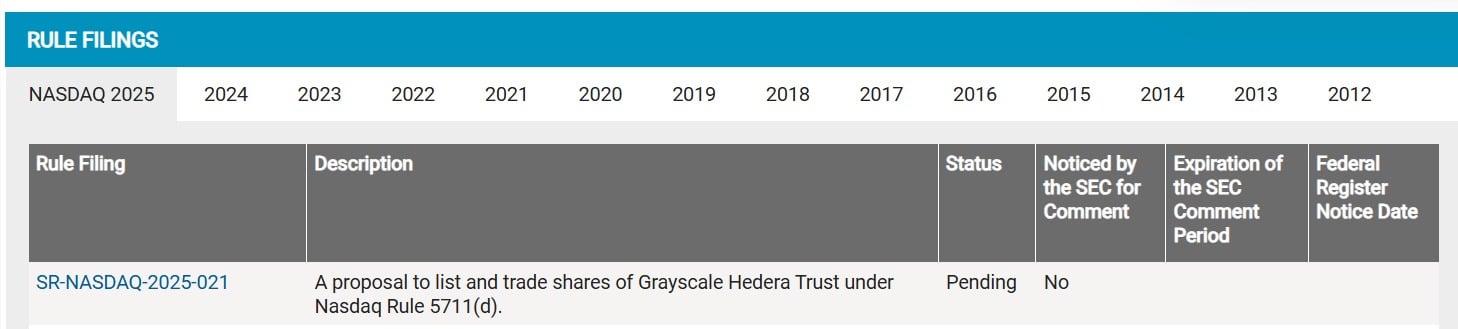

Source: NASDAQ

As such, the Nasdaq Stock Market LLC has filed a 19b-4 form with the U.S. Securities Exchange Commission (SEC) to list and trade Grayscale’s Spot Hedera Exchange-traded fund.

Usually, a 19b-4 filing is the second phase before the acknowledgment by the SEC. Once acknowledged, it’s published in the federal register awaiting SEC’s approval.

The recent filing by Nasdaq on behalf of Grayscale comes shortly after Nasdaq submitted another Hedera ETF on behalf of Canary Capital.

The second filing positions Hedera in a favorable position among altcoins to get approval based on its network development and the progress of its ecosystem.

If approved, the ETF will facilitate investors to gain exposure to HBAR without having to directly own the crypto.

What it would mean for HBAR

Notably, the approval of Hedera’s ETFs would be a game change especially as the altcoin’s network continues to struggle.

Inasmuch, Hedera’s active accounts have declined by 93% from 621k to 39k over the past three months. This shows declining network usage and adoption rate, which are central to the altcoin’s continued growth.

Therefore, ETF would give room for other users and investors even though indirectly, it will boost the demand rate, which will eventually positively impact HBAR’s growth.

Source: Hashscan

While the good news of a potential ETF were expected to positively impact HBAR’s market sentiments and price movement, this is yet to.

In fact, as of this writing. Hedera was trading at $0.2272. This marked a 9.18% decline over the past day.

The sharp decline despite these developments suggests that the altcoin is experiencing bearish sentiments, as evidenced from Hedera’s aggregated Open Interest, which declined from $145 million to $103 million over the past day.

Source: Coinalyze

So, investors appeared to be actively closing their positions to lock in profits or others are forcefully liquidated as the market retraced. Such investor behavior reflects a lack of confidence, as they expect prices to decline further.

The prevailing market conditions suggest investors see an ETF as a long-term bet. Therefore, these ETFs have to first get SEC approval to have a real impact on Hedera’s price movements.

In short term, the markets remain bearish.

If these conditions remain, HBAR could decline to $0.21. However, if investors take the filing as a bullish signal, and turn to accumulate, Hedera would reclaim $0.25.

Source: https://ambcrypto.com/nasdaq-files-with-sec-to-trade-grayscale-hedera-etfs-what-about-hbar/