Key Takeaways

What has Mastercard chosen Polygon for?

Mastercard tapped Polygon to power verified usernames for self-custody wallets through its Crypto Credential system.

What is POL’s price outlook despite the partnership?

POL remains under bearish pressure and could drop to $0.13 unless new demand lifts it back toward $0.16.

With institutional acceptance of crypto and Web 3 on the rise, Mastercard has joined the bandwagon, expanding its crypto credential to self-custody wallets.

A month ago, Mastercard announced the creation of a self-custody Web3 card that allows worldwide users to retain custody, in collaboration with Polygon Labs and Mercuryo.

Mastercard moves to self-custody wallets

According to official reports, Mastercard has picked Polygon [POL] to power its system that allows users to send crypto to verified usernames.

Thus, users will use usernames instead of commonly used long wallet addresses.

Mercuryo will be the initial issuer, onboarding verified users, and allowing for the creation of Mastercard Crypto Credential aliases.

According to Polygon, with Mastercard Crypto Credentials, users can onboard once, receive a verified username, link a wallet, and access their assets.

The introduction of this feature aims to reduce transfer errors and make crypto tools and their usage easier for all users.

Will this boost Polygon’s usage?

These developments have arisen at the right time, as Polygon’s network activity has been recovering from a recent decline.

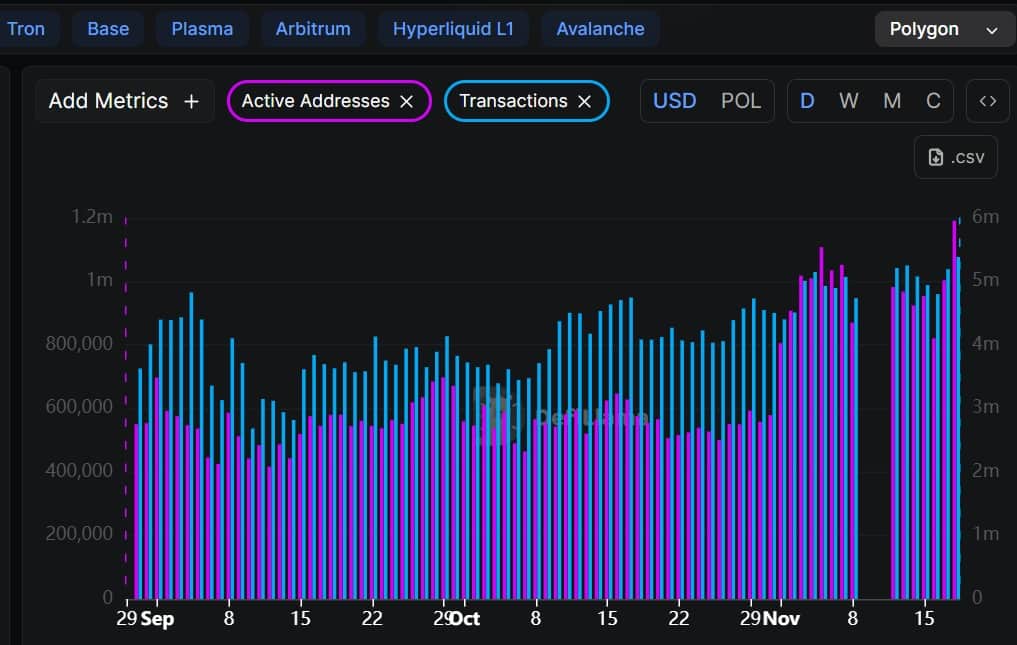

The chain’s Active Addresses have bounced back, reclaiming the 1 million mark, to 1.19 million as of this writing. At the same time, Transactions also reclaimed 5 million, hitting a high of 5.39 at press time.

Source: Defillama

With the partnership with Mastercard, the chain’s network activity is expected to rise even further. This is because Polygon’s integration into Mastercard’s stack exposes the chain to millions of potential users.

Therefore, we could see the chain record more transactions backed by an increased number of active addresses.

What about POL?

Surprisingly, the recent announcement has yet to have a positive impact on POL’s price action. In fact, at press time, POL traded at $0.145, down 3.24% on daily charts.

Amid this decline, the token has held below its Moving Averages (MA) since it made a death cross three weeks ago, reflecting intense bearish pressure.

Source: TradingView

Coupled with that, the positive index of Directional Movement Index (DMI) has declined consistently, hitting a low of 9 at press time.

These market conditions suggest total bear dominance, positioning POL for further losses. If the trend continues, the token will drop to $0.13.

However, if Mastercard brings fresh demand, it will boost POL up to reclaim $0.16.

Source: https://ambcrypto.com/mastercard-chooses-polygon-to-kill-wallet-addresses-but-pol-keeps-bleeding/