- Metalpha secures deal for $12 million investment from Gortune and Avenir.

- Funds target digital asset growth and blockchain service expansions.

- Deal set to close by November 30, 2025, marking growth trajectory.

Metalpha Technology Holding Ltd. (NASDAQ: MATH) secures $12 million from Gortune International Investment Limited Partnership and Avenir Group, finalizing a stock subscription by November 30, 2025.

This funding aims to boost Metalpha’s blockchain services, digital asset technologies, and operating capital, potentially impacting institutional market strategies and liquidity in BTC, ETH, and major altcoins.

Metalpha and Partners Commit $12M to Blockchain Expansion

Metalpha Technology Holding Limited has secured a $12 million investment from Gortune International Investment Limited Partnership and Avenir Group. The transaction involves a private placement of common stock, expected to complete by November 30, 2025. Adrian Wang, Metalpha CEO, emphasized the significance, stating, “This funding marks a new era of growth, positioning Metalpha to deliver expanded blockchain trading strategies and digital asset innovation for our institutional clients.”

Utilization of the investment will focus on expanding blockchain trading services, investing in digital asset technologies, and supporting operating funds. This aims to bolster Metalpha’s service offerings and enhance its position in the digital asset sector.

Market Reactions have been generally positive, welcoming the expansion potential. Adrian Wang noted that this move positions the company to deliver enhanced services to institutional clients. However, regulatory environments remain critical, particularly in regions focusing on digital asset oversight.

Blockchain Sector Awaits Impact of Strategic Funding

Did you know? Metalpha’s latest investment aligns with historical trends where similar capital raises often precede significant growth in financial products and market influence, akin to the $10 million rounds seen with other asset management firms.

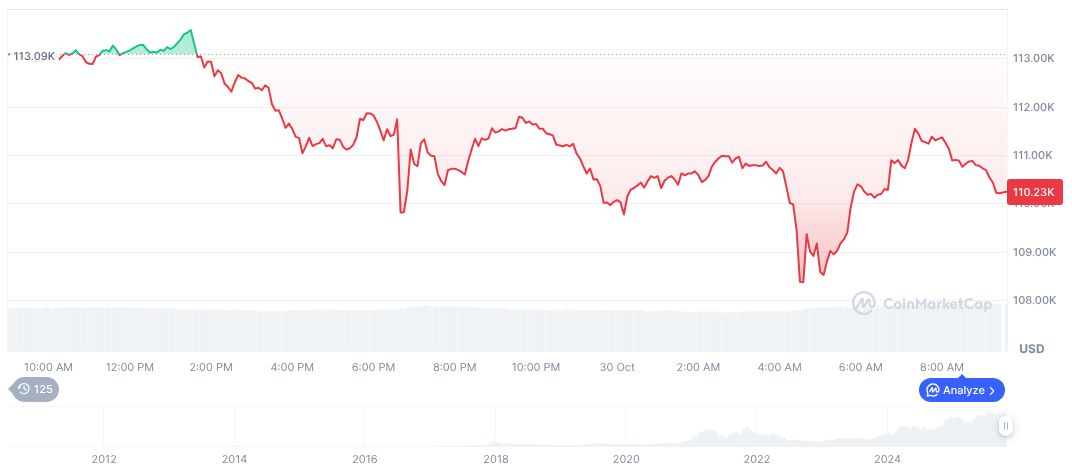

According to CoinMarketCap, Bitcoin (BTC) holds a market cap of $2.15 trillion and a 59.24% dominance, although it saw a slight decrease of 3.23% in the past 24 hours. Trading volume reached $70.94 billion, reflecting a 13.42% shift. Supply remains capped at 21 million, with 19.94 million in circulation.

The Coincu research team suggests that Metalpha’s strategic advancements could strongly influence BTC and ETH trading, given the expected increase in market liquidity and investor engagement. Technological innovations and regulatory compliance remain pivotal in the firm’s growth projections.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/metalpha-12m-investment-gortune-avenir/