- Missouri exempts capital gains tax, impacting cryptocurrencies and assets.

- Investors benefit starting in 2025.

- Potential state revenue decrease by $430 million first year.

Governor Mike Kehoe is set to sign Missouri’s bill, making it the first U.S. state to exclude cryptocurrency gains from state taxes starting in 2025.

This bold action will boost Missouri’s appeal to crypto investors, likely influencing broader fiscal policies across states in the coming years.

Missouri’s Pioneering Tax Policy Boosts Crypto Appeal

On May 7, the Missouri House of Representatives approved a legislative bill exempting capital gains from state income taxes. This initiative positions Missouri as the first state to undertake such a measure in the United States. The bill was endorsed by legislators including Representative George Hruza, who highlighted its potential to attract companies and benefit residents financially.

For individual investors, this exemption will be effective from 2025. As a result, Missouri may see a significant draw from crypto investors who seek to maximize returns without state-level tax deductions. For corporations, exemptions will occur sequentially, contingent on the state’s fiscal environment.

“It will encourage companies to invest in Missouri, and it will also encourage reinvestment of existing companies to grow and bring high-paying jobs to Missouri. It also will benefit most Missourians in their pocketbook, so they get to keep more of their money.”

Reactions from the market have been cautiously optimistic, with Missouri’s stance setting a precedent. Governor Mike Kehoe’s acknowledgment of the bill’s potential for economic growth further aligns with investor sentiment, and exploratory discussions have emerged about whether other states might follow.

Economic Ripple Effect and Potential Revenue Implications

Did you know? Cryptocurrency exemptions in Missouri could spark a trend akin to Delaware’s approach to incorporating companies, positioning the state as a pioneering hub for digital asset investment in the Midwest.

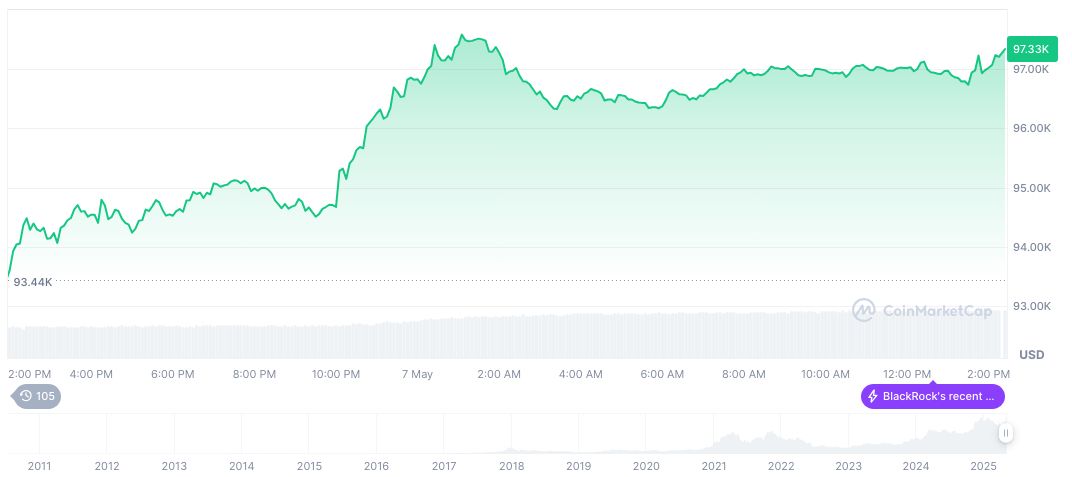

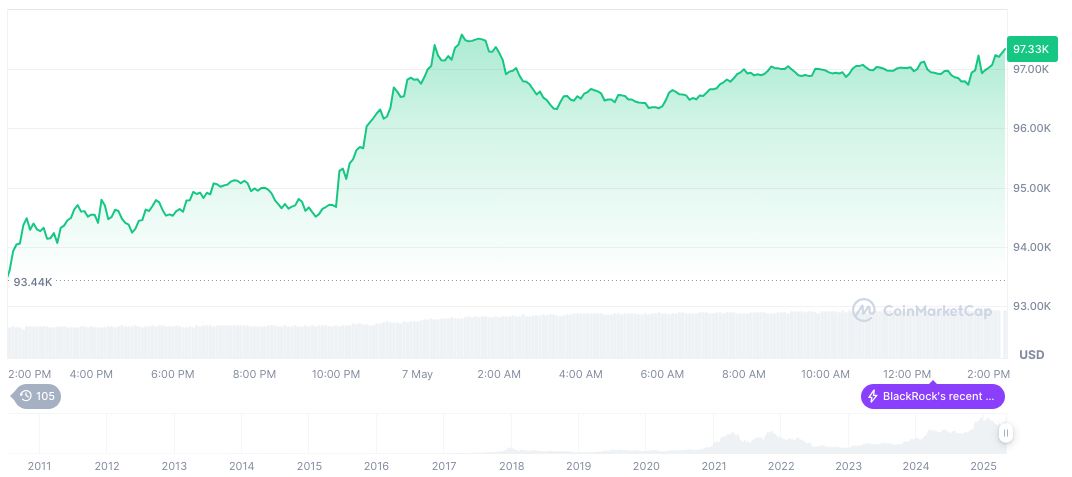

According to CoinMarketCap, Bitcoin (BTC) currently trades at $99,480.25, with a market cap of $1.98 trillion. Its market dominance stands at 63.92%, showing a 2.44% increase over the past 24 hours. Notably, the 7-day change was 3.38%, with a monthly gain of 24.52%.

Research from Coincu suggests two main outcomes from this legislation. Economically, Missouri may attract a notable influx of crypto firms seeing to benefit from tax breaks. In regulatory terms, this initiative could prompt similar measures in neighboring states, tightening competition for tax-related advantages.

Source: https://coincu.com/336366-missouri-cryptocurrency-capital-gains-exemption/