- New jobs data may shift Federal Reserve stance and market sentiment.

- Market awaits U.S. July employment data’s economic indication.

- Cryptocurrency markets experience volatility amid macroeconomic uncertainty.

The U.S. will release its July employment report on Friday at 8:30 PM Beijing time, expected to show a moderation in job growth and a slight increase in unemployment.

This report could influence Federal Reserve interest rate decisions and impact cryptocurrency markets by affecting the U.S. dollar’s strength.

U.S. July Job Growth and Federal Reserve Implications

Market anticipation is high as the U.S. prepares to release key employment data. Expected to reflect a reduction to 110,000 jobs, this data is a pivotal economic indicator. The unemployment rate may increase slightly to 4.2% and wages could rise modestly by 0.3%.

If predictions hold, this signals a slowing job market which may not immediately provoke Federal Reserve action. However, market analysts stress that weaker jobs data can dampen hawkish expectations, consequently easing dollar pressures and possibly aiding a gold price rebound.

Jerome Powell, Chair of the Federal Reserve, recently stated “There is a lot of data to be released before [the September meeting].” This highlights ongoing uncertainty in policy direction. As of now, crypto markets remain volatile as traders calculate the potential effect on asset valuations.

Cryptocurrency Markets React to Job Data Trends

Did you know? In past instances, subdued U.S. job growth often led to strength in risk assets, including cryptocurrencies, as dollar pressures eased. This historical context provides insight into potential market movements.

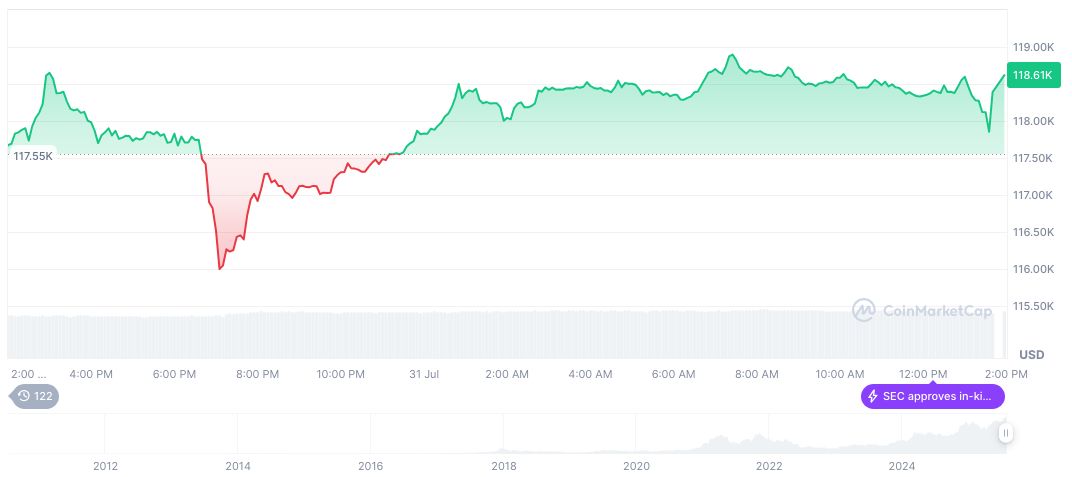

CoinMarketCap data notes Bitcoin’s steady position, priced at $114,635.43 with a 3.33% 24-hour decrease. The cryptocurrency’s market cap stands at 2.28 trillion USD, signifying 61.12% market dominance. Over 24-hours, trading volumes fluctuated by 13.54%, showcasing considerable market activity.

The Coincu research team reveals potential repercussions arising from the report. Analysts suggest that, historically, lower than expected data typically strengthens the case for minimal Federal Reserve action, encouraging more accommodating market conditions for digital asset growth and stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/us-july-jobs-impact-crypto/