Key Notes

- Monero (XMR) price gained 7% on Sunday, Aug 17, rebounding above $260 after Qubic’s failed 51% attack.

- Kraken’s suspension of XMR deposits triggered a panic-driven 19% sell-off earlier in the week, but the network remained operational and secure.

- Community response over the weekend has strengthened Monero’s decentralization, improving hashrate distribution.

Behind Chainlink’s (LINK) 14% weekend rally, Monero emerged as the second-best performer among the top 30 ranked cryptocurrencies, gaining 7% intraday on Sunday, Aug 17, to cross the $260 mark.

This recovery follows a major network controversy, which saw XMR price plunge nearly 19% between Aug 12 and Aug 15, after centralized exchange Kraken halted Monero deposits in response to social media claims of a network takeover.

Monero appears to be in the midst of a successful 51% attack.

The privacy-focused blockchain, launched in 2014 and long targeted by governments and 3-letters agencies, is already banned from most major centralized exchanges.

The Qubic mining pool has been amassing hashrate for…

— Charles Guillemet (@P3b7_) August 12, 2025

The controversy began when mining firm Qubic was accused of executing a 51% attack on the Monero network, sparking centralization fears and prompting exchange panic. As the concerns eased over the weekend, community contributor Smart Degen, berated Kraken’s decision to suspend trading and deposits, hinting that it was based more on media panic than identified blockchain frailties.

💣 $XMR Faced Its DEATH SENTENCE This Week – But Something INCREDIBLE Happened Instead

$300M project vs $8B network. Government bans. Exchange delistings.

Here’s how Monero became UNKILLABLE 🧵👇 pic.twitter.com/wwstt6I6wI

— Smart Degen (@smartsdegen) August 17, 2025

The analyst pointed out that the Monero network continued functioning normally throughout the incident, with no double-spends or security breaches recorded.

What Next for Monero After Network Attack?

Following coordinated efforts by the Monero miner community, the attack was reversed with hashrate distribution across mining pools improving as P2Pool adoption spiked.

At press time, Monero’s network remains stable, with no recorded losses from the attempted attack. The community coordination mechanisms that emerged from this incident are viewed as a key step in protecting the network against future attacks.

For XMR price action, the network’s restored confidence fueled the 7% weekend rally, setting Monero apart from broader market weakness. While Bitcoin’s sideways consolidation within the $116,000 to $118,000 range anchored most altcoins lower over the weekend, XMR’s rebound highlights renewed investor confidence as controversy surrounding the Qubic 51% attack eases.

XMR Price Forecast: Bulls Eye $280, But $250 Support Critical

Technical analysis shows Monero price rebounding strongly from last week’s lows near $230, gaining more than 19% in the last 48 hours to retest the $280 resistance zone. More so, the recovery coincides with RSI bouncing from oversold levels near 31, now trending toward 46, suggesting bullish momentum could extend if XMR trading volumes remain elevated.

The immediate XMR price resistance lies at $280, where profit-taking could trigger consolidation. A breakout above this level opens the door to $300 psychological resistance, with further upside toward $320 if broader market sentiment improves.

Monero (XMR) Price Forecast | TradingView XMRUSD 24H Chart

On the downside, the $250 area remains the critical short-term support to watch, aligning with Monero’s 20-day moving average. Failure to hold this zone could see prices revisit the $230 region, especially if regulatory headlines or renewed exchange restrictions resurface.

With trading volume on the rebound and confidence restored in the network’s stability, bulls have regained near-term control. However, tepid sentiment in the broader crypto market still poses a major threat that could cap upside momentum.

Best Wallet Presale Gains Momentum as Monero Spotlights Privacy and Security

The controversy surrounding the Monero network this week further emphasizes the role of secure crypto tools like Best Wallet (BEST), a multi-chain wallet offering secure storage and passive income opportunities.

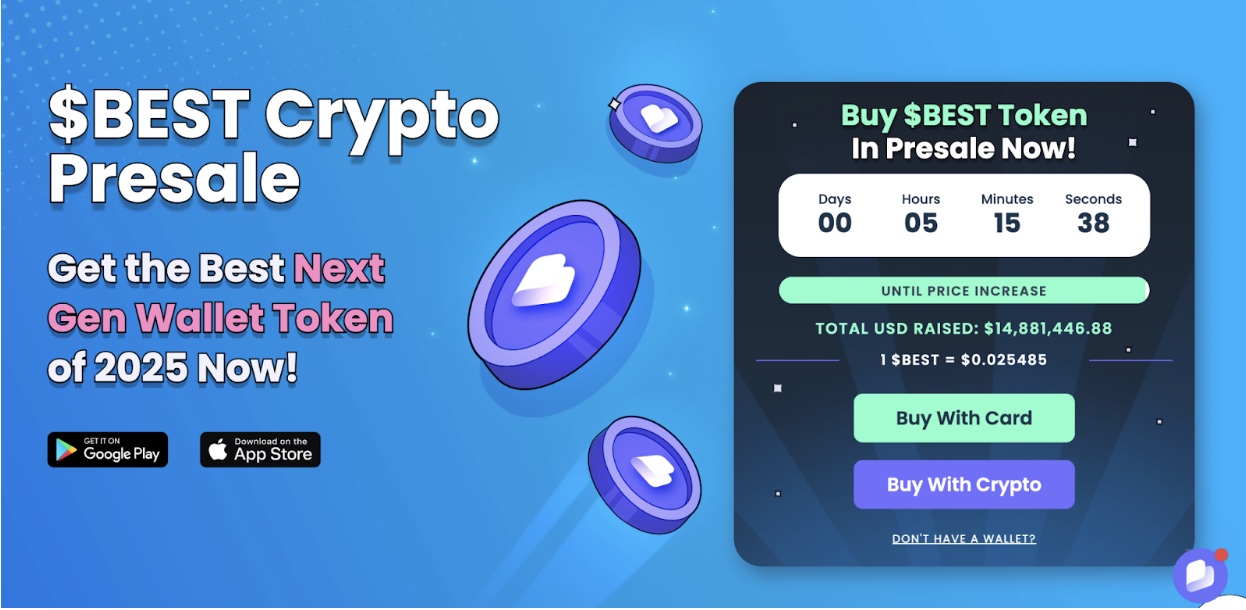

Best Wallet Presale

Having raised over $14 million in its presale, Best Wallet combines low transaction fees, high-yield staking options, and early access to decentralized apps. Investors can still secure early exposure at discounted tiers through the Best Wallet official site before the next presale price tier unlocks.

next

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn

Source: https://www.coinspeaker.com/monero-xmr-emerges-top-gainer-as-miners-reverse-qubics-51-attack-and-kraken-restriction/