- MegaETH’s USDm stablecoin bridge creates market concern due to speculated actions.

- Speculated quota changes remain unverified by official sources.

- No confirmed whale activities or quota expansions in primary disclosures.

MegaETH announced a pre-deposit bridge for its USDm stablecoin, opening November 25, capped at $250 million in USDC on Ethereum, according to their official Twitter account.

The cap ensures controlled USDC movement into MegaETH’s ecosystem, affecting liquidity patterns and gauging market response to Layer 2 stablecoin integrations without confirmed exploits or cap increases.

MegaETH’s $250 Million Stablecoin Bridge Launch Sparks Concerns

MegaETH launched its USDm stablecoin pre-deposit bridge, opening at the defined quota of $250 million USDC. Initial reports of an increased limit and speculated transaction manipulations by a whale are still unverified. Official channels reiterated a $250 million limit, without reference to the alleged actions. Despite the claims, the distributed quota remains at $250 million as per official records.

Yet, the speculation surrounding premature transactions and quota manipulation has stirred the crypto community. The alleged event spotlights a vulnerability in MegaETH’s protocol, raising concerns about potential exploitations.

Market analysts note the absence of official confirmations regarding quota and whale activities, which prompts stakeholders to seek further clarity. On social media, users have debated MegaETH’s strategy, sparking discussions around its measures to prevent such issues.

Market Analysts Question Integrity Amid Unverified Quota Claims

Did you know? Crypto projects like Ethereum’s recently launched stablecoins also faced initial stage speculations, reflecting the consistent nature of market reactions.

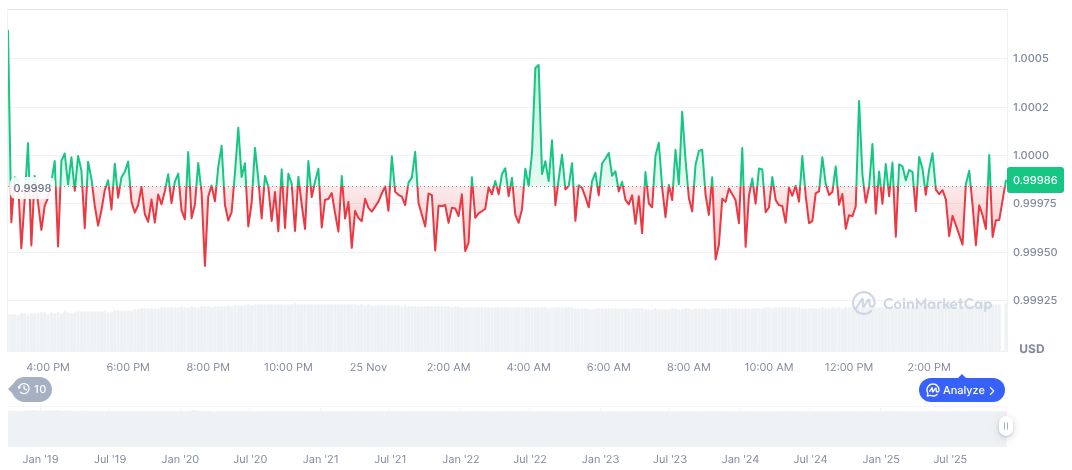

USDC, currently stable at $1 with a market cap of 74.85 billion USD, shows minimal volatility, according to CoinMarketCap. Despite a trading volume of 16.08 billion USD, the price remains unchanged, highlighting USDC’s stability even amidst broader crypto fluctuations.

Coincu Research suggests potential enhancements in MegaETH’s transaction protocols to shield against exploitation risks, leveraging past patterns seen in Layer 2 network practices. Enhanced security measures may restore market confidence as technological advancements continue.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/megaeth-pre-deposit-quota-concerns/