- Michael Saylor enters Bloomberg Billionaires Index with a net worth of $7.37 billion.

- MicroStrategy’s stock rise driven by Bitcoin market performance.

- Institutional interest in Bitcoin as a treasury asset continues to grow.

Michael Saylor, founder of MicroStrategy, enters the Bloomberg Billionaires Index for the first time, ranking 491st with a net worth of $7.37 billion.

Saylor’s wealth increase highlights the influence of Bitcoin’s price surge on institutional holdings, affecting market sentiment and MicroStrategy stock performance.

Michael Saylor’s Wealth Surges: Net Worth Hits $7.37 Billion

Michael Saylor’s net worth increased by $1 billion since the start of the year, entering the Bloomberg Billionaires Index at a rank of 491. His estimated fortune of $7.37 billion is primarily attributed to the appreciation of MicroStrategy’s stock, closely tied to the company’s Bitcoin strategy.

MicroStrategy’s stock price rose nearly 12% since January, driven by Bitcoin’s bullish performance. This increase aligns with the company’s strategy to use Bitcoin as a treasury reserve, influencing market perceptions of the cryptocurrency as an institutional asset.

“The increase in our stock price is directly tied to the appreciation of Bitcoin and our ongoing BTC accumulation strategy.” – Michael Saylor, Founder and Executive Chairman, MicroStrategy.

Reactions from industry leaders have been minimal, with no official statements from Saylor on his Bloomberg Index inclusion. However, the impact of MicroStrategy’s Bitcoin accumulation strategy has been profound on market narratives. Ethereum co-founder Vitalik Buterin noted the importance of scalability in blockchain technology unrelated to Saylor’s activities.

Bitcoin’s Bullish Trend Boosts Institutional Asset Strategy

Did you know? Michael Saylor’s Bitcoin accumulation strategy began in 2020, catalyzing institutional interest in digital assets and influencing companies like Tesla and Square to follow suit.

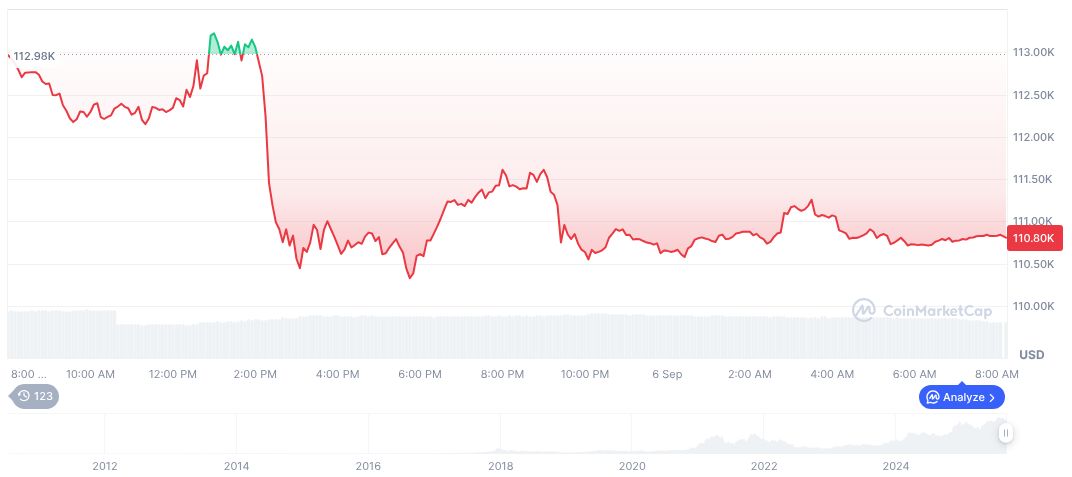

Bitcoin, currently priced at $110,663.93, holds a market cap of $2.20 trillion, with a 57.80% dominance, as reported by CoinMarketCap. The cryptocurrency experienced a 0.27% decline over 24 hours but has risen 4.63% over the past 90 days, maintaining its relevance as a major asset with a circulating supply nearing 20 million coins.

Coincu research team observes that institutional adoption of Bitcoin as a treasury asset, spearheaded by MicroStrategy, may lead to continued market endorsement and potential regulatory shifts. This highlights ongoing interest in integrating digital assets within traditional financial frameworks, as discussed in the Cambridge global cryptocurrency benchmarking study.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/michael-saylor-bloomberg-billionaires-index/