- US cryptocurrency stocks experience mixed results on July 24.

- Ethereum sees rise in trading volume dominance.

- No CEO statements addressed specific stock movements.

On July 24, 2025, US cryptocurrency-concept stocks showed mixed results, with Sharplink Gaming up 8.87% and Circle down 5.01%, according to Rockflow market data.

These fluctuations highlight ongoing market volatility, influenced by Ethereum’s trading surge and potential institutional interest, with no immediate commentary from key company leaders.

Ethereum’s Role in Shaping Stock Market Dynamics

Sharplink Gaming reported an increase of 8.87% and Bitmine rose by 6.29%, aligning with Ethereum’s trading volume increase. Bitdeer saw a 3.97% rise, showing strong market engagement. Circle declined by 5.01%, slightly affecting broader market sentiments.

There were no direct statements from CEOs of Coinbase, Circle, or Bitdeer regarding these shifts. The broader market speculation continues, aiming for strategic insights as trading expands.

Despite the fluctuation, “specific quotes were not available,” and it is recommended to continually monitor official channels for insights related to market conditions.

Historical Context, Price Data, and Expert Analysis

Did you know? In past years, altcoin rotation phases, similar to today’s Ethereum focus, have often led to temporary rallies and high resale volatility, presenting opportunities for short-term market shifts.

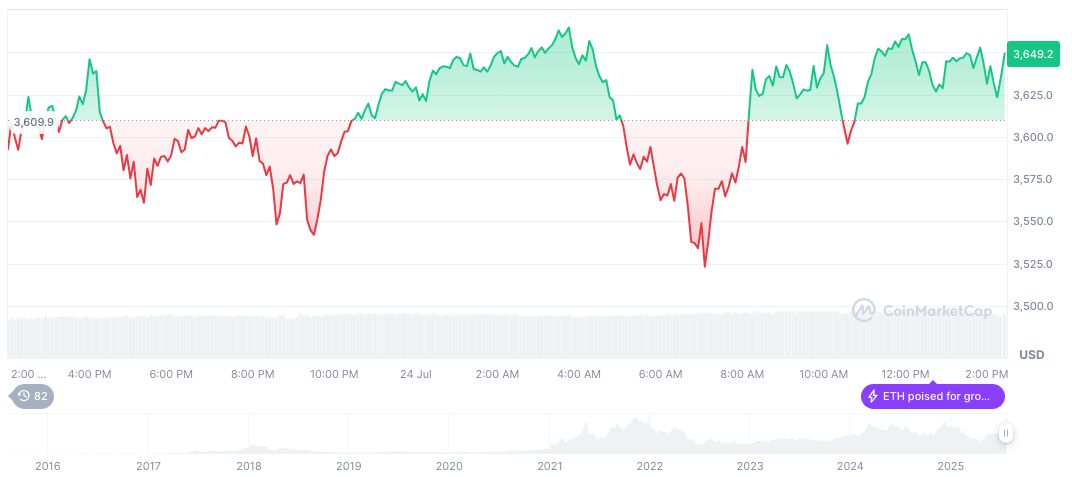

Ethereum (ETH) saw a notable performance improvement, with a current price of $3,707.81 and a market cap of formatNumber(447573467630, 2) billion as reported by CoinMarketCap. Its 24-hour trading volume is formatNumber(40,521,429,814, 2), showing a slight decline. Over the last 90 days, ETH surged by formatNumber(106.93, 2)%, confirming its dynamic movement.

The Coincu research team indicates potential growth for Ethereum-backed stocks, based on historical trading data. Expert analysis suggests that had market volatility been lower, Ethereum’s continued dominance might lead to more opportunities for speculative trading partnerships and increased economic interest in associated tech advancements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-cryptocurrency-stocks-july-24/