- Metaplanet ranks top in Tokyo, significant stock growth recorded.

- Transaction volume hits ¥222 billion and 170 million shares.

- BlackRock’s ETF nears becoming the largest Bitcoin holder.

Metaplanet’s stock achieved a significant milestone on June 3, 2025, by ranking first in transaction volume on the Tokyo Stock Exchange, totaling ¥222 billion with 170 million shares traded.

Metaplanet’s leadership strategy, which involves aggressive Bitcoin accumulation, has driven its stock to unprecedented heights amid Japan’s economic challenges. The firm’s approach reveals broader investor interest in alternative assets.

Metaplanet Tops Transaction Charts with ¥222 Billion Volume

Metaplanet reached a significant milestone by leading the Tokyo Stock Exchange in both transaction amount and volume. With a total transaction volume of ¥222 billion, Metaplanet’s growth has captured industry attention. CEO Simon Gerovich credits the company’s transparency and strategic Bitcoin holdings for this achievement.

The company’s strategy involves substantial Bitcoin acquisition, with aspirations to reach 21,000 BTC holdings by 2026. This approach challenges traditional financial strategies, positioning Metaplanet as a major player in Bitcoin holdings globally. As Simon Gerovich, CEO of Metaplanet, expressed, “Metaplanet has positioned itself as the ‘Japanese MicroStrategy,’ adopting an aggressive Bitcoin accumulation strategy amid Japan’s public debt crisis and a weakening yen.”

The stock market reacted favorably to Metaplanet’s transparent operations and significant growth. Analysts praise the company’s innovative approach, while industry observers note strong interest from investors seeking alternatives amid Japan’s economic climate.

Bitcoin Price Trends and Metaplanet’s Global Influence

Did you know? Metaplanet’s approach closely mirrors strategies previously criticized by some industry leaders due to potential security risks, yet it drives significant investor interest in Japan.

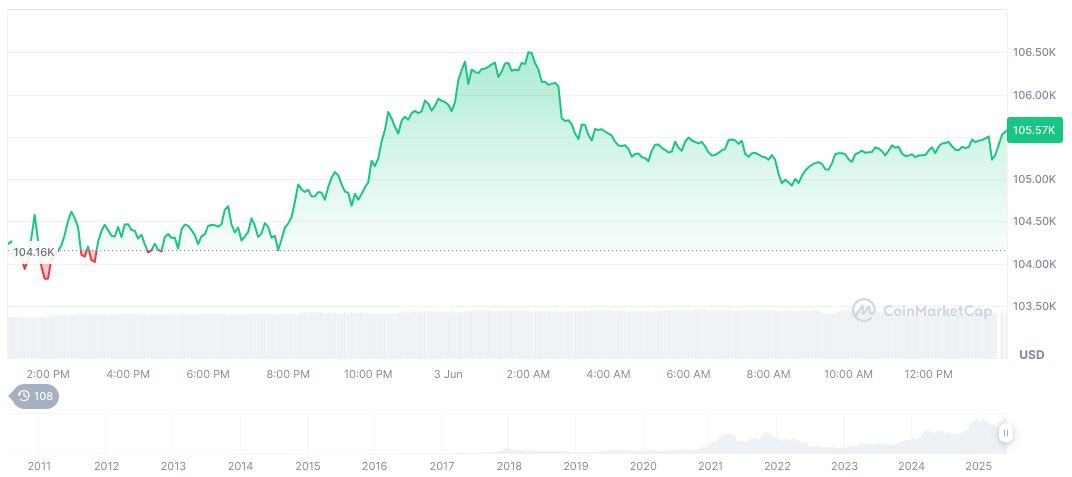

Bitcoin’s price stands at $105,541.54 with a market cap of $2.10 trillion, reflecting a 0.12% decrease over 24 hours. Despite recent volatility, a 15.02% increase is observed over the past 90 days, as per figures from CoinMarketCap.

Experts from Coincu suggest that Metaplanet’s success might influence broader financial trends in Asia, encouraging investment in digital assets. Regulatory responses could shift toward increased oversight while acknowledging the role of transparency in fostering market confidence. For instance, Metaplanet leverages its Bitcoin stash of over 5,000 BTC to generate record profits, exemplifying innovative financial practices.

Source: https://coincu.com/341485-metaplanet-tokyo-stock-exchange-success/