Key Takeaways

Why did MemeCore [M] surge this week?

Spot outflows and a 40% jump in Derivatives Volume lifted the price near $2.23 amid renewed buying.

Can bulls keep control?

RSI at 56 and approaching DMI crossover suggest a retest of $2.50 if momentum holds.

MemeCore [M] continued its rally, becoming the fourth-largest memecoin by market capitalization. The token surged 10.13%, hitting a high of $2.28 before cooling to $2.23 at press time.

Over the same period, trading volume rose 43% to $19.4 million, while market cap climbed to $2.35 billion—showing sustained capital inflow.

Buyers return to the Spot market

After a brief round of profit-taking, buyers returned aggressively. In fact, Spot activity confirmed the shift.

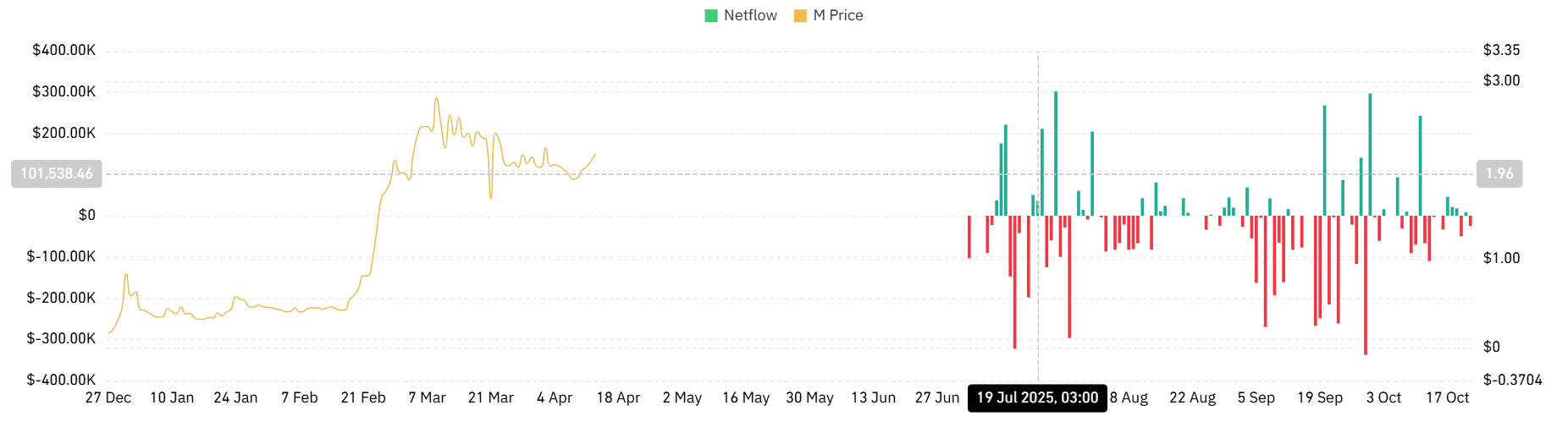

According to CoinGlass, MemeCore’s Netflow dropped to -$26.9k from +$8k the previous day, showing higher outflows and accumulation.

Source: CoinGlass

Historically, sustained outflows have preceded rallies, suggesting traders are moving tokens off exchanges to hold them longer term. This renewed accumulation set the tone for derivative traders.

Derivatives heat up as Futures inflows rise

Capital also flooded into the Futures market as traders positioned for short-term swings.

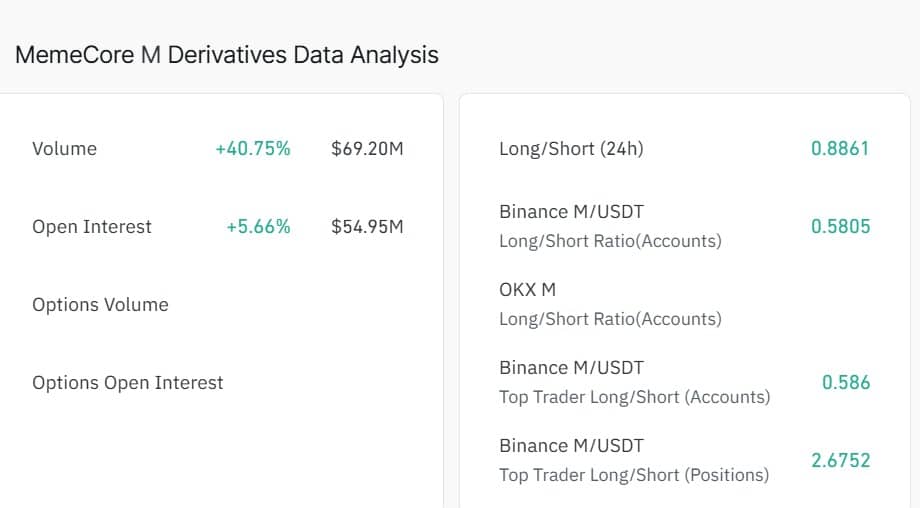

CoinGlass data showed Derivatives Volume rose 40.75% to $69.2 million, while Open Interest climbed 5.66% to $54.95 million. When both expand together, it signals new positions entering the market.

Source: CoinGlass

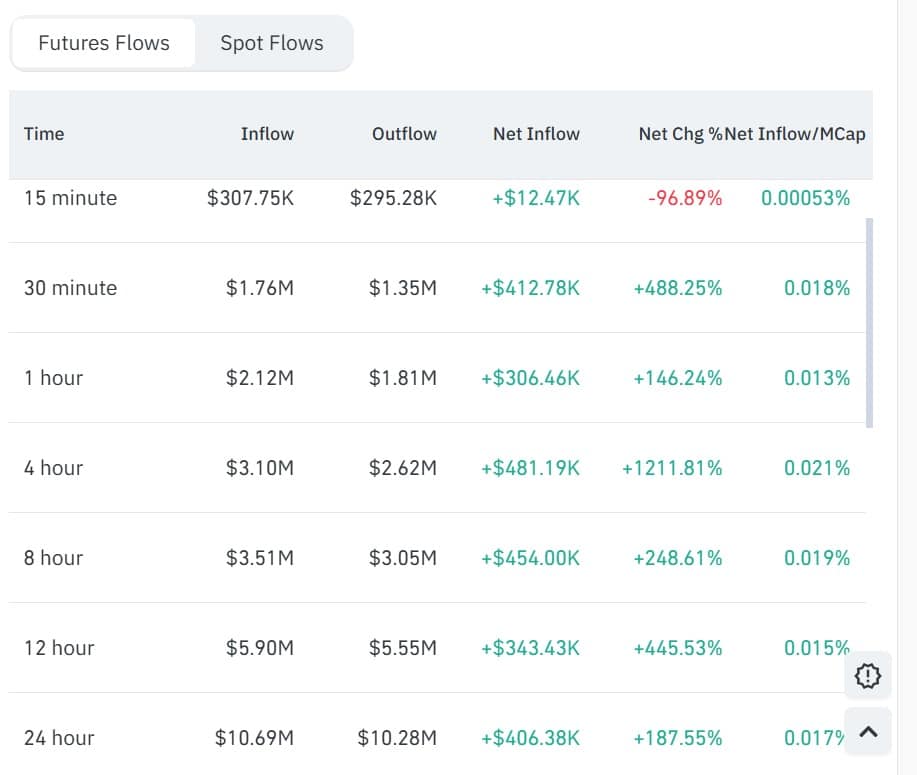

In fact, Futures Inflow surged to $10.69 million compared to $10.28 million in Outflows.

As a result, Futures Netflow surged 187% to $406k, indicating more funds entered the Futures market. Such increased capital flow suggests that investors sent capital to open either short or long positions.

Source: CoinGlass

Interestingly, our examination of Derivatives revealed that investors mostly rushed to bet against the market.

As such, the Long/Short Ratio across major exchanges stood below 1.0 at 0.88, suggesting the broader Futures crowd leaned bearish.

Binance top traders remained the outlier, with ratios above 2.6 in positions, indicating selective optimism among high-volume accounts.

This divergence between retail and top traders kept short-term sentiment mixed.

MemeCore’s technical setup favors bulls

According to AMBCrypto’s analysis, MemeCore rallied as massive capital flowed into both the Spot and Futures markets.

On the daily chart, M’s RSI climbed to 56.22, crossing above its signal line at 49.27—a mild bullish sign.

Source: TradingView

For the uptrend to strengthen, the Directional Movement Index (DMI) must form a positive crossover between the +DI (18.69) and -DI (19.43) lines.

If confirmed, M could retest $2.30 and aim for $2.50 resistance. A rejection or shift in sentiment, however, could drag prices back toward $1.90 support.

Source: https://ambcrypto.com/memecores-rally-heats-up-this-divergence-could-decide-ms-breakout/