- MEI Pharma incorporates Litecoin into its treasury, with Charlie Lee joining the board.

- Litecoin’s use as a treasury asset signals institutional growth.

- Strategic involvement from GSR and Litecoin Foundation enhances credibility.

MEI Pharma has announced a $100 million commitment into Litecoin as a primary treasury asset, advised by GSR. This significant shift underscores the growing trend of integrating cryptocurrency into traditional financial strategies, with Litecoin benefiting from institutional endorsement.

MEI Pharma has committed over $100 million to a Litecoin-based treasury, positioning Litecoin at the core of its financial strategy. MEI Pharma [further details](https://coincu.com/325767-digital-asset-investment-products-outflows-103/), positioning Litecoin at the core of its financial strategy. Charlie Lee, founder of Litecoin, joins MEI Pharma’s Board, reflecting a pivotal shift by integrating digital assets into traditional sectors. GSR joins as strategic advisor, tasked with managing and advising MEI Pharma’s digital asset strategy. The funding move involved the sale of nearly 29 million shares, now converted into Litecoin.

MEI Pharma Invests $100 Million in Litecoin Treasury

Market reactions have been notable, with MEI Pharma’s stock surging over 50%, marking a landmark moment as a U.S.-listed company adopts Litecoin. Charlie Lee emphasizes the institutional scope brought to Litecoin via this partnership:

Investor sentiment is positive, with market recognition growing for Litecoin due to this groundbreaking collaboration.

For 14 years, Litecoin has consistently delivered a stable, low-cost, and accessible network for millions … This partnership with GSR and MEI Pharma brings that utility and mission into an institutional setting for the first time.

Litecoin’s Institutional Adoption Gains Momentum

Did you know? MEI Pharma’s move mirrors the early-adoption phases of Bitcoin by companies like MicroStrategy and Tesla, but sets precedence for Litecoin as a treasury asset.

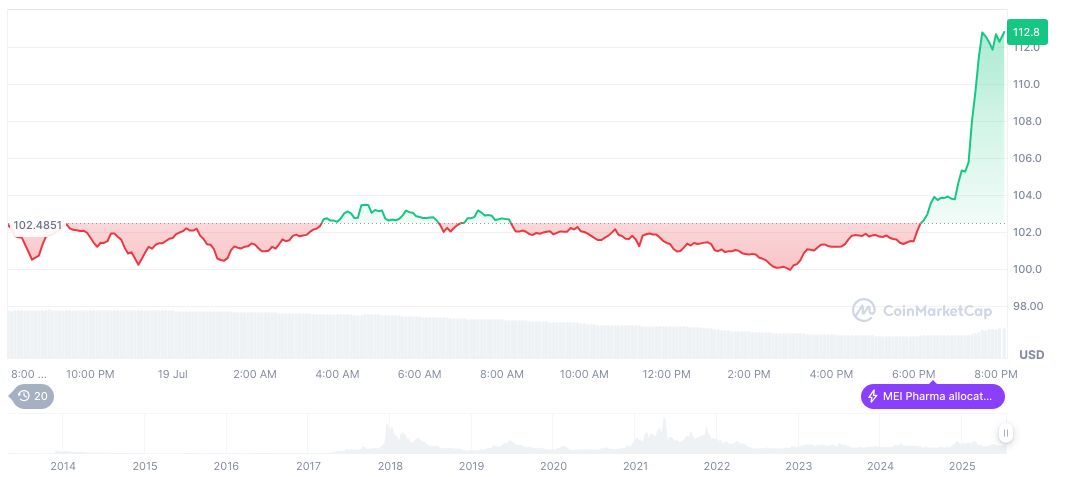

According to CoinMarketCap data, Litecoin (LTC) currently trades at $112.92, featuring a market cap of $8,592,304,802 and a 24-hour trading volume of $1,172,096,733. Notably, it has seen a 10.91% price rise within the past 24 hours. The cryptocurrency has demonstrated increasing momentum, with a noteworthy 44.50% price increase over 90 days.

Coincu research suggests that MEI’s decision may prompt further institutional adoption of alternative cryptocurrencies for treasury management, widening options beyond Bitcoin and Ethereum. This could gradually influence regulatory frameworks and blockchain technology integration within traditional financial institutions, enhancing cross-market dynamics and accelerating fintech innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349622-mei-pharma-litecoin-treasury-investment/