- Multicoin Capital invests in Ethena Protocol’s ENA token.

- Ethena’s USDe stands out among synthetic dollars.

- Ethena reports $600 million in revenue since its launch.

On November 15th, Multicoin Capital announced a strategic investment in the Ethena Protocol’s native token ENA, reinforcing confidence in Ethena’s synthetic dollar, USDe.

Ethena’s USDe, used on major platforms like Binance, exemplifies growth in stablecoin utilization, evidencing substantial protocol revenue and industry integration over the past year.

Multicoin’s Strategic Bet on Ethena Amid Revenue Surge

Multicoin Capital, a cryptocurrency investment firm led by Vishal Kankani, announced a strategic purchase of Ethena Protocol’s native token, ENA. This move underscores Kankani’s belief in the potential of Ethena’s synthetic dollar, USDe. Ethena has reportedly generated over $450 million in revenue in the past year alone, reflecting its growth trajectory.

Kankani emphasizes the strategic potential of USDe, set apart by its substantial liquidity and unique positioning among synthetic dollars. The token’s adoption as core collateral on platforms like Binance and Bybit demonstrates its market relevance.

In response, the crypto community, including institutional backers like Binance, has shown enthusiastic support for Ethena’s advancements. As Kankani stated, “Ethena has become the largest synthetic dollar in less than two years.”

Ethena’s Market Performance and Regulatory Position

Did you know? Ethena Protocol’s USDe synthetic dollar rapidly achieved acceptance as collateral on major exchanges like Binance in less than two years, illustrating a swift market integration unseen in typical stablecoin cycles.

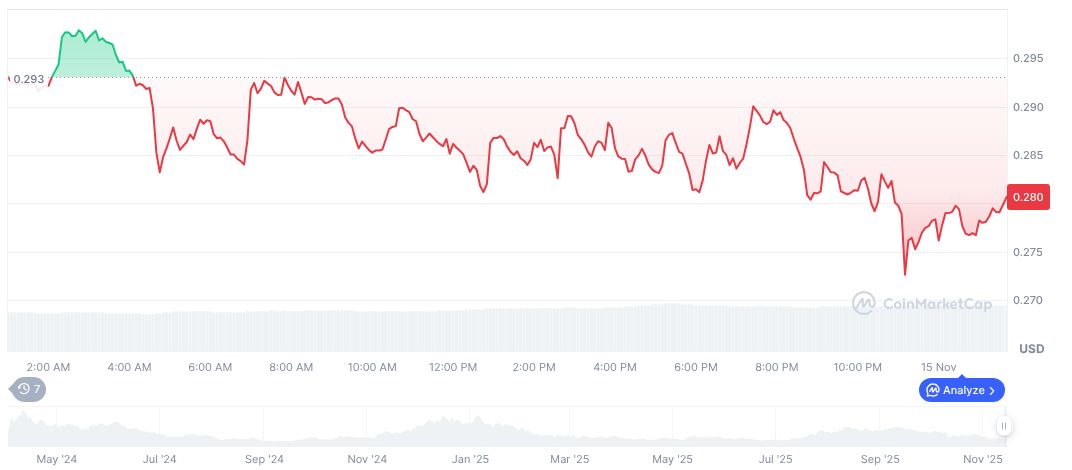

CoinMarketCap reports Ethena (ENA) at $0.28, with a market cap of $2.08 billion and a circulating supply of 7.42 billion. Recent trends show a -4.23% decline over 24 hours and a -61.65% loss over 90 days, with trading volumes reaching $344.75 million. Data from November 15, 2025, indicates significant activity.

Insights from Coincu research suggest Ethena’s non-algorithmic structure offers a stable and verifiable backbone for synthetic currencies. This positions USDe to remain robust against regulatory scrutiny while leveraging its model for extended market applications.

“Ethena is starting by tokenizing the basis trade—but there’s nothing stopping Ethena from diversifying its yield sources over time… Ethena has become the largest synthetic dollar in less than two years.” – Vishal Kankani, Principal, Multicoin Capital

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/altcoin/multicoin-capital-invests-ethena-token-ena/