Key Takeaways

What happened with the aPriori airdrop?

On-chain data revealed that newly created wallets received 60% of aPriori’s $APR token distribution on 23 October.

How does this scandal affect Monad’s upcoming mainnet launch?

The controversy threatens Monad’s mainnet launch and $MON token sale on Coinbase because aPriori was designed to handle $MON staking.

Monad’s highly anticipated mainnet launch faces its first major crisis.

aPriori, a $30 million-funded liquid staking protocol set to launch as a Day 1 application, now stands accused of orchestrating one of crypto’s most blatant insider airdrops.

The dump that rocked Monad

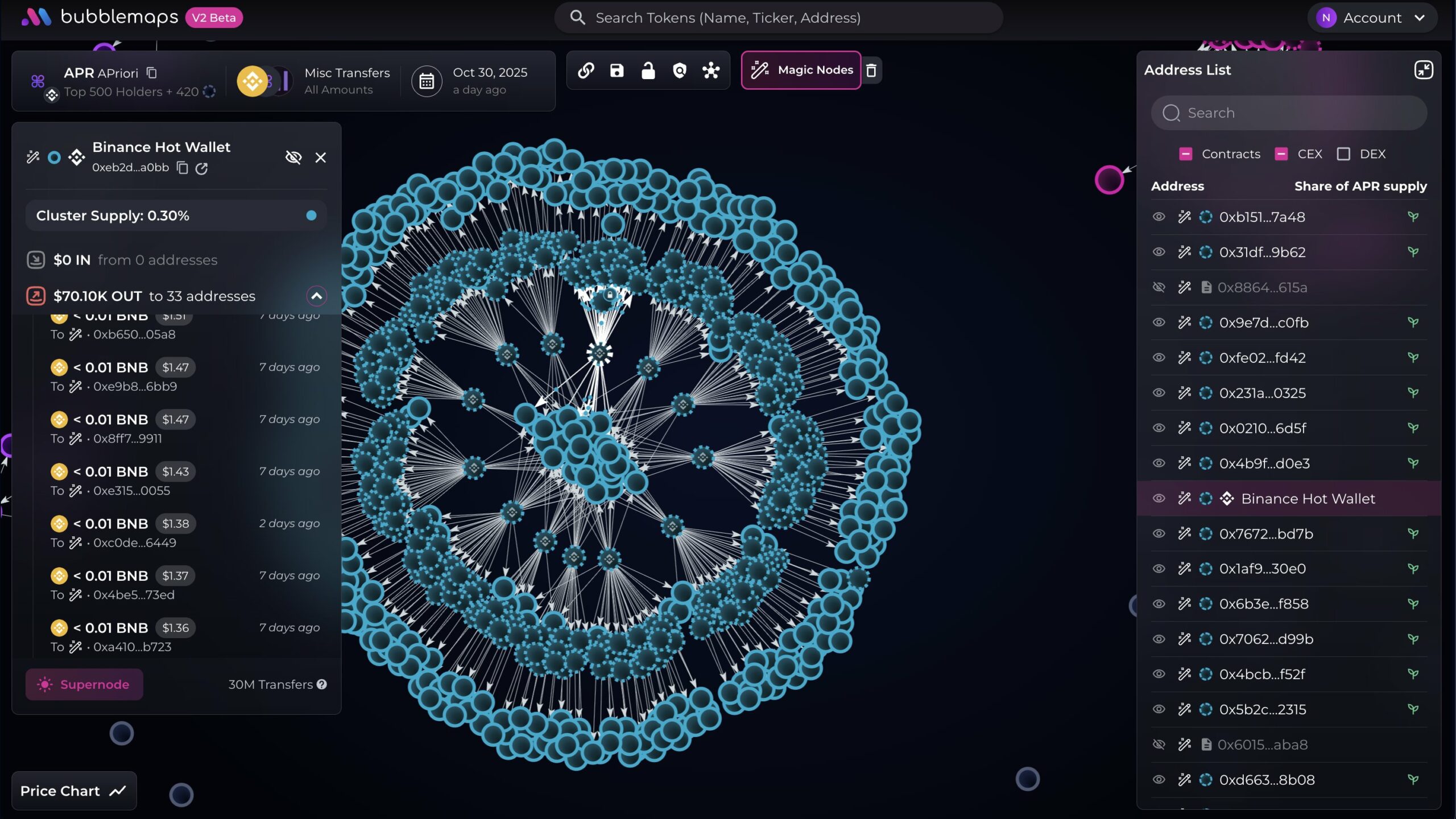

Blockchain analytics firms Bubblemaps and Lookonchain exposed suspicious wallet activity surrounding aPriori’s $APR token distribution on 23 October.

On-chain data, as of 11 November, reveals that 14,000 newly created wallets claimed 60% of the total airdrop allocation. The data shows that the wallets mysteriously appeared just days before the public claim window opened.

Source: Bubblemaps

These wallets followed an identical pattern. They claimed their tokens, dumped them immediately, and went silent.

$APR’s market cap crashed from $300 million to $93 million within weeks—a devastating 69% collapse that wiped out millions in value.

As of this writing, the market capitalization is approximately $57 million, according to CoinMarketCap data.

“Insiders farmed the drop and left real users with crumbs,” community member @doge9899 wrote on X. “aPriori locked small allocations behind vesting cliffs while the big bags walked free.”

Source: X

The timing couldn’t be worse for Monad. The Ethereum rival recently announced its mainnet launch for 24 November 24, with a $MON token public sale scheduled for 17 November on Coinbase at $0.025 per token.

Radio silence fuels the fire

aPriori’s response amplifies community frustration. The team has gone completely silent since the scandal broke.

Founder Ray Song hasn’t posted on social media since the token drop. Discord moderators close support tickets without explanation.

The project website still promotes “MEV-powered staking” features as if nothing happened.

Monad’s dilemma

Monad faces a strategic nightmare. The chain boasts impressive technical specifications, including 10,000 transactions per second, sub-second finality, and full EVM compatibility.

These fundamentals should dominate headlines as mainnet approaches.

Instead, aPriori’s scandal steals focus at the worst possible moment. The protocol was supposed to handle $MON staking when the mainnet goes live.

The trust tax

Monad’s mainnet launch is 13 days away. The $MON token sale opens in six days. Every day without resolution pushes more users, developers, and capital toward competing chains.

Monad spent years building technology and hype. The aPriori development might become a major issue for it.

Source: https://ambcrypto.com/monads-star-project-apriori-faces-airdrop-scandal-days-before-mainnet-launch/