- Mizuho lowers Circle’s stock target to $70, citing market risks.

- Circle stock down nearly 40% last month.

- Analysts cite competition and distribution costs as key factors.

Mizuho Securities downgraded Circle Internet Group’s stock, lowering its target price from $84 to $70 by Nov 15, 2025, citing mid-term profitability risks and competitive pressures.

This adjustment contrasts sharply with JPMorgan’s optimistic outlook and highlights potential market volatility influenced by interest rate changes and stablecoin sector challenges.

Mizuho Lowers Circle Target to $70 Amid Profit Concerns

Given the information presented, it appears there are currently no direct quotes or public statements from Circle Internet Group’s leadership, including CEO Jeremy Allaire, regarding the Mizuho downgrade as of November 15, 2025.

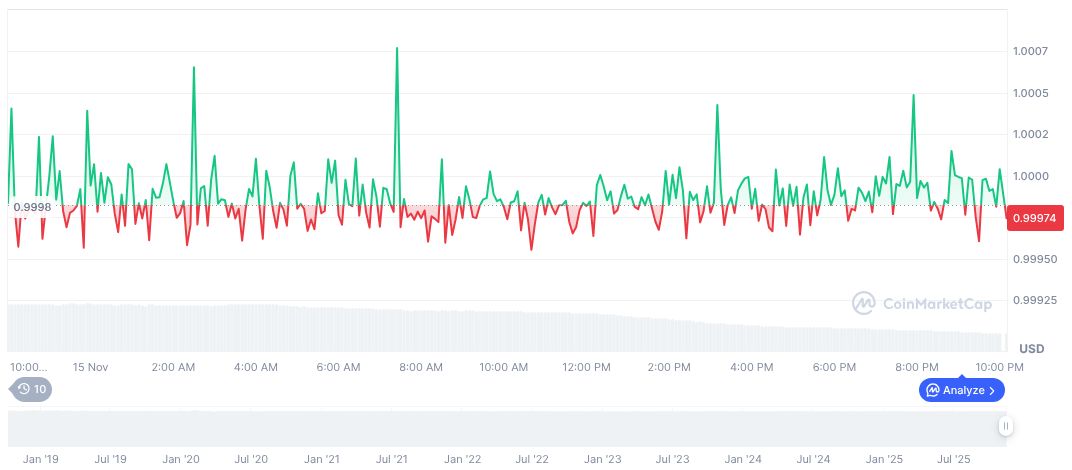

USDC exhibits stable pricing, maintaining its $1.00 value amid moderate trading volume fluctuations. According to CoinMarketCap, the stablecoin saw a 24-hour trading volume of $8.58 billion. Market data shows minimal price movement, indicating stability despite broader industry shifts.

Did you know? Mizuho’s pessimistic target of $38 for Circle stock is significantly below its optimistic scenario of $251, reflecting the degree of uncertainty and variability in market predictions.

JPMorgan vs. Mizuho: Divergent Views on Circle’s Future

Did you know? Mizuho’s pessimistic target of $38 for Circle stock is significantly below its optimistic scenario of $251, reflecting the degree of uncertainty and variability in market predictions.

The Coincu research team suggests that future interest rate changes and stablecoin circulation stagnation could impact both Circle’s stock and USDC adoption. Increased competition is expected to tighten profit margins. However, Circle’s technological framework and strategic collaborations may counterbalance pressures, offering potential resilience.

The Coincu research team suggests that future interest rate changes and stablecoin circulation stagnation could impact both Circle’s stock and USDC adoption. Increased competition is expected to tighten profit margins. However, Circle’s technological framework and strategic collaborations may counterbalance pressures, offering potential resilience.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/mizuho-cuts-circle-stock-target/