- Monad’s token sale has raised over $130 million.

- Significant retail engagement noted by Coinbase’s Scott Shapiro.

- Potential impact on DeFi and Layer 1 blockchain frameworks post-mainnet.

The Monad token public sale on Coinbase platform has raised over $130 million, achieving nearly 70% of its $187.5 million target with the sale concluding on November 23.

This event marks one of the largest token sales since 2018, showcasing significant retail investor interest and potentially impacting Layer 1 blockchain assets in the market.

Monad Token Sale on Coinbase Exceeds $130 Million

Monad’s token sale on Coinbase has made headlines as it surpasses the $130 million mark, representing 69.6% of its $187.5 million fundraising target. Keone Hon, alongside partners including Paradigm and Electric Capital, aims to bolster a scalable Layer 1 ecosystem. “Our focus is on scalable, parallelized EVM for the next era of DeFi and dApps,” Hon stated. Overview of MON tokenomics and economic model explains the sale offering of 7.5% of the total MON supply at $0.025 per token, setting a Fully Diluted Valuation of $25 billion.

The sale indicates robust demand, with $23.2 million raised in the last 24 hours. The mainnet launch, scheduled for November 24, promises potential advancements in DeFi and dApps. This offering aligns with trends in increasing retail participation, a shift catalyzed by compliance with post-2018 SEC regulations.

Did you know? Monad’s recent sale on Coinbase marks the largest public token offering on a U.S. exchange since 2018’s regulatory impacts, a sign of evolving market dynamics.

Changing DeFi Landscape and Regulatory Shifts

Did you know? Monad’s recent sale on Coinbase marks the largest public token offering on a U.S. exchange since 2018’s regulatory impacts, a sign of evolving market dynamics.

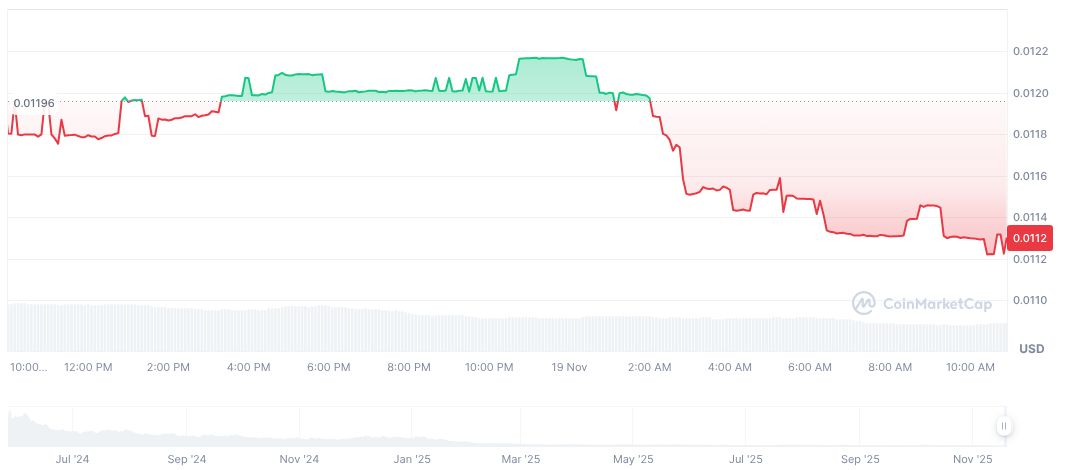

According to CoinMarketCap, Monad (MON) is currently priced at $0.01 with a market cap of $6.66 million. Insights and analysis on cryptocurrency data and trends show the market shows a 0.00% dominance with a Fully Diluted Market Cap of $11.22 million. Its 24-hour trading volume is at $467,255, indicating a -39.94% change. The 24-hour price change stands at -4.89%, with a more extended decline evident in the 90-day change at -49.95%. The circulating supply records at 593,782,391.

The Coincu research team emphasizes potential outcomes related to financial regulations and technological evolutions. With scalable DeFi and dApps, MON’s mainnet launch could influence future Layer 1 blockchain frameworks, propelling innovation in economies tied to crypto assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |