- Moody’s downgraded U.S. credit from Aaa to Aa1.

- Expected government debt growth by 2035.

- Market reactions follow the downgrade announcement.

On May 16th, Moody’s Investors Service downgraded the United States’ sovereign credit rating from Aaa to Aa1, altering the U.S. economic landscape. Analysts attribute this adjustment to the continuous escalation in U.S. government debt.

The downgrade rebounded throughout financial markets, reflecting concerns over the evolving debt situation and its long-term ramifications, affecting investor confidence.

U.S. Debt Projections and Market Volatility

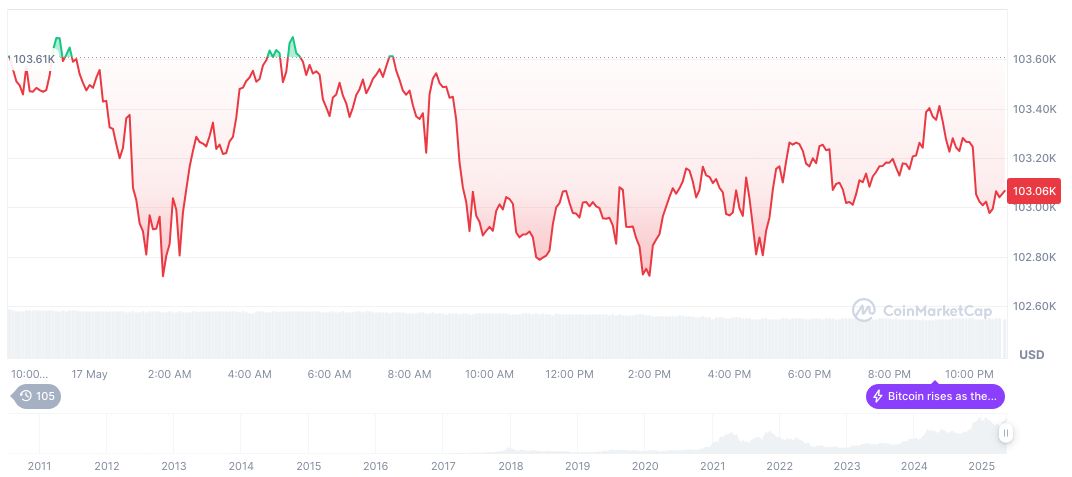

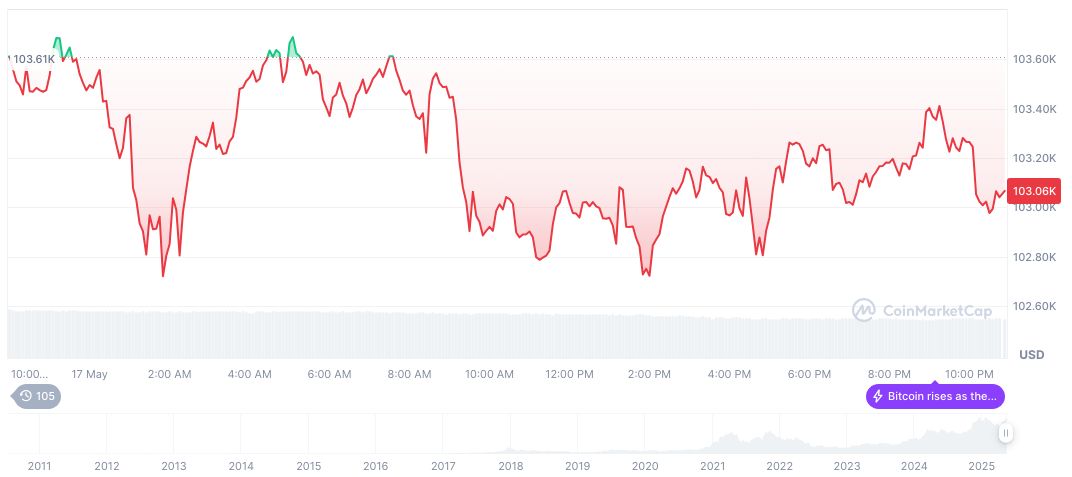

According to CoinMarketCap, Bitcoin (BTC) trades at $103,322.82 with a market cap of $2.05 trillion, maintaining a dominance of 62.61%. Its 24-hour trading volume stands at $36.28 billion, though trading activity has decreased by 18.75% recently. Bitcoin’s circulating supply is 19,865,290 BTC, nearing its max supply of 21 million.

Expert analysis by the Coincu research team projects that the recent downgrade may prompt a surge in regulatory discussions. Historical trends suggest potential shifts in economic policy as governments navigate heightened financial scrutiny. The situation presents a critical window for analyzing future fiscal adjustments and their implications for global financial systems.

It seems that there is no information available about Moody’s downgrading the United States’ sovereign credit rating from Aaa to Aa1 on May 16th, 2025, in the search results you provided. The results primarily focus on crypto-related news and do not cover the credit rating event, its implications, or expert analyses. Therefore, I cannot extract quotes on this specific topic. If you have other sources or need assistance on a different subject, feel free to let me know!

Bitcoin’s Position Amid U.S. Credit Rating Downgrade

Did you know? Moody’s last downgraded the U.S. in 1917, marking this as a pivotal moment that reverberates across markets globally.

According to CoinMarketCap, Bitcoin (BTC) trades at $103,322.82 with a market cap of $2.05 trillion, maintaining a dominance of 62.61%. Its 24-hour trading volume stands at $36.28 billion, though trading activity has decreased by 18.75% recently. Bitcoin’s circulating supply is 19,865,290 BTC, nearing its max supply of 21 million.

Expert analysis by the Coincu research team projects that the recent downgrade may prompt a surge in regulatory discussions. Historical trends suggest potential shifts in economic policy as governments navigate heightened financial scrutiny. The situation presents a critical window for analyzing future fiscal adjustments and their implications for global financial systems.

Source: https://coincu.com/338206-moodys-downgrades-us-credit-rating/