- Mizuho Securities lowers Circle’s stock target to $70 amid concerns.

- Circle stock drops nearly 40% over the past month.

- No comments from Circle’s leadership following the downgrade.

On November 15, Mizuho Securities kept an ‘underperform’ rating on Circle stock, reducing the price target to $70 amid key risks impacting medium-term earnings.

This rating and price cut highlight challenges such as interest rate concerns, stagnant USDC circulation, and escalating costs, influencing Circle’s stock and market dynamics among stablecoins.

Circle Faces Decline Amid Stagnant USDC and Competition

Mizuho Securities cites substantial risks for Circle’s medium-term earnings and has lowered its price target for the company’s stock. In addition to potential interest rate cuts due to economic shifts, the firm highlighted Circle’s structural challenges like high distribution costs and competitive pressure in the stablecoin market.

Circle’s stock has experienced considerable decline in value, dropping nearly 40% in the last month. Such movements highlight ongoing bearish sentiment surrounding Circle, accompanied by stagnant USDC circulation. This has further raised concerns among investors about Circle’s strategic growth prospects.

Community and executive responses are notably absent, with no statements from Circle’s leadership on this Mizuho downgrade. According to a Form 4 Filing for Company 1818008, the absence of comments may affect shareholder confidence, contributing to the existing market doubts about Circle’s operations.

Market Reaction and Historical Parallels Draw Insights

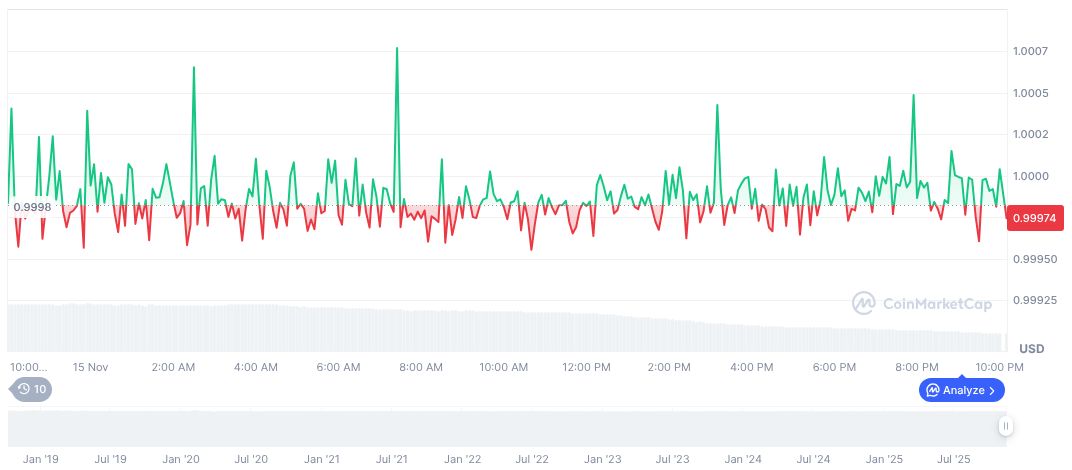

Did you know? USDC, issued by Circle, remains at a stable price of $1.00 despite the falling stock.

According to CoinMarketCap, its market cap stands at $74.93 billion with a trading volume of $9.28 billion, reflecting a 60.61% decrease over 24 hours. Price changes span negligible shifts across one to ninety days.

Coincu analysts observe that the market’s reaction to Circle’s lowered price target by Mizuho aligns with regulatory concerns and economic shifts. Historical patterns indicate that stablecoin markets face contrasting trajectories that often depend on broader financial policies and technological advancements within the sector. Another relevant filing, the Form 4 Filing for Company 1876042, may shed more light on these changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/mizuho-downgrades-circle-stock-usdc/