- Morgan Stanley expects three Fed rate cuts in 2025.

- Shifts due to economic changes, labor market cooling.

- Global financial impact anticipated, influencing crypto markets.

Morgan Stanley predicts the Federal Reserve will lower interest rates by 25 basis points in each upcoming meeting of 2025, totaling three rate reductions due to economic indicators.

These expected rate cuts could affect global liquidity, potentially boosting cryptocurrency markets like Bitcoin and Ethereum due to increased risk appetite among investors.

Morgan Stanley Projects Fed’s 2025 Rate Cut Strategy

Morgan Stanley, led by Chief US Economist Michael Gapen, forecasts the Federal Reserve will reduce rates by 25 basis points at each remaining meeting in 2025. This revision comes in response to softer inflation and a cooling labor market. The firm had previously anticipated just two cuts.

Shifting economic dynamics motivate these expectations. Fed rate cut projections may impact global funding costs and asset allocations. Lower rates generally signal increased market liquidity and risk appetite, possibly driving interest in cryptocurrencies.

This brings forward another Fed cut into September, kicking off a quarterly pace of 25 basis-point moves. — Michael Gapen, Chief US Economist, Morgan Stanley

Interest Rate Adjustments and Cryptocurrency Market Dynamics

Did you know? Historically, when Fed reductions coincide with steady economic growth, risk assets often experience initial rallies. Morgan Stanley’s updated forecast marks the first instance of anticipated quarterly cuts since prior easing cycles.

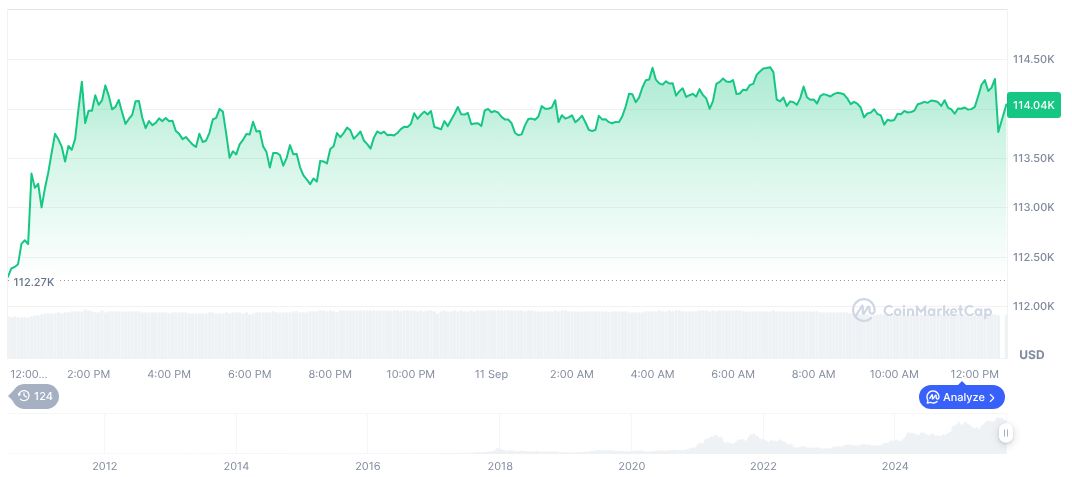

Bitcoin (BTC) is currently priced at $114,957.93, holding a market cap of $2.29 trillion, as reported by CoinMarketCap. Trading volume in the past 24 hours hit $54.13 billion with a 0.76% price increase over the 24-hour span. The market dominance is noted at 57.17%, with the total circulating supply at 19,919,859 BTC, last updated at 11:15 UTC on September 12, 2025.

Coincu research suggests that the combination of easing interest rates and resilient economic conditions could boost investment in Bitcoin and other cryptocurrencies. This potential shift is grounded in historical trends where past Fed cuts led to increased asset flows into high-risk sectors, benefiting blockchain technologies and their adoption.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/morgan-stanley-fed-rate-cuts-2025/