- MATIC shows strong bullish momentum with rising trading volume and market interest.

- Resistance levels at $0.54 and $0.55 are key, with potential selling pressure ahead.

- Total Value Locked in Polygon’s network is high, signaling robust asset support.

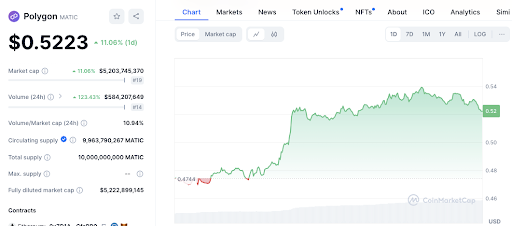

Polygon (MATIC) is currently experiencing a notable bullish momentum. Over the past 24 hours, MATIC’s price has surged by 12.44%, reaching $0.5309. This substantial increase reflects a broader positive trend in the market for Polygon. Let us look at the recent price action, trading volume, support and resistance levels, and other key market metrics.

MATIC’s price has been steadily climbing. The cryptocurrency has gone from about $0.4744 to $0.5309 in a single day. This sharp rise is backed by a dramatic 121.36% increase in trading volume, showing growing investor interest in Polygon.

Support and resistance levels play a crucial role in understanding MATIC’s price dynamics. The $0.4744 level has emerged as a critical support point. This level marks the origin of the recent price increase and could act as a potential buying zone if the price retraces.

Additionally, the $0.50 level, being a psychological barrier, might serve as another support point. Round numbers like this often function as support or resistance levels due to their psychological impact on traders.

On the resistance front, MATIC has faced difficulty breaking through the $0.54 level. Despite several attempts, the price has struggled to break above this point decisively. This suggests that $0.54 is a significant obstacle. If the price manages to surpass this, the next resistance could be around $0.55, another psychological point that might see increased selling pressure.

According to DefiLlama data, the Total Value Locked (TVL) in the network is currently an impressive $919.14 million. The market capitalization of stablecoins within the Polygon ecosystem is $2.015 billion, indicating a strong asset base.

Moreover, daily trading volume has surged to $140.81 million. This includes $1.67 million in inflows and a total of 579,394 active addresses over the past 24 hours.

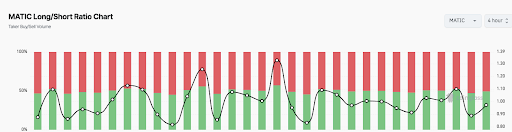

In terms of futures trading, the open interest in MATIC futures has shown a gradual decline. This trend, combined with price movements, suggests a potential cooling off or consolidation phase in the market.

Additionally, the MATIC long/short ratio reveals cyclical shifts between long and short positions. These fluctuations indicate volatile market sentiment, with traders frequently adjusting their positions based on short-term price changes.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/matic-price-soars-12-44-as-bulls-eye-0-54-resistance-but-can-it-hold/