- Moody’s downgrades U.S. credit from Aaa to Aa1 amid rising debt concerns.

- U.S. faces potential increases in government borrowing costs.

- Expert analysis suggests significant economic shifts and potential market reactions.

On May 16, 2025, Moody’s downgraded the United States’ sovereign credit rating from Aaa to Aa1, citing increased national debt and fiscal challenges. This action marks the first such downgrade by Moody’s since 1917.

The U.S. Treasury faces potential pressures and market uncertainties. Investors might demand higher yields, possibly leading to increased borrowing costs for the government.

Moody’s Downgrade and Its Economic Repercussions

Moody’s decision to lower the U.S. credit rating reflects increased government debt and interest payment burdens, with the fiscal deficit projected to approach 9% of GDP by 2035. This is part of a historical context where all three major rating agencies no longer offer their top ratings to the U.S. Growing fiscal deficits and anticipated challenges continue to concern financial markets.

The economic landscape could see rippling effects, as increased borrowing costs for the government could influence investor confidence and market dynamics. The debate over, and potential continuation of, significant federal spending remains a pivotal factor. Industry and government reactions include skepticism; U.S. Treasury Secretary Janet Yellen stated, “I don’t quite believe in Moody’s,” highlighting leadership concerns about the decision.

Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs. — Moody’s Ratings Service

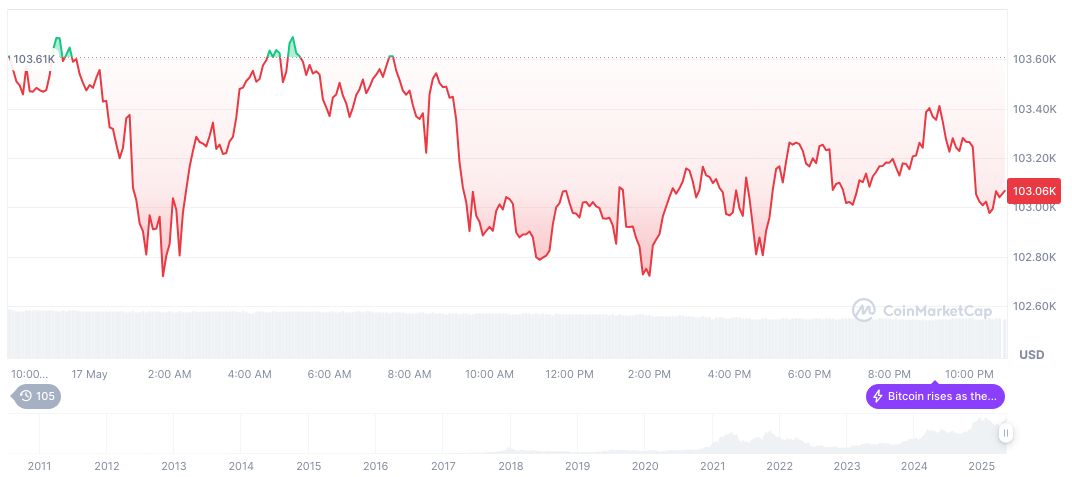

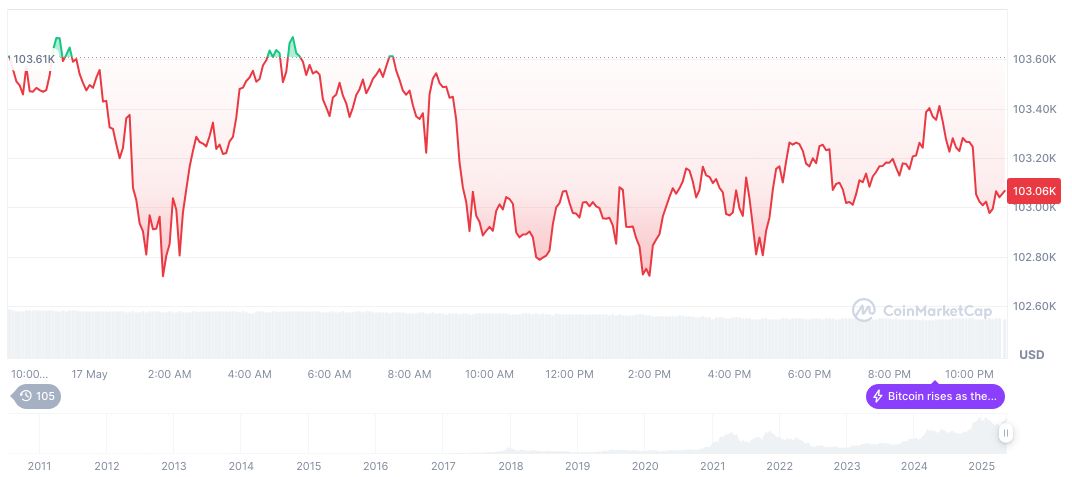

Bitcoin’s Stability Amid U.S. Credit Downgrade

Did you know? In 2023, Fitch also downgraded the U.S. credit rating, intensifying concerns over fiscal management and debt ceiling negotiations.

Bitcoin (BTC), currently valued at $103,936.98 with a market capitalization of $2.06 trillion, shows a 24-hour trading volume drop to $34.23 billion, decreasing by 18.91% as per CoinMarketCap. Despite the downgrade, Bitcoin prices stabilized, demonstrating moderate resilience in cryptocurrency markets. Over the past 30 days, Bitcoin climbed 22.94%, maintaining relevancy despite broader economic uncertainties.

According to Coincu research, the downgrade might impact cryptocurrency markets, potentially increasing volatility. Complex fiscal and regulatory dynamics may intensify, prompting collaboration between governments and economic entities to navigate potential financial repercussions. Attention will remain on how macroeconomic shifts influence digital asset valuations and investor confidence.

Source: https://coincu.com/338276-moodys-downgrade-us-credit-rating/