- Moscow Exchange initiates Bitcoin and Ethereum index futures, targeting professional investors.

- Exclusively offers cash-settled futures to qualified participants.

- Regulatory changes enable expanded crypto product offerings on MOEX.

The Moscow Exchange officially launched cash-settled Bitcoin and Ethereum index futures, attracting significant investor interest in Russia’s expanding crypto derivatives market.

This introduction for qualified investors highlights Russia’s financial market innovation, potentially influencing cryptocurrency access and regulatory approaches.

MOEX Expands with $7 Billion Bitcoin Futures Launch

Moscow Exchange recently launched cash-settled Bitcoin and Ethereum futures for qualified investors, drawing on its reputation as Russia’s largest stock market operator. With approval from the Central Bank of Russia, these futures represent a regulated expansion into cryptocurrency products, providing a route for professional investors to engage with digital assets without direct custody.

Investors will have opportunities to speculate on Bitcoin and Ethereum price changes, settled in rubles, enhancing the financial landscape for those with qualified status. The cumulative trading volume for Bitcoin futures reached 7 billion rubles and involved over 10,000 participants, demonstrating substantial interest. According to Maria Patrikeeva, Managing Director at MOEX:

The first three weeks of BTC futures have seen a cumulative trading volume of 7 billion rubles, reflecting significant interest among qualified investors.

Central Bank’s 2025 Crypto Strategy Enhances Russian Market

Did you know? The Central Bank of Russia’s 2025 decision to permit crypto derivatives trading for qualified investors has significantly expanded MOEX’s crypto offerings, aligning with global trends in regulated crypto investments.

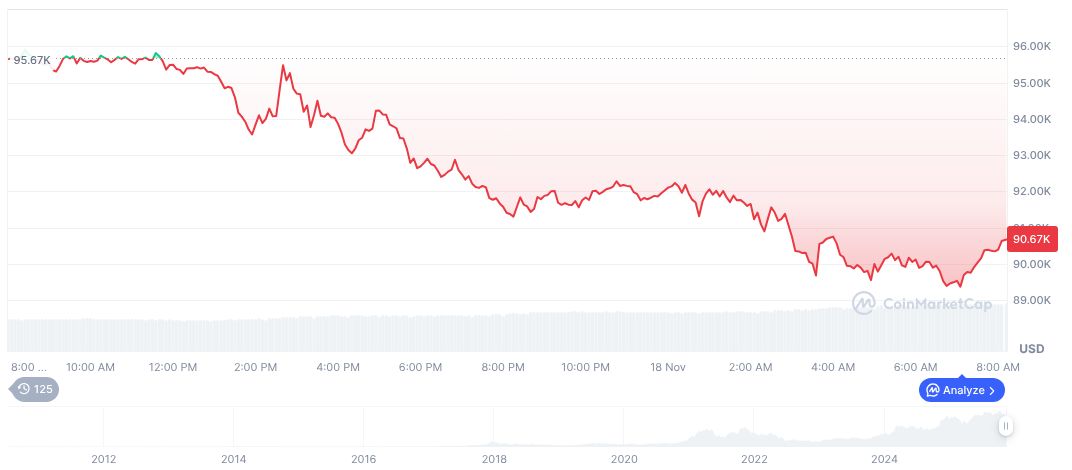

According to CoinMarketCap, Bitcoin’s current price stands at $93,415.75, with a market cap of formatNumber(1863685359350, 2), a dominance of 58.38%, and a 24-hour trading volume of formatNumber(122397634245, 2). Bitcoin’s price reflects a recent 0.52% drop, continuing a 90-day decline trend.

The Coincu research team suggests that MOEX’s product expansion may stimulate further regulatory adaptations in Russia’s crypto market. It reflects a broader trend of traditional financial platforms integrating digital currencies to meet professional investor demand, encouraging technological innovation and potentially influencing future regulatory policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/moscow-exchange-crypto-index-futures/