Strategy’s (formerly known as MicroStrategy) stock, MSTR, posted mixed results earlier in the week, but investor confidence may have improved after it cleared a key 2026 risk.

During the U.S. trading session on the 6th of January, the stock gained 4.1% and closed at $164.7.

This followed a slight Bitcoin [BTC] correction after the early January recovery and the MSCI deletion fears that had dragged the stock down in the past few weeks.

MSCI Global keeps Microstrategy stock

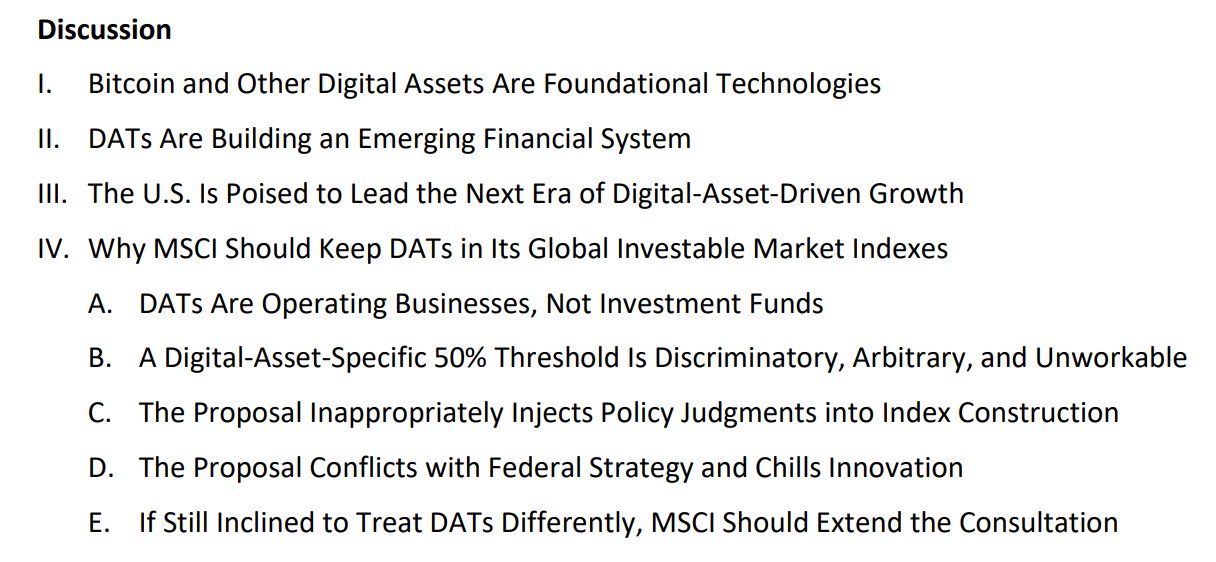

However, after U.S. market hours on the 6th of January, the MSCI Global said it will retain MSTR and other digital asset treasury companies (DATCos) for the time being.

“For the time being, the current index treatment of DATCOs identified in the preliminary list published by MSCI of companies whose digital asset holdings represent 50% or more of their total assets will remain unchanged.”

MSCI Global added that it will need “further research” and new metrics to evaluate the sector before issuing further guidance on the inclusion criteria.

“Distinguishing between investment companies and other companies that hold non-operating assets, such as digital assets, as part of their core operations rather than for investment purposes requires further research and consultation with market participants.”

MSTR stock reaction

With the MSCI risk out of the way, MSTR recovered 6% to a high of $171.9 after the update.

However, at the time of writing, it has given back some gains after BTC faced price rejection at the $94K resistance level.

Source: Google Finance

Reacting to the MSCI decision, Strategy billed it as a “strong outcome for neutral indexing.” Chaitanya Jain, an executive at Strategy, echoed the firm’s stance and added,

“Neutrality in indexing matters. Let the market choose winners and losers.”

Source: X

Will MSTR extend its recovery?

Bitcoin treasury firms have been pushing against the MSCI Global argument that they are investment funds and not operational companies like most of the firms on the index listing.

Meanwhile, Strategy continues to cover other mid-term risks, including preferred stock dividend obligations.

It recently expanded its U.S. dollar reserve fund to $2.25 billion and scaled its BTC holdings to 673,783 following Michael Saylor’s typical weekend ‘orange/green dot’ signal.

In other words, it can handle about three years of dividend coverage without needing to sell BTC.

Final Thoughts

- MicroStrategy stock is out of the woods after the MSCI Global decision to keep it and other DATs on the index for now.

- The MSTR stock jumped 6% but later retreated after the Bitcoin price turned choppy below $94K.

Source: https://ambcrypto.com/microstrategy-mstr-jumps-4-as-msci-keeps-dats-for-the-time-being/