- Metaplanet Inc. is issuing up to 555 billion yen in perpetual preferred shares for Bitcoin accumulation.

- Simon Gerovich emphasizes Bitcoin’s role in expanding Metaplanet’s capital strategy.

- Metaplanet aims to solidify its presence as a pioneer in Japan’s corporate Bitcoin ventures.

Simon Gerovich, CEO of Metaplanet Inc., announced plans to issue 555 billion yen in perpetual preferred shares to support capital growth and strategy in Tokyo.

This unprecedented move could significantly impact Bitcoin markets, positioning Metaplanet as a leading Bitcoin-centric corporate entity in Asia.

Metaplanet’s $3.72 Billion Share Issue for Bitcoin Reserves

Metaplanet Inc. recently announced plans to raise up to 555 billion yen (approximately $3.72 billion USD) through issuing perpetual preferred shares. This statement was made by its CEO, Simon Gerovich, emphasizing the company’s strategy to expand its capital structure for Bitcoin accumulation.

The preferred shares will underpin Metaplanet’s balance sheet and flexibility in further Bitcoin purchases. This aligns with its long-standing strategy inspired by MicroStrategy, concentrating on building its Bitcoin reserves substantially by 2025.

Market observers have noted a positive effect on Metaplanet’s stock as it becomes increasingly recognized within Bitcoin-focused forums. While there hasn’t been significant feedback from critical opinion leaders, Tokyo Stock Exchange flows indicate approval of Metaplanet’s approach.

Historical Context: Pioneering Corporate Bitcoin Endeavor in Japan

Did you know? No Japanese listed company has ever raised funds at this scale explicitly for Bitcoin-related purposes, positioning Metaplanet as a pioneer in the region.

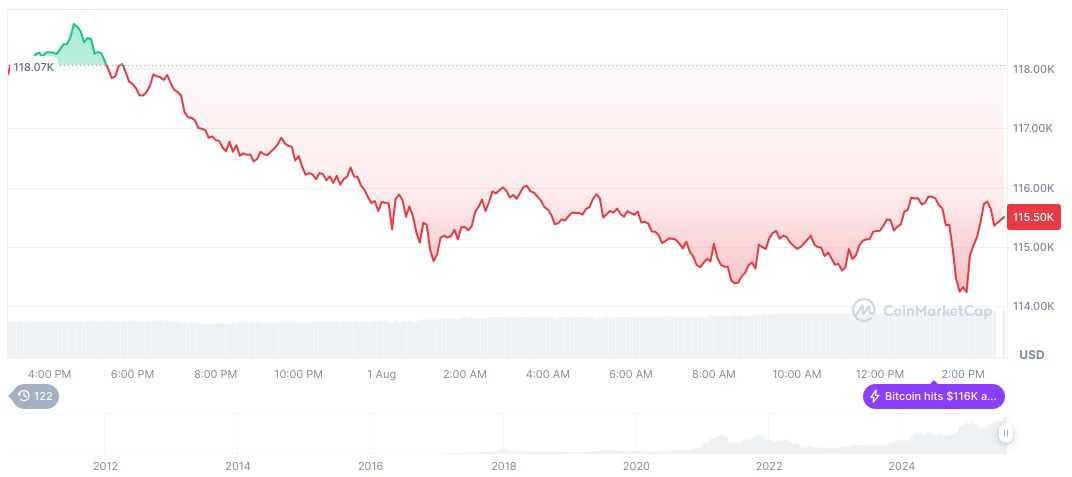

As of August 1, 2025, Bitcoin holds a current price of $115,368.70 with a market cap of $2.30 trillion. Dominating the market at 61.13%, Bitcoin’s 24-hour trading volume reached $89.84 billion. Price changes over 90 days show a 19.62% increase, according to CoinMarketCap.

According to Coincu Research, Metaplanet’s initiative signifies potential growth in institutional acceptance of Bitcoin in Asia. Historical trends suggest the use of perpetual preferred shares could attract larger corporate engagement and possibly lead to increased stock performance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/metaplanet-perpetual-shares-issue/